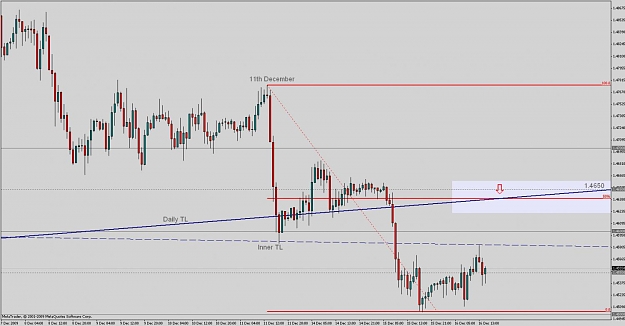

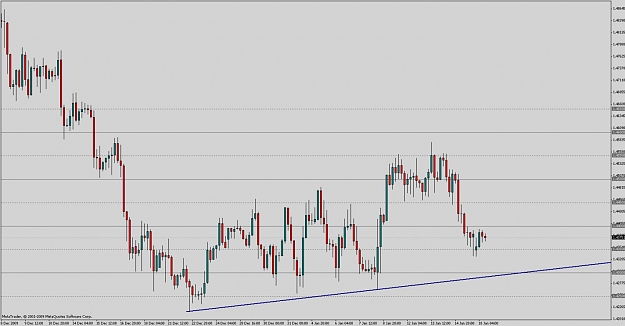

Basing a trade on a 1 hour chart would give me an opportunity to place a fib from 11th December to the most recent low, at this point in time a 50% retrace would give me an opportunity to get in safely (or as near to safe as trading allows) at 1.4650 where there is confluence of three barriers, TL, fib and round number.

Of course, price may well push on down from the time I posted this chart and I'm back to the drawing board.

Of course, price may well push on down from the time I posted this chart and I'm back to the drawing board.