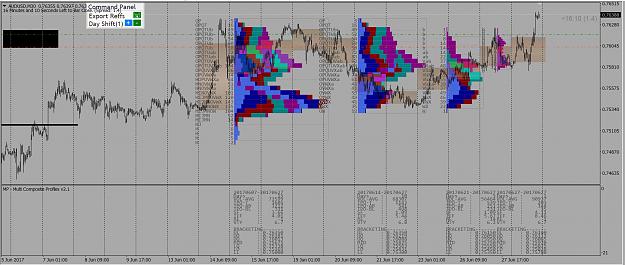

Nice trades! I got into EUR party too...

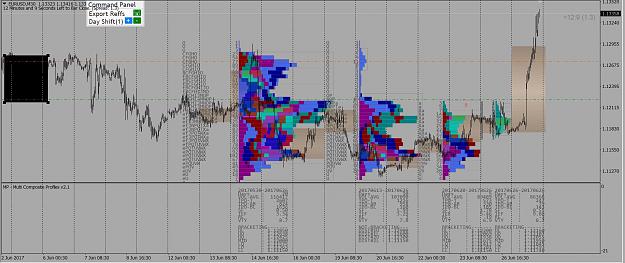

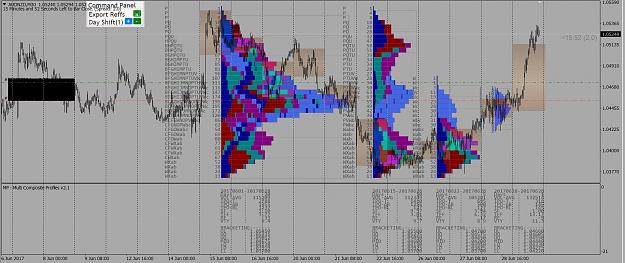

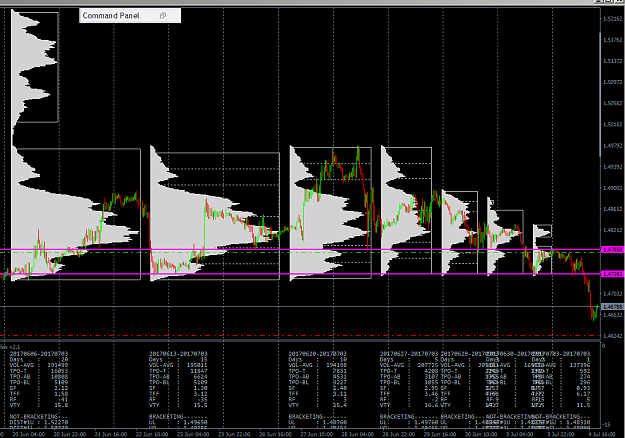

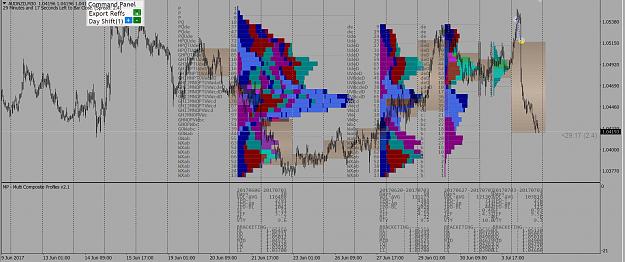

EURUSD have been bracketing for almost 27 days or so but rotation was down for most of last 2 weeks. Daily value was unchanged yesterday but there was increase volatility prior to it and 5 day RF is very positive for trade after its reversal back up.

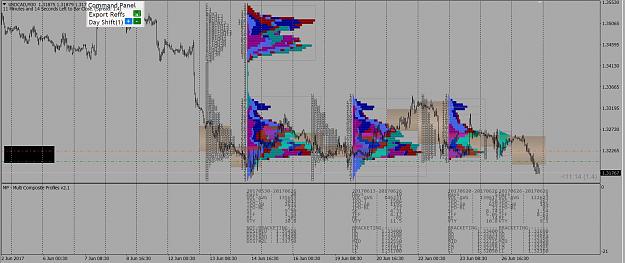

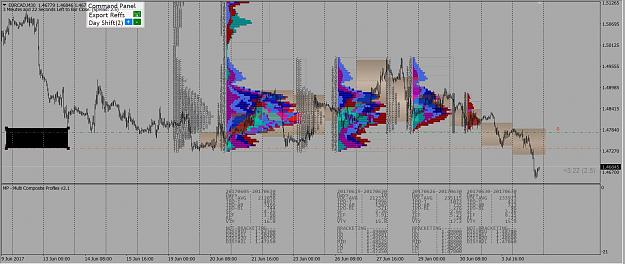

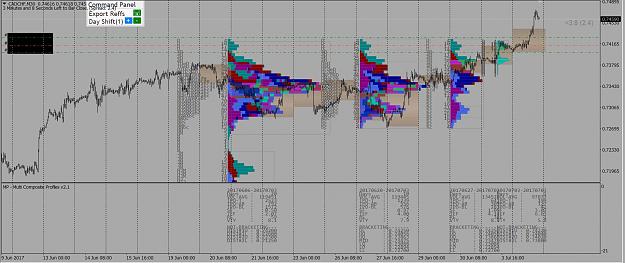

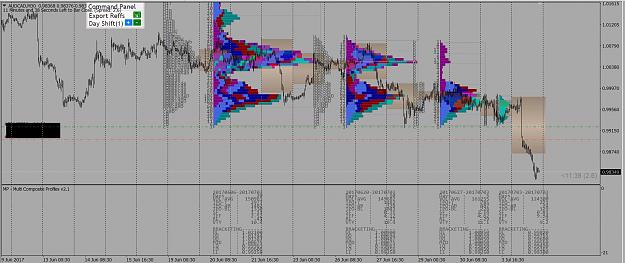

USDCAD Major trends are mostly pointing down, daily activity was increasing even though yesterday was very subdue (but v-area was unchanged).

EURUSD have been bracketing for almost 27 days or so but rotation was down for most of last 2 weeks. Daily value was unchanged yesterday but there was increase volatility prior to it and 5 day RF is very positive for trade after its reversal back up.

USDCAD Major trends are mostly pointing down, daily activity was increasing even though yesterday was very subdue (but v-area was unchanged).

4