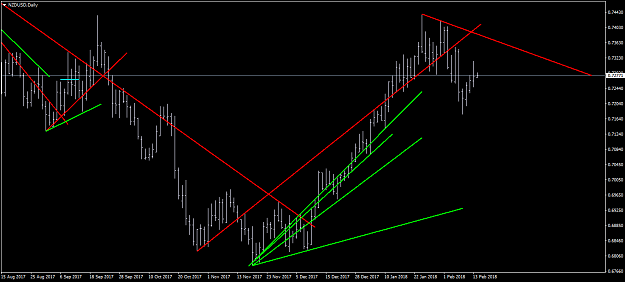

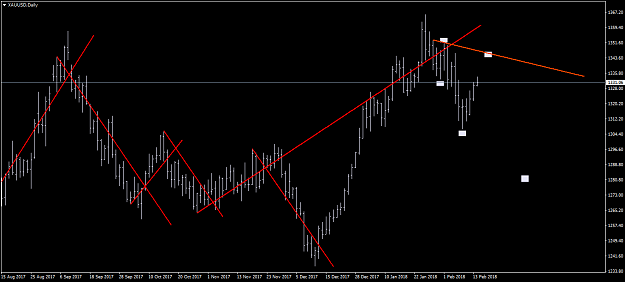

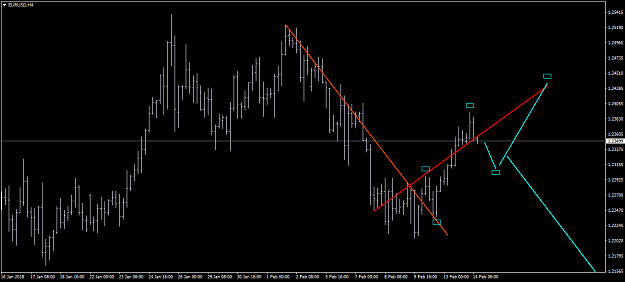

Twould appear these pull-backs could go further than first suspected. With this in mind I have redrawn the daily trend lines to reflect this.

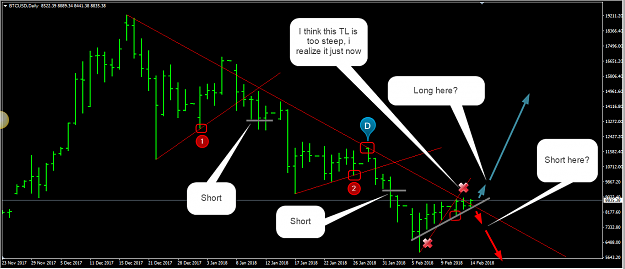

I probably confused y'all drawing the "Tentative" lines a couple of days ago.

Sometimes these early pull-backs can be quite pronounced.

As with SLs you have to give the lines room to breath.

EG: The green lines on this pick.

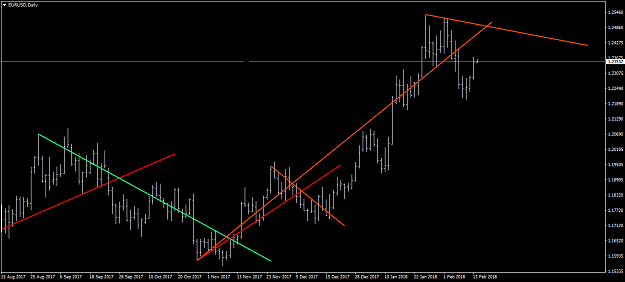

I probably confused y'all drawing the "Tentative" lines a couple of days ago.

Sometimes these early pull-backs can be quite pronounced.

As with SLs you have to give the lines room to breath.

EG: The green lines on this pick.

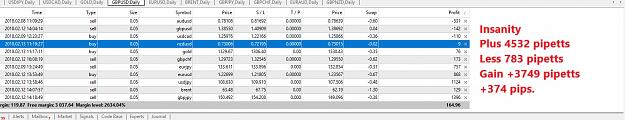

Conventional trading is for losers

1