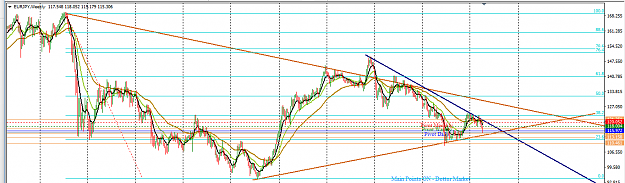

EURJPY Weekly Technical Outlook

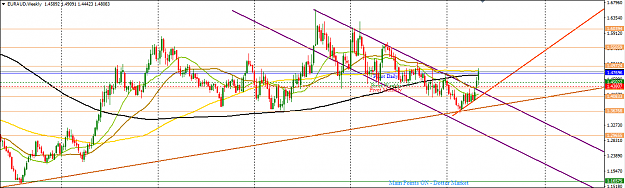

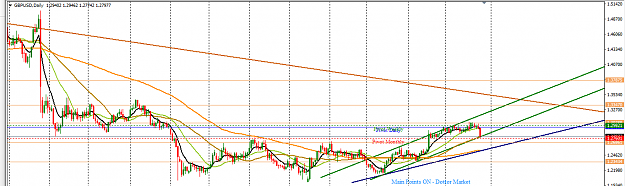

The pair has been on the decline since July 2008. It witnessed about 61.8 Fib retracement in January 2014 and peaked just shy of 76.4 Fib retracement by the end of that year. The pair has rejected southwards the major descending trendline on the weekly time frame (chocolate colour) and is now respecting another descending trendline from the high of 2014 (navy colour). Between December 2016 and January 2017, price action consolidated around 38.2 Fib retracement of the July 2008 decline. After a brief southward move, price retested the same zone in March 2017 before it drove further southwards four weeks ago. The order flow in April has been largely under the control of sellers but a major support zone which intersects with the ascending trendline (chocolate colour) from the low of 2012 (serving as a support) is just about 45 pips away and there is likelihood of some sideways move or reaction upwards at the zone before the southward drive gathers much impetus. Should price break the support southwards that will expose the 110.400/450 handle, the low of 2016 which has served as a multi-year support. The technicals on the weekly time frame support further southward move.

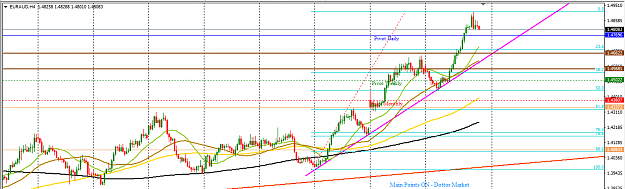

On the H4 time frame, the pair is respecting a descending trendline (magenta colour) from the high of March 2016 around the 38.2 Fib zone and an inner descending trendline (magenta colour) has formed, indicating an increase in momentum. Price action has formed two descending price waves with accompanying pullbacks and a third price wave is still in play but there is likelihood of a pullback before a further move southwards particularly as price action has hit support in the shape of an ascending trendline (saddlebrown colour) from the low of September 2016. However, given the price momentum and the order flow context, unless the fundamentals contrive otherwise, the major technical outlook is for a bearish continuation.

I may be wrong. Trade safe and prosper.

KP

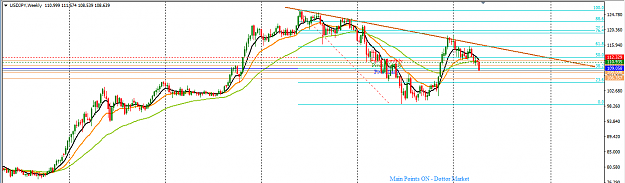

The pair has been on the decline since July 2008. It witnessed about 61.8 Fib retracement in January 2014 and peaked just shy of 76.4 Fib retracement by the end of that year. The pair has rejected southwards the major descending trendline on the weekly time frame (chocolate colour) and is now respecting another descending trendline from the high of 2014 (navy colour). Between December 2016 and January 2017, price action consolidated around 38.2 Fib retracement of the July 2008 decline. After a brief southward move, price retested the same zone in March 2017 before it drove further southwards four weeks ago. The order flow in April has been largely under the control of sellers but a major support zone which intersects with the ascending trendline (chocolate colour) from the low of 2012 (serving as a support) is just about 45 pips away and there is likelihood of some sideways move or reaction upwards at the zone before the southward drive gathers much impetus. Should price break the support southwards that will expose the 110.400/450 handle, the low of 2016 which has served as a multi-year support. The technicals on the weekly time frame support further southward move.

On the H4 time frame, the pair is respecting a descending trendline (magenta colour) from the high of March 2016 around the 38.2 Fib zone and an inner descending trendline (magenta colour) has formed, indicating an increase in momentum. Price action has formed two descending price waves with accompanying pullbacks and a third price wave is still in play but there is likelihood of a pullback before a further move southwards particularly as price action has hit support in the shape of an ascending trendline (saddlebrown colour) from the low of September 2016. However, given the price momentum and the order flow context, unless the fundamentals contrive otherwise, the major technical outlook is for a bearish continuation.

I may be wrong. Trade safe and prosper.

KP

Do your homework, follow the footprints of smart money