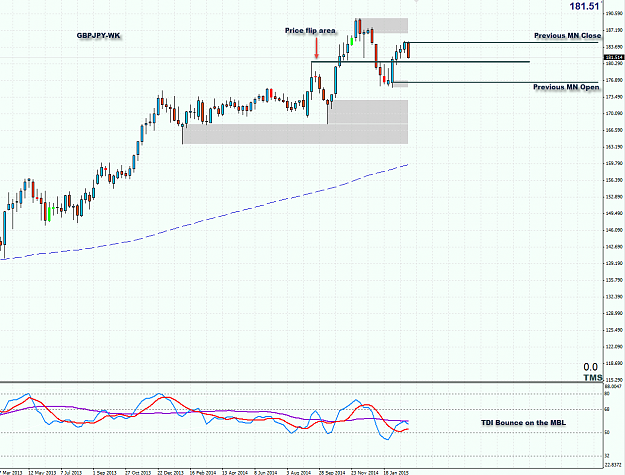

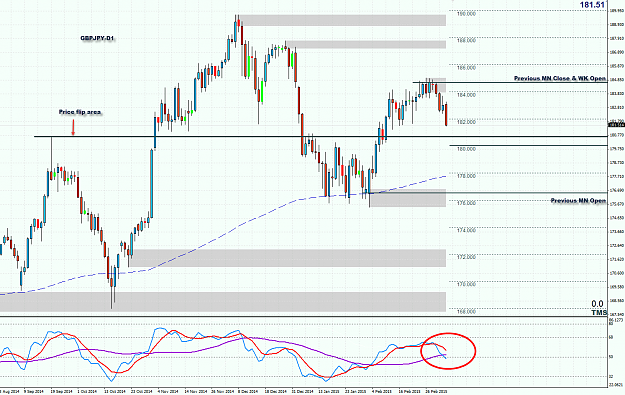

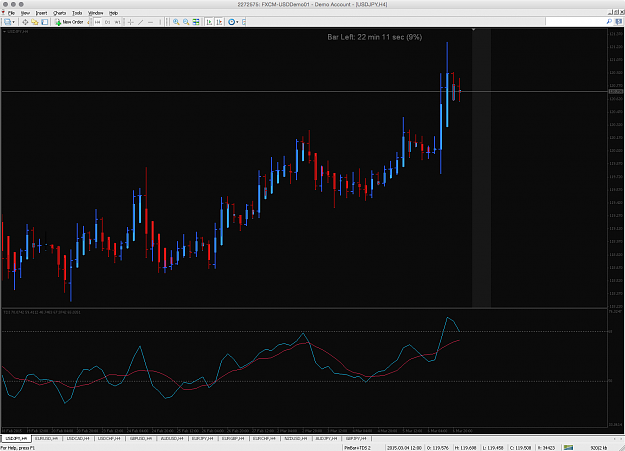

DislikedI see lot of new members were having trouble finding 1. How to use PAC for entry and exit 2. How to use TDI properly 3. How to read multi timeframe (MTI) TDI provided by lastingwell properly on your trading chart 4. How to stay away from consolidation Below is a chart that will help you with the answers. What does the chart teaches me ? 1. How to spot H4 PA movement and daily movement on your current H1 chart, as we trade based on the higher TF PA. 2. How to use H1 TDI to spot a trade entry and see if it comply with the higher TF PA. 3. What to...Ignored

Simplicity is the ultimate sophistication - Leonardo da Vinci