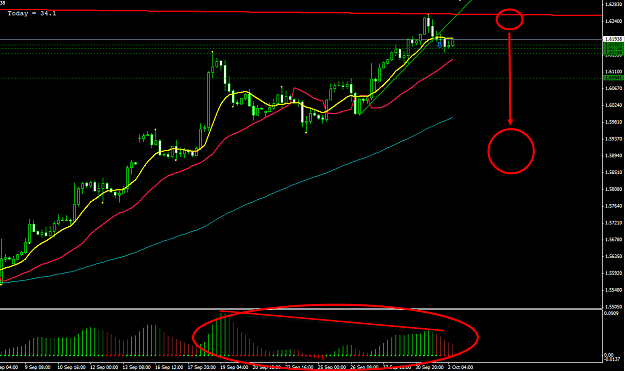

DislikedOzzie Kiwi looking a short (intermediate to long term) on fundamentals (interest rate differential/expectations) but we have to be patient while it sets up... this would potentially be a very rewarding long term trade, with almost no exposure to USD risk on/off dynamics (good diversification) Weekly {image}Ignored

Basically I am looking for a reversion to the 200 day ema before any more down. This should coincide with the 38.2% fibo at 1.1765 and of course I expect some penetration.

Those who say it cannot be done should not interrupt those who are doing it