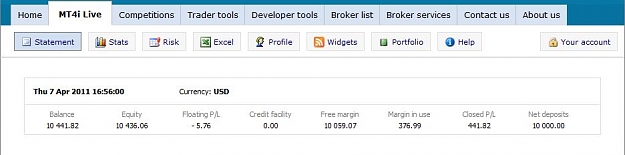

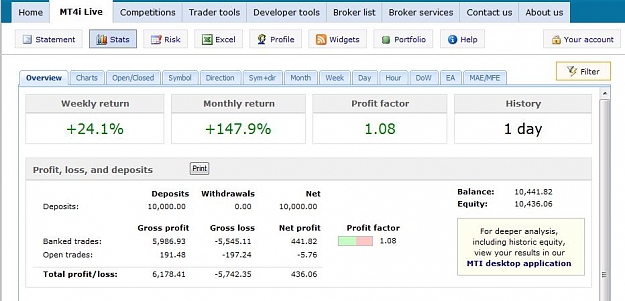

DislikedJust noticed my demo in work somehow ended up with just 1 GBPJPY trade. I have been getting occasional error alerts, I am presuming that the market moved too fast for the trade to be placed? I suppose this will be the problem with high volatile pairs. Anyway I have attached screenshot.Ignored

Update in post 1, adding a maximum trade level input, and cash profit to aim for at breakeven time, and trading hours.

The initial trade is L1, so the default allows an open trade and 5 hedges.

The breakeven profit calculation works by multiplying the CashProfitPerBreakEvenPip by the trade level.

Have fun.