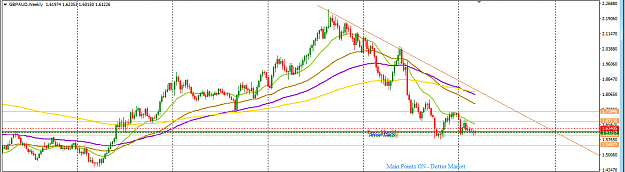

GBPUSD Weekly Technical Outlook

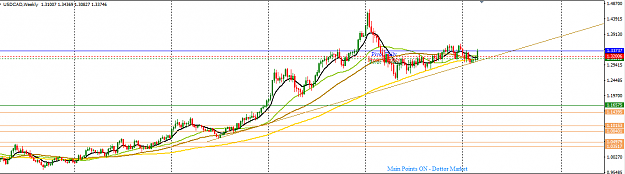

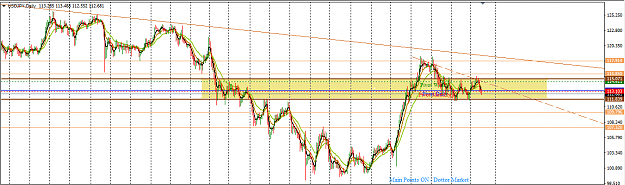

The pair has maintained a predominantly declining trend since July 2014. Recently, price action on the weekly time frame was largely sideways but the descending market structure holds. All the technicals on the weekly time frame still favour further southward price action. After a northward pullback in January 2017, for three weeks in February price action was in sideways mode around the monthly pivot but this was rejected southwards last week with a bearish move. However, the move was limited by some bullish struggle. Should the bears break free, an initial target is likely to be the immediate support around 1.2150, which may be extended to 1.1995 – a level which is a mullti-year low and a significant area of support.

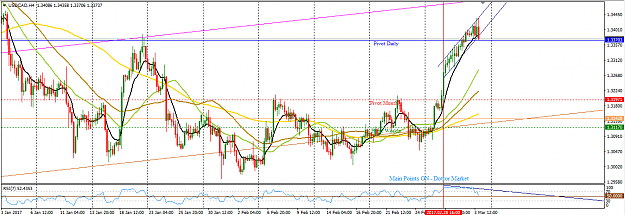

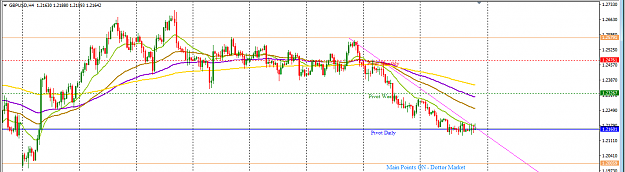

On the H4 time frame, recent price action resulted in a southward price wave and a pull back developed as part of the process of completing the first descending price wave. If this pull back retests the immediate weekly resistance around 1.2398 (which adjoins the 50 Fib retracement of the recent drop), or validates the descending trendline by a southward rejection, the second southward price wave may be in the offing; this may target 1.2155, the immediate weekly support.

I may be wrong. Trade safe and prosper.

KP

The pair has maintained a predominantly declining trend since July 2014. Recently, price action on the weekly time frame was largely sideways but the descending market structure holds. All the technicals on the weekly time frame still favour further southward price action. After a northward pullback in January 2017, for three weeks in February price action was in sideways mode around the monthly pivot but this was rejected southwards last week with a bearish move. However, the move was limited by some bullish struggle. Should the bears break free, an initial target is likely to be the immediate support around 1.2150, which may be extended to 1.1995 – a level which is a mullti-year low and a significant area of support.

On the H4 time frame, recent price action resulted in a southward price wave and a pull back developed as part of the process of completing the first descending price wave. If this pull back retests the immediate weekly resistance around 1.2398 (which adjoins the 50 Fib retracement of the recent drop), or validates the descending trendline by a southward rejection, the second southward price wave may be in the offing; this may target 1.2155, the immediate weekly support.

I may be wrong. Trade safe and prosper.

KP

Do your homework, follow the footprints of smart money