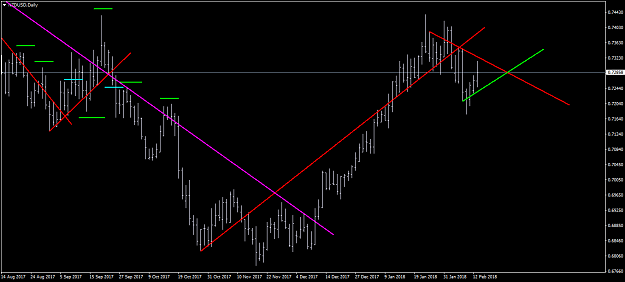

This is the first time I've every gotten in a trade at the "top" or "bottom" of a trend. I'm a little concerned that this might be just weekly pullbacks, and then the trend will resume it the former direction.

I'll breathe easier when this pullback is confirmed, and it continues in the new direction, and I can move my SL into safe territory.

I'll breathe easier when this pullback is confirmed, and it continues in the new direction, and I can move my SL into safe territory.

"Be the change that you wish to see in the world." --Gandhi