some humor when i looked back at my previous post.

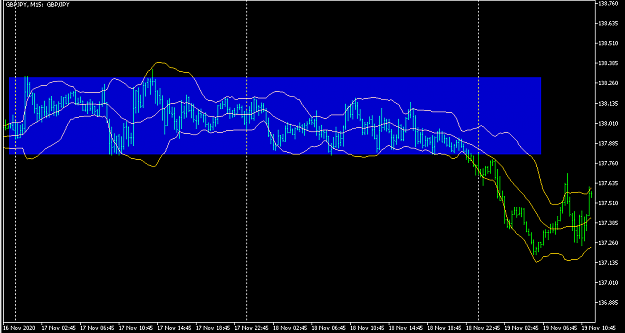

there is a famous book advising trading in the zone, whereas i trade out of the zone.

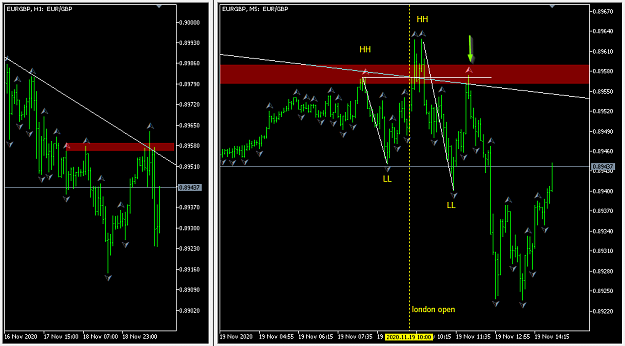

people advised to think outside the box, whereas i think Inthebox.

LOL ...... don't know what to do with my life ........

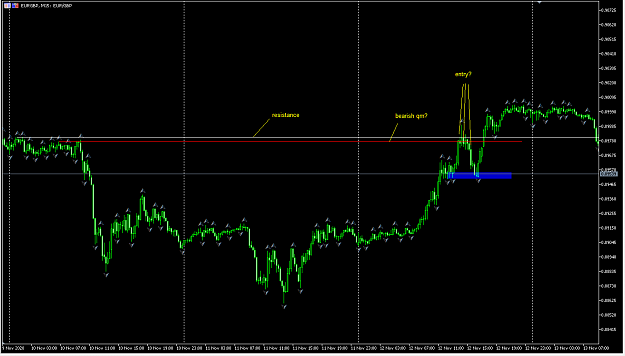

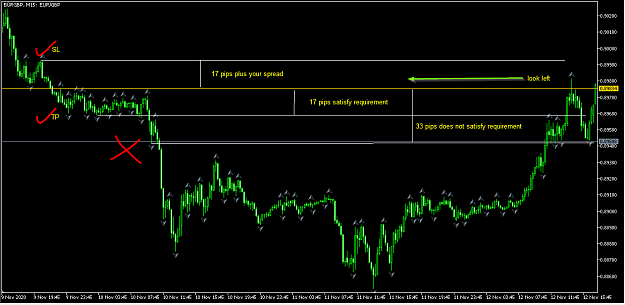

but in trading, i following the trend. checked at least one correct.

there is a famous book advising trading in the zone, whereas i trade out of the zone.

people advised to think outside the box, whereas i think Inthebox.

LOL ...... don't know what to do with my life ........

but in trading, i following the trend. checked at least one correct.

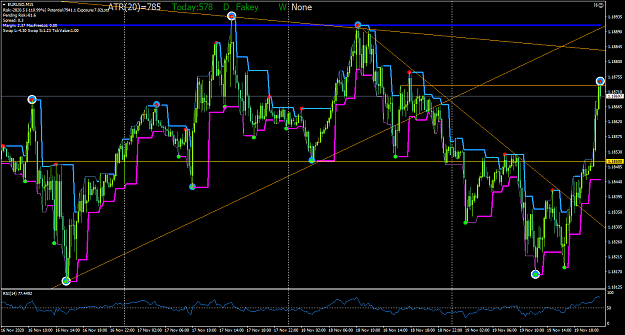

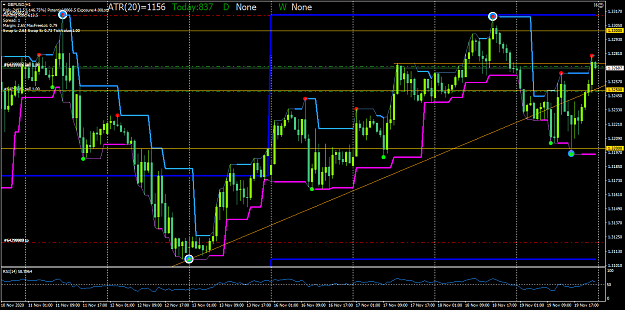

ITB - Seeing Orderliness amongst 'Randomness'