Good afternoon.

I started my trading journal.

In this journal I will keep my analytical reviews and thoughts about the market situation.

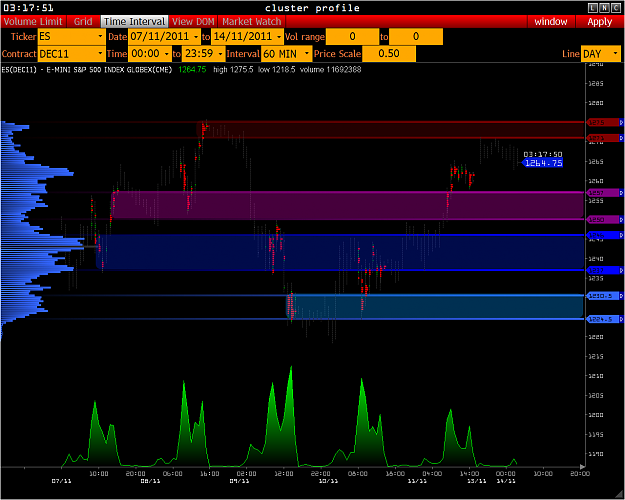

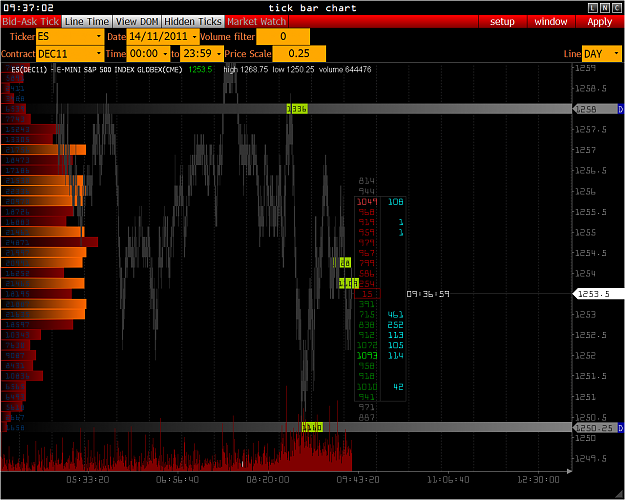

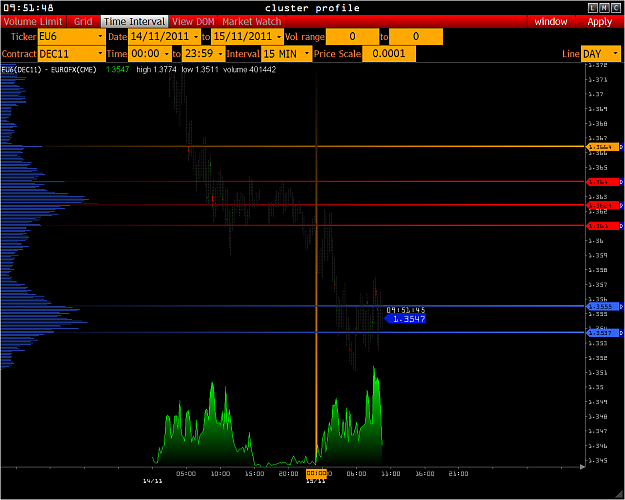

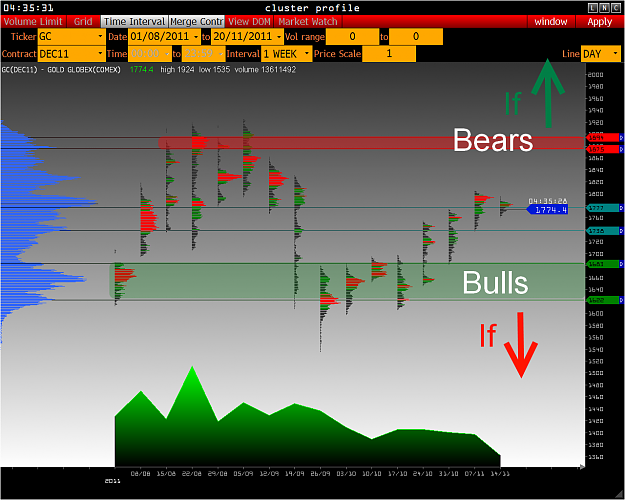

My analysis is based on the profile and market data on transactions.

I will analyze S&P 500 mini, Euro, FESX, FGBL and gold, oil.

If you like this thread, subscribe!

I started my trading journal.

In this journal I will keep my analytical reviews and thoughts about the market situation.

My analysis is based on the profile and market data on transactions.

I will analyze S&P 500 mini, Euro, FESX, FGBL and gold, oil.

If you like this thread, subscribe!