In this thread I hope to find the answers to the following questions:

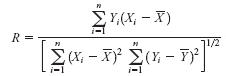

- Is it true that GBPUSD and EURUSD are 98% correlated? How has the correlation been calculated? For how long this relationship would last?

- How can we relate GBPUSD movements with EURUSD movements? Is ATR a reliable tool?

I'm quite open to any other topic that discusses the relationship between these two pairs. It would be great if you accompany your ideas with links to reliable white papers or news articles.