I dont trade this way. (At least not all the time).

But I drew this chart a fews ago.

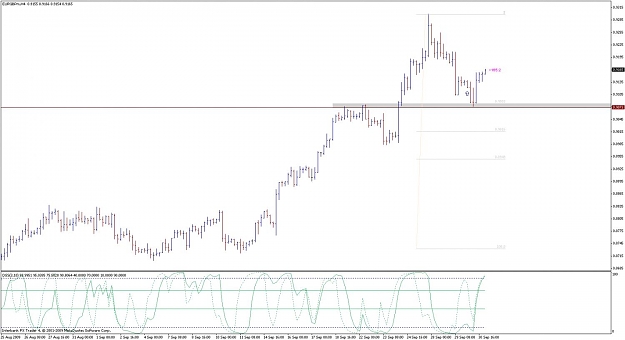

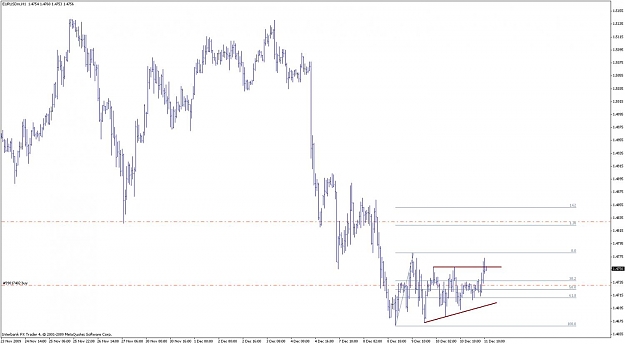

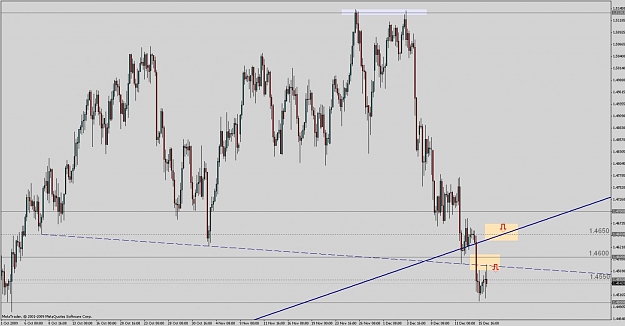

The grey bar is a confluence of demand and a fib retracement.

Price touched it perfectly and took off.

But I drew this chart a fews ago.

The grey bar is a confluence of demand and a fib retracement.

Price touched it perfectly and took off.