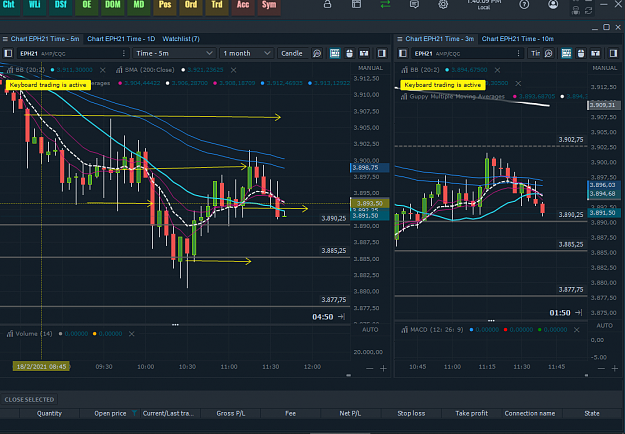

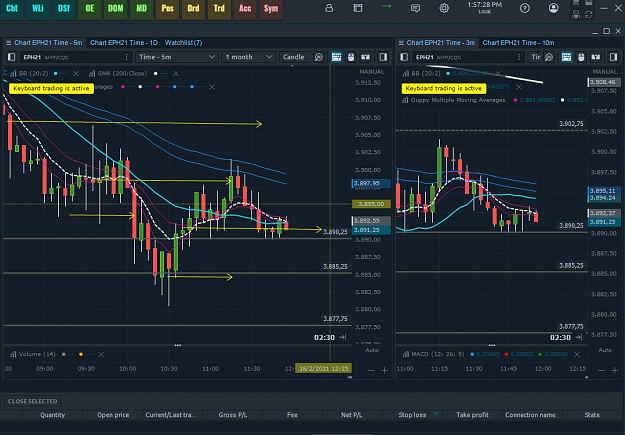

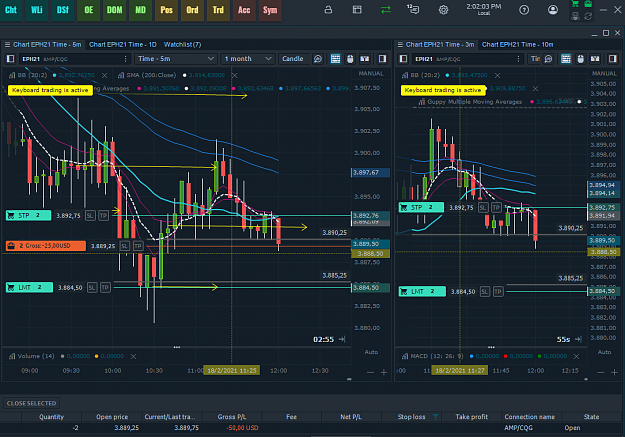

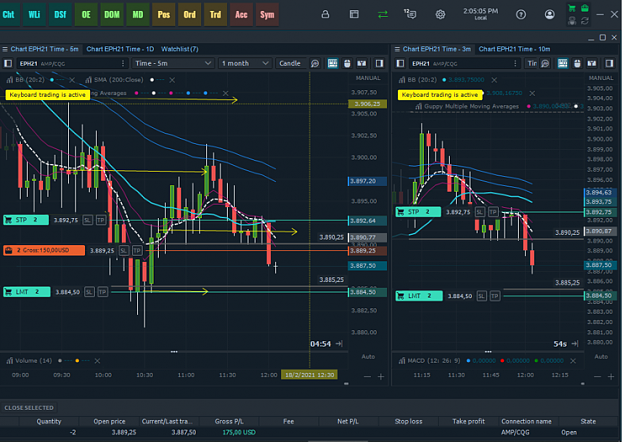

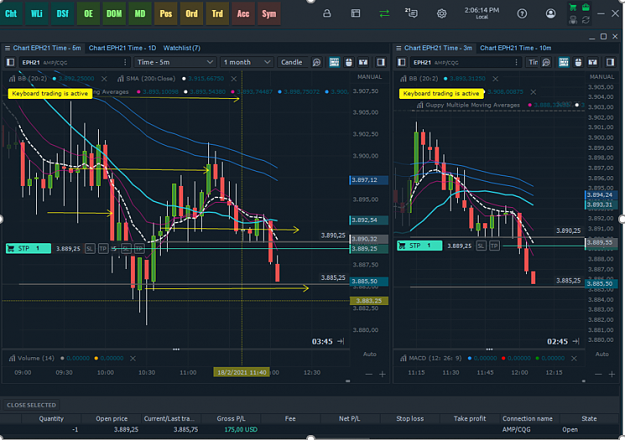

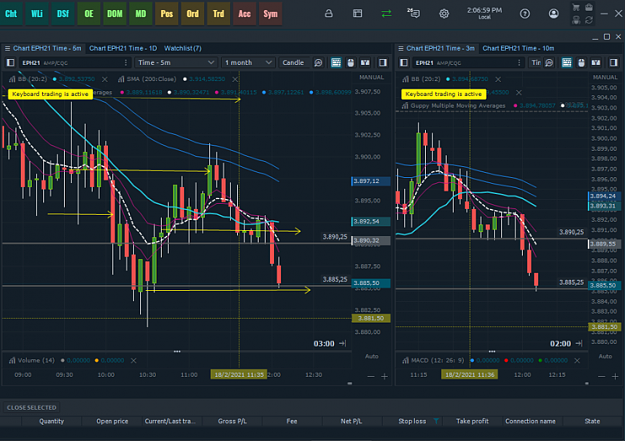

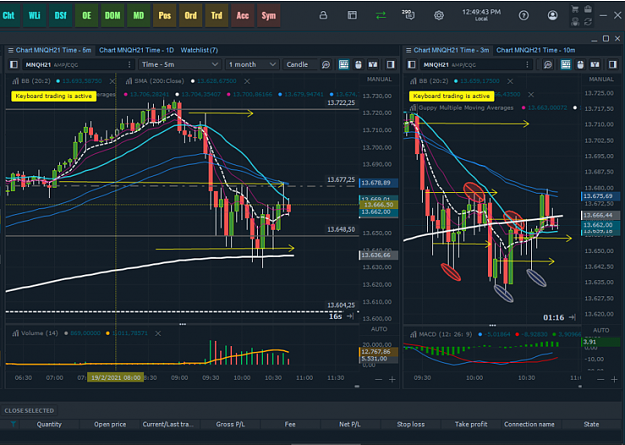

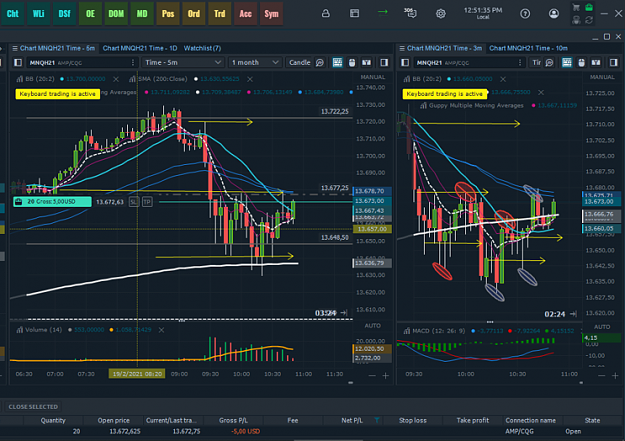

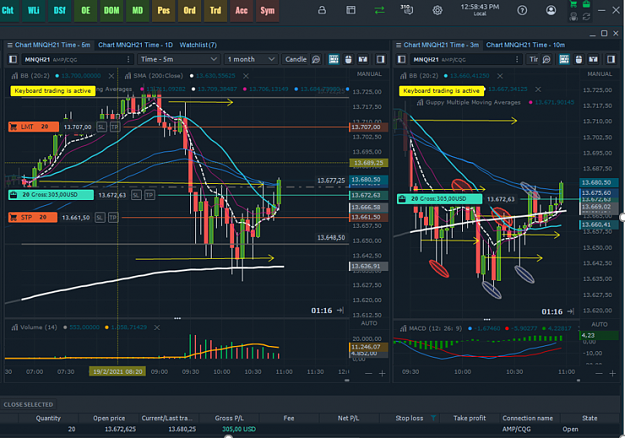

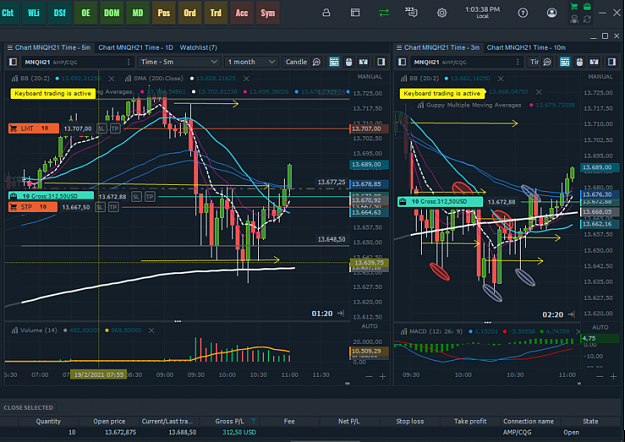

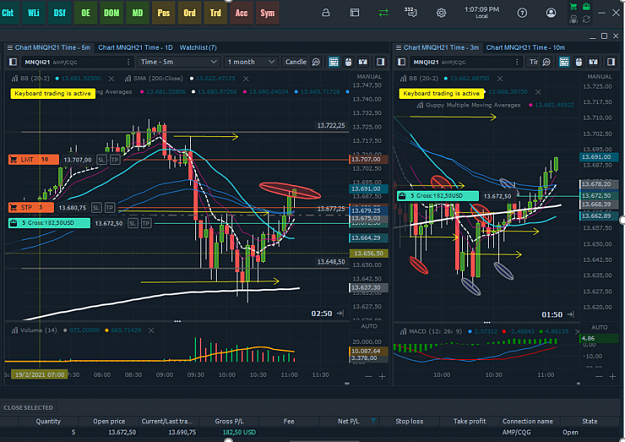

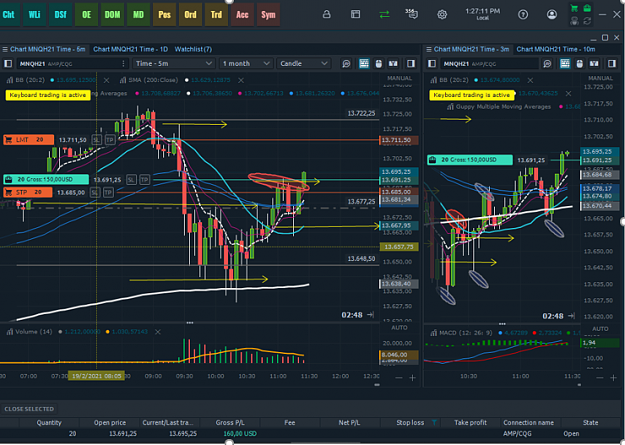

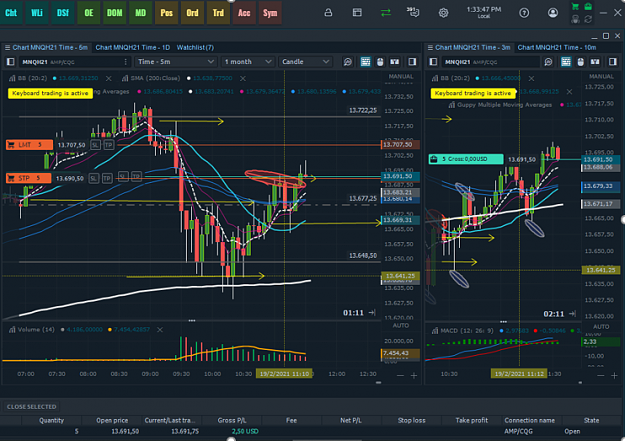

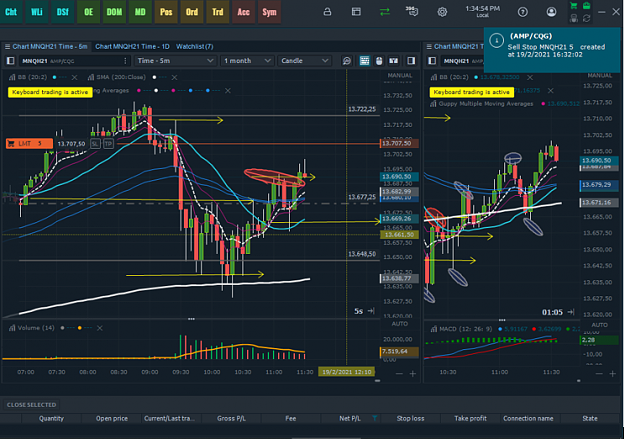

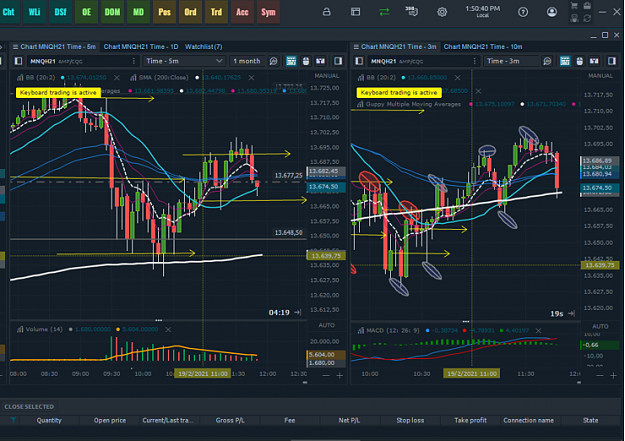

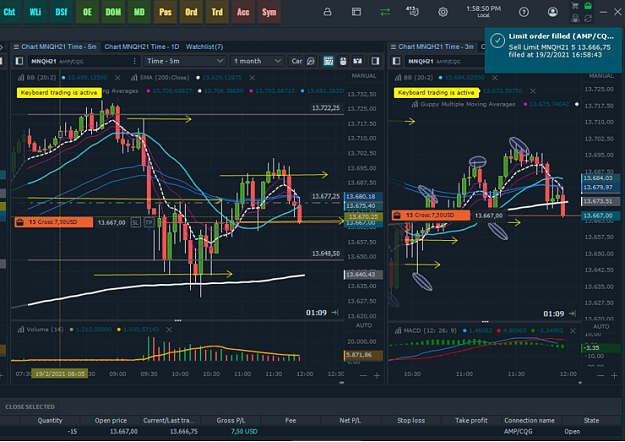

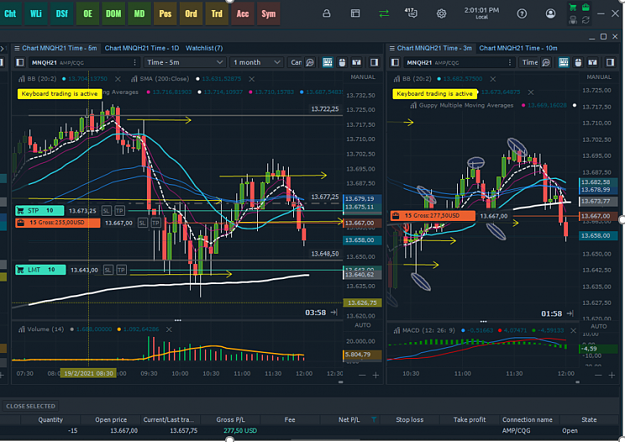

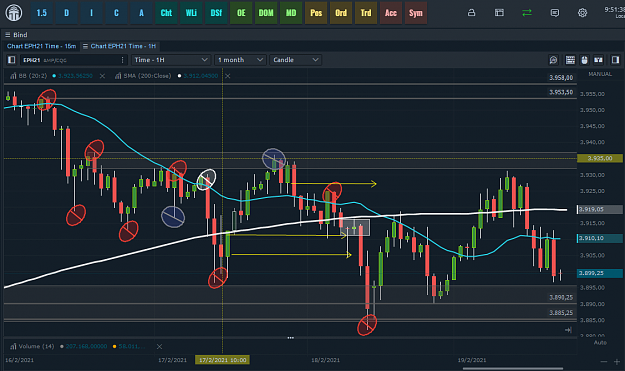

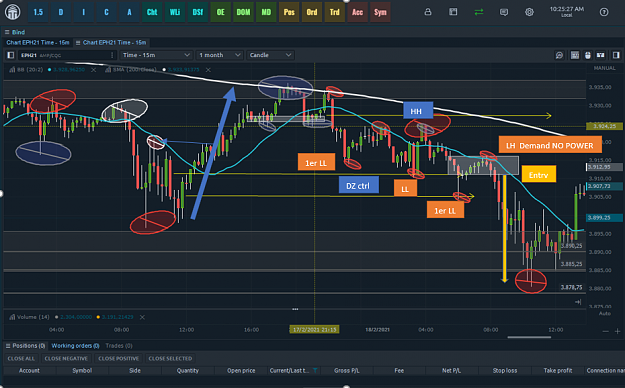

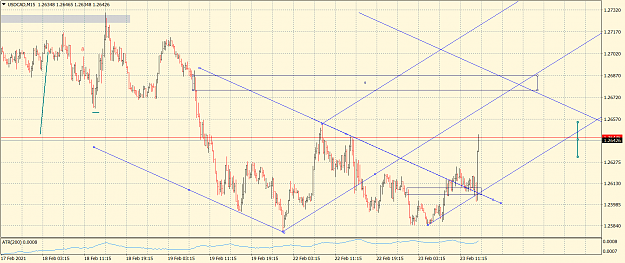

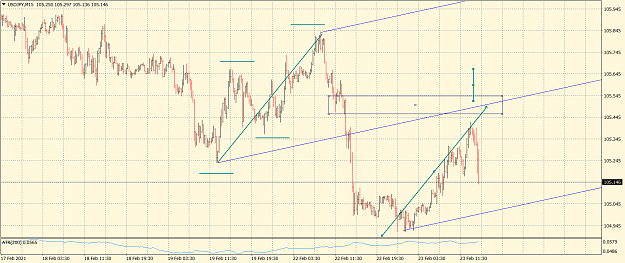

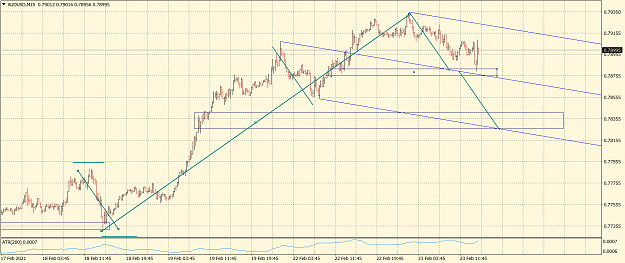

ANOTHER 3rd ENTRY. We see that there was a big bullish pullback, we measure the strength and weakness of each, and we re-identify the probable dz and sz. In yellow arrows. Stand by. Continue stand by fig (2). Entry Fig (3). Trade control Fig (4) TP Fig (5). Partial close and TP in DZ. End of day Fig6.

3