ATTENTION ALL LURKERS AND NEW POSTERS

BEFORE POSTING ANYTHING IN THIS THREAD, YOU MUST READ AND AGREE TO ALL THE RULES AND OBJECTIVES POSTED ON PAGE 1

CURRENT POSTERS WHO HAVE MADE SIGNIFICANT CONTRIBUTIONS TO THIS THREAD ARE GIVEN A FRIENDLY NUDGE WHEN THEY STEP OUT OF LINE.

HOWEVER, NEW POSTERS DO NOT GET A SECOND CHANCE. YOU ONLY GET ONE SHOT AT MAKING A FIRST IMPRESSION, SO MAKE IT A GOOD ONE.

THANK YOU

~

========================================================================================

Welcome to EurAnalysis

Yes I know it sounds like urinalysis but in a way the purpose of this thread is to do more or less the same thing. The only difference is that instead of urine, we are analyzing the Euro against its most major counterparts.

I invite all participants to contribute what they know about the EUR/USD as well as any other Euro related currency pairs... and since everything is correlated nowadays, that pretty much includes all currency pairs, commodities and equity indices

Before I get started with submitting my first post, I want to lay down the ground rules of this thread. I only have a few rules but they will be strictly enforced.

1. During busy market hours, please keep the discussions strictly on issues directly related to trading the Euro and any other instrument which influences (or is influenced by) the Euro. This can be technical analysis of charts and indicators, Fundamental analysis of political and economic factors which directly or indirectly affect the Euro and related instruments, or any other information you wish to exchange with others that you feel will be of help in determining general market sentiment or providing trade ideas. During off-market hours or slow periods, you are free to engage in any discussion that you feel the other thread participants would find of interest including humor and trivia. Just keep it clean please ![]()

2. If you are going to make a bold statement and represent it as fact, please back it up with authoritative references. This could be a chart for a trade call or technical analysis, or a link to a reputable news source or article for fundamental analysis.

3. Vulgarity, personal attacks, mocking, condescending remarks, lecturing, name calling or bullying of any kind for any reason will not be tolerated here. Generally the only acceptable posts are the ones that offer value to other posters and I will determine whether any such posts meet that criteria at my sole discretion. Obviously healthy, respectful and clean debate is always welcome and encouraged.

4. This thread is not a signal service or a trading school. Information and opinions are given freely by the participants for many varying reasons. If you notice that other posters are trading in a way that does not match your own trading style, or you do not agree with the information they post, it is not your place to criticize or try to "re-educate" them unless they have specifically asked you to do so. Everybody has a different style. It is fine to make suggestions to the general audience, but it is not appropriate to single out any one trading method or poster in a condescending manner. There are almost just as many personalities and language barriers in this thread as there are trading methods. As such you never know how your communication may be interpreted. Therefore, when posting anything about trading methods, only state how you do it and not how you believe others should.

5. In the interest of privacy and security for everyone who posts here, divulging your capital balance, profits or losses in any live trading account is very strongly discouraged. It is not wise of you to do so on any public forums. If you want to tell other traders your profits and losses booked to balance, you may use aggregate standard pips (or pipettes), or you may express it as a percentage of your capital. The same applies to floating profits and losses... pips or percentage of capital. Obviously this rule does not apply if you are trading in a demo account as long as you make that fact clear to others while posting your numbers.

6. This thread is not private. Anything you post here is visible by all internet users whether or not they are Forex Factory members. Furthermore, anything you post here will be indexed by search engines such as Google, Yahoo and Bing etc. If you know the personal identity of another poster in this thread, you must not reveal it in a public post. Doing so is against the rules of this thread as well as very disrespectful towards the poster. It may also put the poster at risk of identity theft. If you have a problem with any poster which results in a conflict, you will bring it to my attention immediately without exception. Failure to abide by this rule is cause for immediate temporary suspension from Forex Factory pending a review by the site administrator. A repeat offence will get you permanently banned.

7. According to the Forex Factory rules, any solicitation to/from posters, whether done via a post on the thread or via private message is prohibited. As such, all posts must not have any links to any commercial websites in which you may have some interests. This includes sites that pay you any commission for referrals. You also agree to abide by all the other rules and regulations of Forex Factory. It you are aware of any poster who is conducting any commercial activity, please contact me via private message and I will personally look into the matter.

Any poster who violates any of the above rules, or ignores any instructions given by the thread starter & moderator (that's me), may be immediately blocked without notice. If I have found reason to issue a fair warning to you, it means you have already gone too far, so it is time for you to listen up and take notice. In extreme cases, I may even recommend to the FF administrators that your account be suspended or permanently banned... Yes, I have that power and I will use it at my discretion ![]()

Number of posters currently blocked by me for rule violations: 18

Number of blocked posters currently suspended or permanently banned by FF administrators: 2

That's it for now but I reserve the right to add more rules as I see fit. If you have any ideas to share about some rules that will keep this thread clean and resourceful for others, please feel free to submit them.

Peace

========================================================================================

The thread celebrities (courtesy of AFXFin)

========================================================================================

SOME POSTING GUIDELINES:

I have noticed that at certain times, there was some discussion about certain posts made by certain members wherein text from linked articles was copied and pasted in line with the post. More specifically, the comments were more directed at these members making several such posts in succession and thereby "spamming" the thread.

While I agree that any such successive posts seem somewhat abusive, I cannot agree that they do not meet the requirements or that they violate any current rules or guidelines in this thread.

However, I would like to point out that in the interest of fairness to all, I would prefer to see less successive long postings from any one individual. If you feel a need to make a long post, please allow some time after your post for others to post their views before making another long post. The alternative would be to keep your posts short, or if you have much to say on a variety of topics, then please include them all in one post.

I must stress that these are guidelines and not rules.

I want to encourage everyone to post their views as they see fit and if an external article or news item describes it better than they can, I see no harm in quoting excerpts from any such external links.

One more thing though, which I believe I have made clear in the past and is also a rule.

During peak market hours, especially from Europe open to US close, I would like to see all philosophical, speculative and historical discussions kept to a minimum as this is the time for fundamental/technical analysis and trade calls.

========================================================================================

DISCLAIMER:

Any trade or analysis related comments made in this thread by myself or any other person should not be interpreted as anything other than a point of view by the respective poster. It is your responsibility as a trader to decide what information to use and what to disregard and you do so at your own risk.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all traders or investors. Before deciding to trade the foreign exchange (Forex) markets, you should carefully consider your objectives, financial situation, needs and level of experience. The possibility exists that you could sustain a loss of some or all of your funds and therefore, you should not speculate with capital that you cannot afford to lose.

========================================================================================

FF EMAIL SETTINGS:

Here are some instructions regarding emails you receive from this thread.

Once you post to this thread, depending on your current profile settings regarding email notification, you may start receiving an email for every post that is made on here after yours.

In order to change those option, you have to perform the following steps.

1. Go to your profile and click on the subscriptions link in the left hand column. That will give you a list of all the threads and news items you have posted in.

2. Put a check mark in the far right column of the ones you want to change.

3. At the bottom of the list you will find a pull-down menu. There you will find the subscription action options. Just select the option you want.

4. Click GO

You're done.

========================================================================================

Trader sentiment & positioning

========================================================================================

THINGS THAT MAKE YOU GO HMMM:

Attachment

Attachment

Attachment

Attachment

========================================================================================

RESOURCES:

This section lists a variety of resources for new and seasoned traders alike. I will organize it and build on it as I see fit but welcome suggestions any time.

EDUCATIONAL:

1. Baby Pips School

2. Raghee Horner's 'Best of the daily trading edge" e-book

3. Chart School from stockcharts.com

4. Explains by cnbc.com

5. John Murphy's Ten Laws of Technical Trading

6. Forex trading systems collection revealed!

7. Martin J. Pring’s 19 Trading Rules to Beat the Markets

8. Trading the Forex with Bonds - Part 1 - Part 2 - Part 3 - Part 4

MARKET CHARTS:

1. Futures from Finviz.com

2. Major Currency Pairs from finviz.com

MARKET NEWS:

1. Yahoo Finance Currency News

2. RTT News Earnings Calendar

3. Forex Factory Events Calendar

FF THREADS OF INTEREST:

1. Twelve widely believed forex myths

2. Trading with Deadly Accuracy

OTHER LINKS:

1. World Clocks

2. The Federal Reserve Bank of New York foreign exchange swap agreement web page

3. The latest 10 Year Government bond yields

4. The Swede's primer on options.

RISK ON / RISK OFF:

1. Overview of Risk On/Off

2. Following Example

3. Risk On, Risk Off and the Gold Trade

4. Risk On/Off and Global Currency Flows

5. Overview of Carry Trade

6. Baby Pip's Carry Trade Criteria and Risk

7. The Carry Trade: Get With It Or Get Run Over By It

8. Extra; Bonds and Quantitative Easing For Dummies

PRECIOUS METALS:

1. USA Gold

========================================================================================

SEARCH FOR KEYWORDS:

If you would like to search this thread for a particular post you previously saw that is of interest to you, you don't need to go through all the pages looking for it. The folks at Forex Factory have provided us with a good keyword search tool which you will find just above the first post on every page as a small box called "Search This Thread". Just type in your keyword and search. Try it, it's easy.

========================================================================================

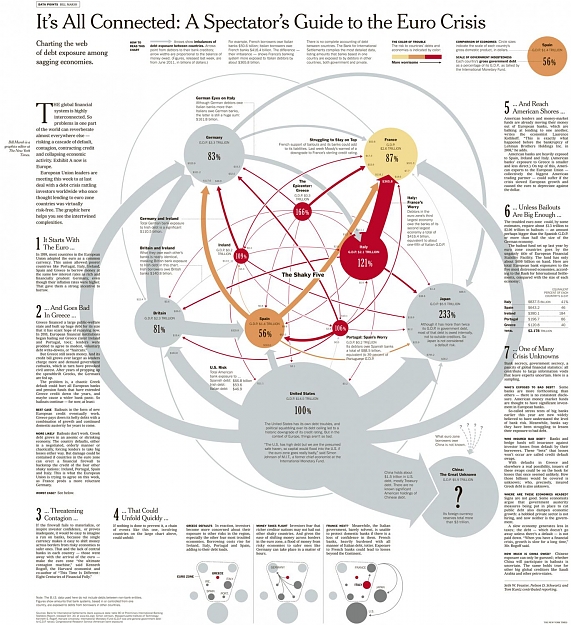

SOVEREIGN DEBT MAP

http://www.nytimes.com/interactive/2...ro-crisis.html

========================================================================================

Links to Italian bond yields (15 minute delayed)

2 Year - 3 Year - 4 Year - 5 Year - 6 Year - 7 Year - 8 Year - 9 Year - 10 Year - 15 Year - 20 Year - 30 Year

Links to Spanish bond yields (15 minute delayed)

2 Year - 3 Year - 4 Year - 5 Year - 6 Year - 7 Year - 8 Year - 9 Year - 10 Year - 15 Year - 20 Year - 30 Year

Links to Greek bond yields (15 minute delayed)

2 Year - 3 Year - 4 Year - 5 Year - 6 Year - 7 Year - 8 Year - 9 Year - 10 Year - 15 Year - 20 Year - 30 Year

The latest 10 Year Government bond yields

========================================================================================

YOU MUST READ THIS:

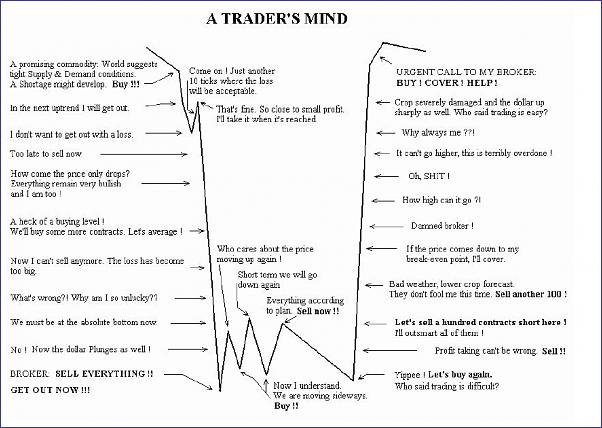

Don't get trapped in a marriage you cannot handle.

Always use sound money management techniques.

It will save your account and your emotional well being.

========================================================================================