GBPCHF is approaching to 1.32 now, I won't trade it unless I would have seen a decent pa around this level. I would like to take try at 1.315 long if it can hit there. what's your view if I may? thank you

krue

krue

JPY Group - Best Group to Trade 58 replies

Your experience with Forex.com [GAIN Capital Group, LLC] 37 replies

Forex Techniques Development Group 24 replies

FOREX, Robert Gray, FXLQ, and Nfa/ctfc... PLEASE REPOST IN EVERY GROUP 0 replies

DislikedGBPCHF is approaching to 1.32 now, I won't trade it unless I would have seen a decent pa around this level. I would like to take try at 1.315 long if it can hit there. what's your view if I may? thank you

krueIgnored

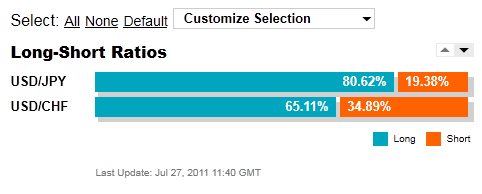

DislikedWith the current uncertainty in relation to the US Debt Ceiling, this is making the markets jittery...when the markets are jittery CHF and JPY tend to strengthen quite hard - look at charts of the CHF pairs and also UJ+CHFJPY and you'll see CHF is currently the strongest currency since market open.

Thus trying to take a long against the strongest current currency is not something I would be recommending right now. It would take a very good technical setup for me to want to go long a CHF pair at the moment.

I am in fact short UJ and UCHF since...Ignored

DislikedWith the current uncertainty in relation to the US Debt Ceiling, this is making the markets jittery...when the markets are jittery CHF and JPY tend to strengthen quite hard - look at charts of the CHF pairs and also UJ+CHFJPY and you'll see CHF is currently the strongest currency since market open.

Thus trying to take a long against the strongest current currency is not something I would be recommending right now. It would take a very good technical setup for me to want to go long a CHF pair at the moment.

I am in fact short UJ and UCHF since...Ignored

Dislikedyeah, absolutely, it totally doesn't make sense to trade against the trend. I still have the bottom fishing mentality, which is very harmful. I noticed the problem after my trade was triggered, was thinking to close the position upon retracement. what a pity is I was in a meeting, and lost the chance to close it when price return to a tiny profit. now, I am in deep water, I am setting a stoploss at 1.3078, if it hits it, then let it get hitted. very bad lesson today

Ignored

DislikedMark, this all makes perfect sense, and thank you for sharing.

Last week the XXXCHF pairs were long, against the long term down trend.

What changed over the weekend to make the XXXCHF pairs look like an easy short to you? I didn't see any news out of the ordinary regarding the markets. Do you think this was just an expected move with the US Debt crisis coming to a head?Ignored

DislikedIt was the developments with the US Debt ceiling over the weekend, or more specifically the lack of positive developments with the deadline looming. Talks broke down on Friday evening and there was no positive developments over the weekend.

In order got any deal to be passd by Congress in time there has to be some sort of deal reached over today and tomorrow from what I've read so hence why the market is so jittery. Just reading some of the major financial news websites over the weekend, the main headlines are all about the US debt ceiling and...Ignored

DislikedAh, I gotcha. I guess as an American I just expect both sides to posture and pretend to "stick to their guns" up until the last possible minute. Then they will compromise on a short term deal that will expire within a year or two.

I don't see it as a crisis, as much as a President who is a disaster, and Congress who cannot agree on anything, and nothing will really get solved until this President is gone and even then I doubt it gets better anytime soon.Ignored

DislikedI expect the same i.e. that both sides will come to an agreement at the last minute or more likely they will come to some sort of temporary agreement which allows the debt ceiling to be extended for a short period etc...if they do the latter then I'd expect the rating agencies to downgrade US debt.

What was important over the weekend is what the market sentiment was and you could gauge the sentiment towards this issue by skimming over the various major financial news websites...all the talk was about this issue, and after talks broke off on Friday...Ignored

DislikedWhat was the reason for your entry, I presumed it was the support and 61% fib confluence?

What concerns me with the above statement is that it appears you decided on your SL once in the trade?

IMO you should always decide your SL before you enter the trade, how else can you sensibly decde on your lot size from your risk for the trade? I always ask myself where has price most likely got to go in order for the reasoning for the trade to be no longer valid...it is at this level where I would set my SL, why would you want to be in a trade if the...Ignored

DislikedLJ, good questions, I should have done in line with the procedure you described, my problem is that I have been used to do thing piece by piece, in a wish to master the entry first ,then make a turn to master the exit. I knew I am lack of plan integrity, the root reason I guess is that I am not very confident about my exit analysis, so, makes a lot excuse to let the trade open, meanwhile greedy takes another role of doing so......

my entry reason was exactly what you analyzed, a seemingly good ppz conflu with 61%. I will add trend...Ignored

DislikedThat is awesome. I saw all these things, but didn't piece together that it would be good enough to keep pushing the JPY and CHF pairs close to or breaking through all time lows.Ignored

DislikedYou will learn over time that exits are more important than entries and that the thing that is most important of all, which is something every trader needs to know from the start is capital perservation and risk management.

If you have proper risk management then you will never blow an account and your mistakes will not prove overly costly to your bottom line. Without risk management you have nothing, entries and exits do not matter because sooner or later you will become unstuck because of your lack of risk management.

When I look at a trade...Ignored

DislikedHi, LJ, it is so nice of you putting so much time to help address the issue which I was relunctant to face , I will take it seriously, and trade well considered plan, rather then concentrate on entry point only.

where might be the stoploss level, if it were you who traded my setup? I guess the wick low below the lowest ppz you drawn? or somewhere else?

Thank you, man

KrueIgnored

DislikedYep you got it, below either of the wicks low marked would be the sensible place to place the SL.Ignored

Dislikedtechnically I think you made great point, just curious what might be the reason once either of these two levels got hit you would think the entry reason becomes invalidated, coz market may have knee jerk reactions to a justifiable ppz level ? in any case, your advices are cuteI thank you very much for the comment, it helps a lot .

krueIgnored

DislikedBecause these represent the maximum price has moved past the support are in the past but where the support area has still held i.e. price has rebounded back up having pierced the support by this amount in the past.

Thus this is the best basis we have to judge where if price moves beyond it stands a higher chance of moving further down. Of course the real test is whether it closes below the support...but this can be far far beyond the support like indeed it was for GCHF so using the previous wicks low is generally a good way to judge where to put...Ignored

QuoteDislikedI am in fact short UJ and UCHF since the market open last night. A no-brainer trade given the current event that is driving market sentiment and armed with knowledge of how the market moves when sentiment is very risk-averse.

DislikedA pretty easy set of trades to manage as price just keeps making new lows, especially in for UJ. Tightened my SL now to lock in profit.

Taking trades in the direction of the trend with supporting tehnicals and fundamentals is often very rewarding...something which is beyond the 'herd' who are just convinced that price will reverse all the time and are always bottom/top picking.

The problem is the herd actually think they are different to the very group they belong to because they are going against the trend...when in fact they are going against...Ignored