This thread is dedicated to Swing / Position Trading of all Financial Instruments

The emphasis being on market analysis and idea generation

Generally, I consider swing trading to consist of a Daily Chart, but H4 is ok for a more granular view and timing related discussions (shorter time frames are also ok, but, please use them very sparingly)

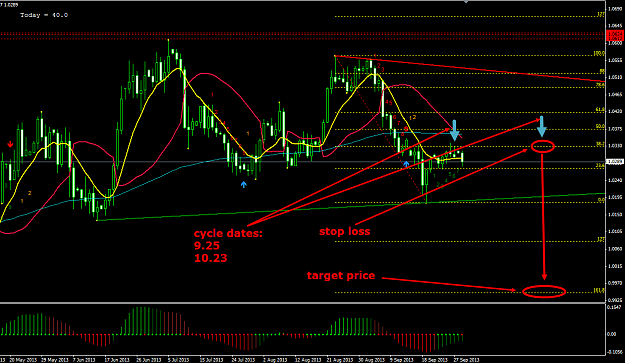

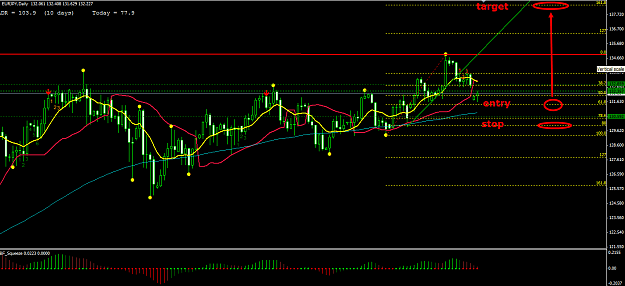

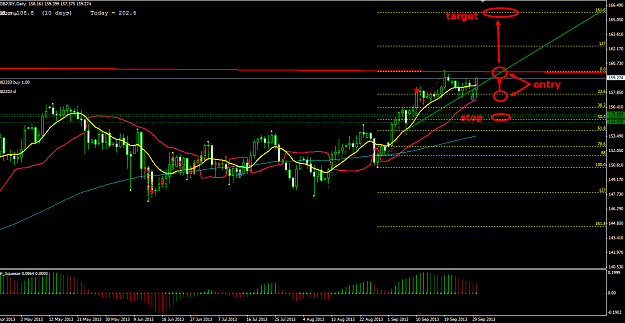

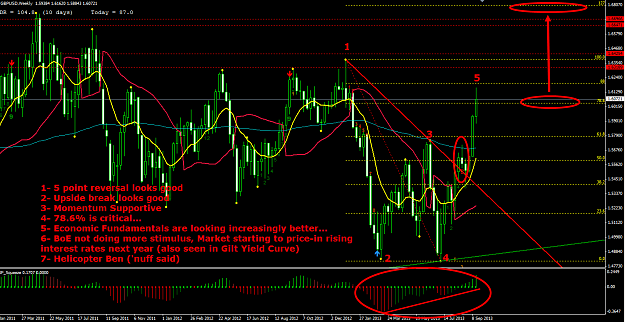

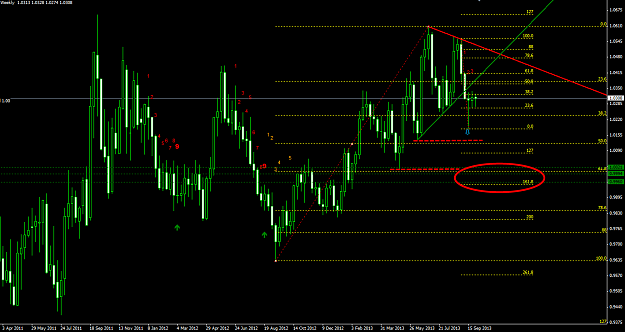

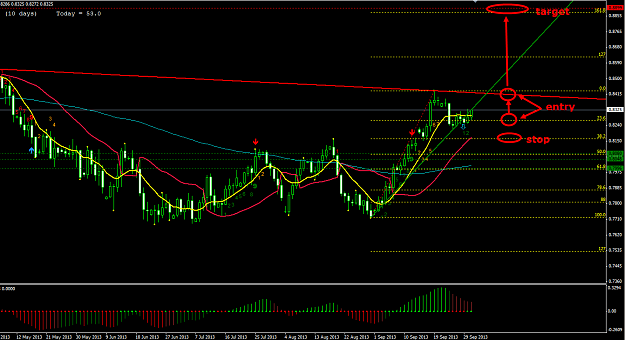

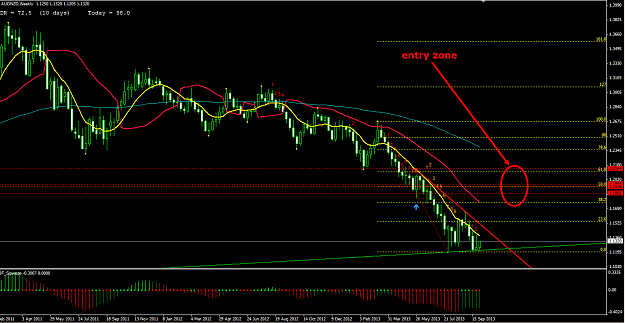

Posting charts with markups is strongly encouraged!

(due to the nature of this thread, it is also encouraged that you post a link to previous post when referencing a trade idea/analysis posted in the past)

It does not matter what school of analysis you prefer, all ideas are welcome (especially if you came up with it yourself)

Discussions about Global Macro Strategies and Economics/Geopolitical developments are also encouraged

(as long as we remain civil and keep it in opportunistic context)

Rooks and Pros are equally welcome, and hopefully, we can all make some money in these markets!

Cheers and good luck!

(additional content coming soon... maybe)

The emphasis being on market analysis and idea generation

Generally, I consider swing trading to consist of a Daily Chart, but H4 is ok for a more granular view and timing related discussions (shorter time frames are also ok, but, please use them very sparingly)

Posting charts with markups is strongly encouraged!

(due to the nature of this thread, it is also encouraged that you post a link to previous post when referencing a trade idea/analysis posted in the past)

It does not matter what school of analysis you prefer, all ideas are welcome (especially if you came up with it yourself)

Discussions about Global Macro Strategies and Economics/Geopolitical developments are also encouraged

(as long as we remain civil and keep it in opportunistic context)

Rooks and Pros are equally welcome, and hopefully, we can all make some money in these markets!

Cheers and good luck!

Inserted Video

(additional content coming soon... maybe)

90% of people, are wrong about 90% of everything, 90% of the time...