AMT resources

James Dalton Videos:

http://vimeo.com/user4051895/videos (A must)

James Dailton daily blog

http://jamesdaltontrading.com/blog/

Alex Benjamin VIDEOS:

http://www.tradingclinic.com/mp201/m...min_021705.wmv

MP101 & MP102 free)

http://www.tradingclinic.com/mp201/m...min_021705.wmv

http://www.tradingclinic.com/downloa...edia/MP102.wmv

MP103

Not free but, clicking on the following link will give you access to a free 3 hour presentation.

http://www.tradingclinic.com/oneoff/...l20080606.html

Father of MP - Peter_Steidlmayer (classics)

http://www.4shared.com/document/WA5J...-_On_Marke.htm

http://www.4shared.com/document/vm01..._Markets_.html

Robin Mersch Strategy

http://www.cmegroup.com/education/in...t-profile.html http://www.forexfactory.com/images/buttons/forward.gif

---------

- http://www.4shared.com/office/ivp7jU...r_Markets.html

- http://www.4shared.com/office/86LvWx...__Jones_E.html

Wisdom from mzvega:

http://www.forexfactory.com/showthre...49#post6313549

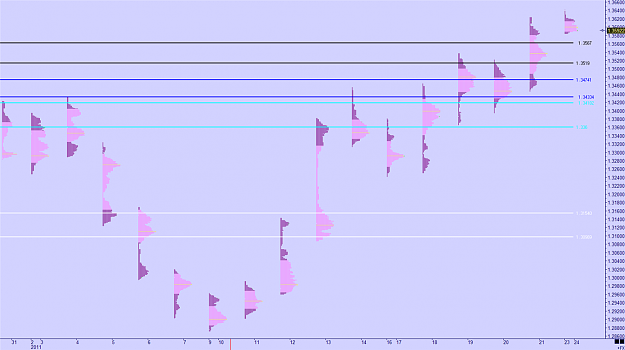

Bandung latest profile indi (non session) :

http://www.forexfactory.com/showthre...52#post5310452

updated Session indi:

http://eyesfx.web44.net/2011/10/mark...icator-update/

Indiconfig tips for GMT & session profiles

http://www.forexfactory.com/showthre...69#post5332069