Haven't posted in a while, because this site got blocked from work  But I am home today.

But I am home today.

I don't think determining the trend is the question. As a swing / trend trader, what I want to know is how to determine when the daily / weekly trend is CHANGING. Becuase it doesn't do this very often when it does it changes the general direction we are going for maybe a month or more.

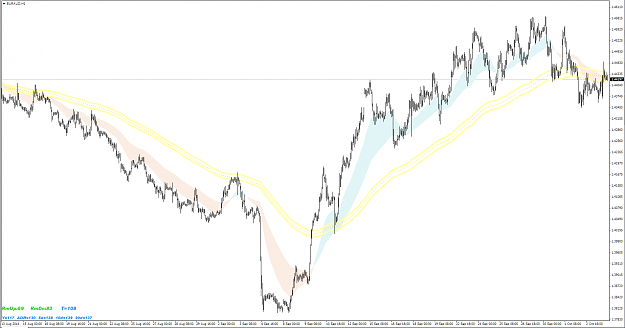

For myself, I use a volatility measure, and then require that the pair go beyond a certain percentage of that volatility. Example: on a weekly trade, it must go above / below 30% of the last 5 week's average range, starting from the open. At that point, we have a potential direction to trade in which is not likely to be range-bound. I might also factor in the weekly trend ( left to right on the chart as CTGUY says ) and ignore trades that are in the wrong direction.

I also agree, the original post could have been titled and worded better.

I don't think determining the trend is the question. As a swing / trend trader, what I want to know is how to determine when the daily / weekly trend is CHANGING. Becuase it doesn't do this very often when it does it changes the general direction we are going for maybe a month or more.

For myself, I use a volatility measure, and then require that the pair go beyond a certain percentage of that volatility. Example: on a weekly trade, it must go above / below 30% of the last 5 week's average range, starting from the open. At that point, we have a potential direction to trade in which is not likely to be range-bound. I might also factor in the weekly trend ( left to right on the chart as CTGUY says ) and ignore trades that are in the wrong direction.

I also agree, the original post could have been titled and worded better.

Disregard all prognostications.