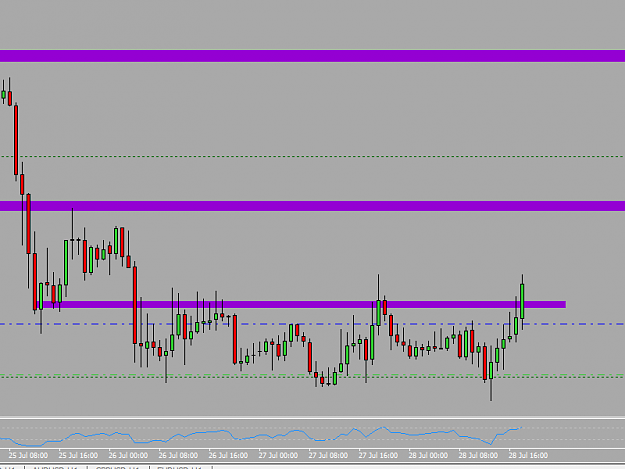

DislikedSuperb, LJ

Curious about the long short ratio, if, for instance, 19% of the positions take short trades, who take the other side of the rest of 81% long trades? maybe my question is a bit misconceptual, just quite not understand how to make up this statistics, if one buy while the other side of the trade sell?

KrueIgnored

Remember that:

a) Oanda is primarily a retail broker and thus this is a good representation of the retail positioning on these pairs but not necessarily the market as a whole.

b) It is a ratio of position and not position sizes/volume.

c) There has to be an imbalance in orders/voume at any given price for price to move away from that price.

You will find the same thing on any retail broker orderbook...the retail trades primarily go against the trend, the stronger the trend the more likely they are going against it adding postions as price keeps going against them.

Now ask yourself where has the big money / the smart money been in UCHF and UJ over the last few months.