Disliked{quote} when will you comeback again? can you do probabilistic based on this below thread.. i will give conditions if you wish.. thanks https://www.forexfactory.com/thread/...4#post13115664Ignored

I will not beg anyone to make money for them

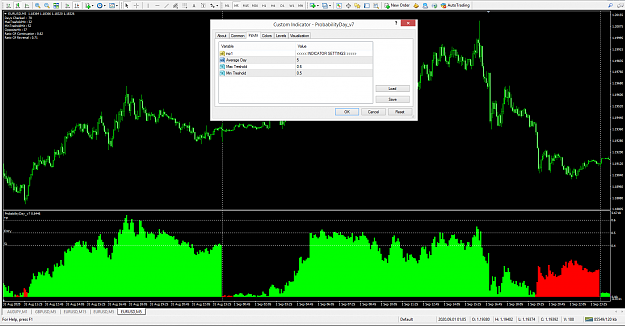

3