Disliked{quote} Sure my friend you are welcome! Ask, research, think, try! Together we can make a lot of cool thingsIgnored

Ok let me try be as simple as my understanding and come with a general statement/question:

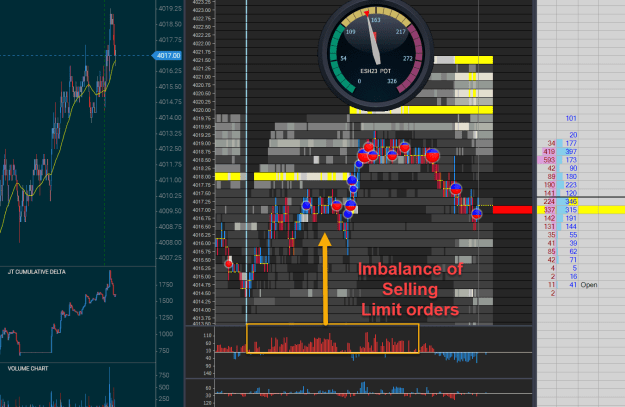

The closing of a market draws liquidity and volume out of that market, which is opposite to the previous general move preceding the close due to most of that move either was sellside liquidity or buyside liquidity, thus that major component of liquidity is gone causing a reversal of the previous move about 20 pips before continuation or flat. Thus there is an imbalance in liquidity since the major driving force is gone(main orders terminated).

True or false?

Equality will be the next big thing in trading