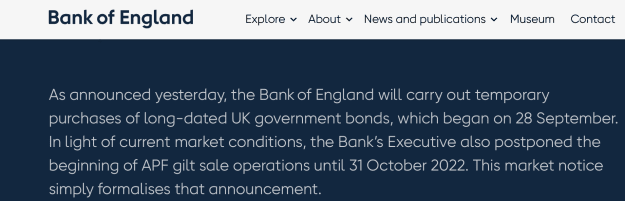

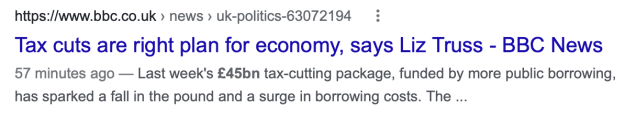

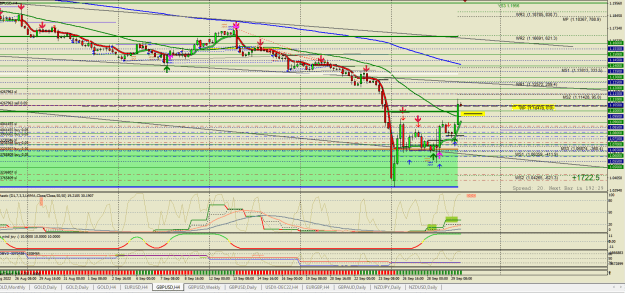

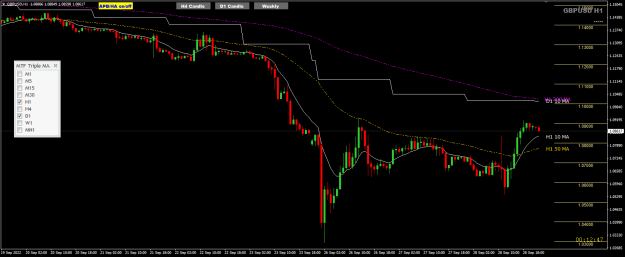

The Bank of England is buying long-dated government bonds, and that amount talked about looks very much like the cost of Truss tax cuts.

But they are unlimited buying of government debt as required.

QE forces rates down.

They are looking for those bonds because that's where the pension funds are, but the whole curve will be affected.

The type of pension funds in trouble are the Liability-Driven Investing (LDI)

The easiest way to understand these funds is to change the name to Leveraged Debt Investment.

Ironically the pension funds have gone up the risk curve because long-term interest rates have been so low and thats why they carry risk on fast rising rates.

"When yields fall the funds receive margin and when yields rise they typically have to post more collateral. After the spike in gilt yields on Friday and into this week, LDI fund managers were hit by margin calls from their investment banks.

LDI collateral buffers are partly set using historical data to build models based on the likely probability of gilt price movements, according to Shalin Bhagwan, head of pension advisory at DWS Group. The sudden recent surge in gilt yields “blew through the models and the collateral buffers,” he said.

“Any pension funds which has used even moderate levels of leverage are struggling to keep pace with the moves,” Mackenzie said before the BOE intervention. “You have a bit of a death spiral potentially where pension funds in particular are being forced to sell because they’re breaching their leverage agreements with their LDI counterparties.”

But they are unlimited buying of government debt as required.

QE forces rates down.

They are looking for those bonds because that's where the pension funds are, but the whole curve will be affected.

The type of pension funds in trouble are the Liability-Driven Investing (LDI)

The easiest way to understand these funds is to change the name to Leveraged Debt Investment.

Ironically the pension funds have gone up the risk curve because long-term interest rates have been so low and thats why they carry risk on fast rising rates.

"When yields fall the funds receive margin and when yields rise they typically have to post more collateral. After the spike in gilt yields on Friday and into this week, LDI fund managers were hit by margin calls from their investment banks.

LDI collateral buffers are partly set using historical data to build models based on the likely probability of gilt price movements, according to Shalin Bhagwan, head of pension advisory at DWS Group. The sudden recent surge in gilt yields “blew through the models and the collateral buffers,” he said.

“Any pension funds which has used even moderate levels of leverage are struggling to keep pace with the moves,” Mackenzie said before the BOE intervention. “You have a bit of a death spiral potentially where pension funds in particular are being forced to sell because they’re breaching their leverage agreements with their LDI counterparties.”

#doyourownanalysisordietryin

6