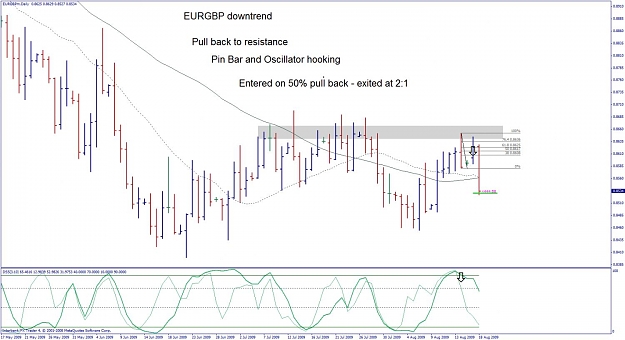

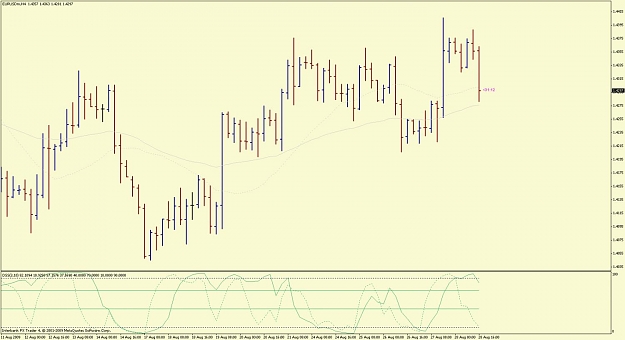

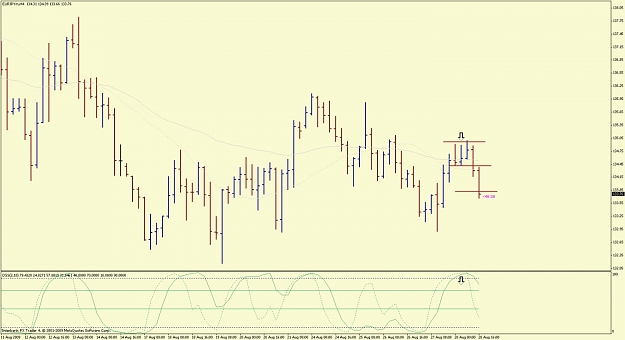

closed trade at +14 pips

entry was early, but the stop was far enough away to survive.

I thought the trade was just churning rather than rocketing off like I hoped it would, so I exited quickly

.2R win

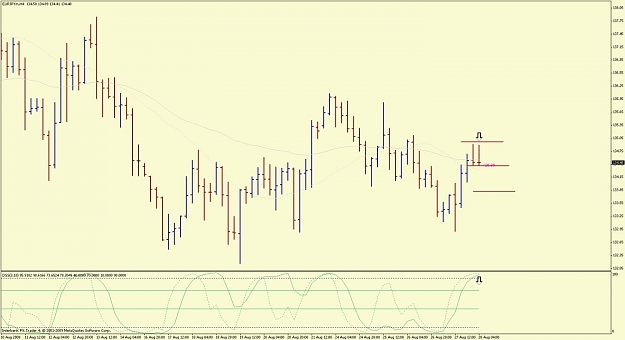

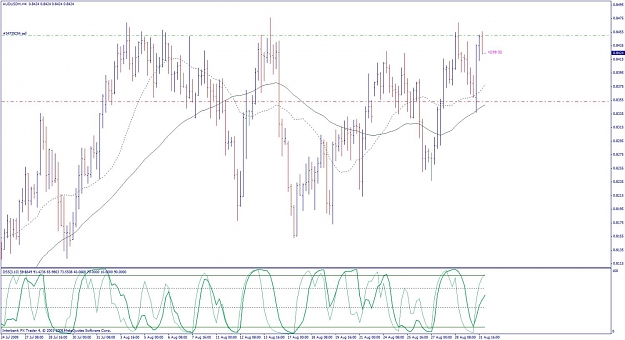

entry was early, but the stop was far enough away to survive.

I thought the trade was just churning rather than rocketing off like I hoped it would, so I exited quickly

.2R win