SAFE - KISS. (Trade safely & "keep it simple stoopid".)

Videos are located at Posts 15, 470 and 471

Check posts 717 & onward for reference to funding traders

Thought it was time to show my trend trading system. You will either love it or hate it. Makes no matter to me. If you don’t like it, just move on. If you like it & want to know more, stick around.

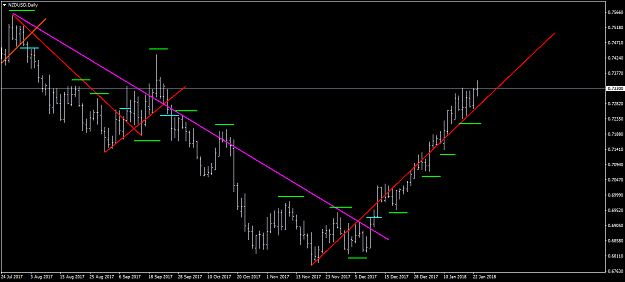

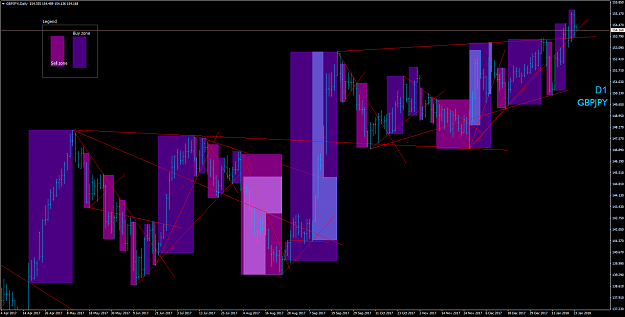

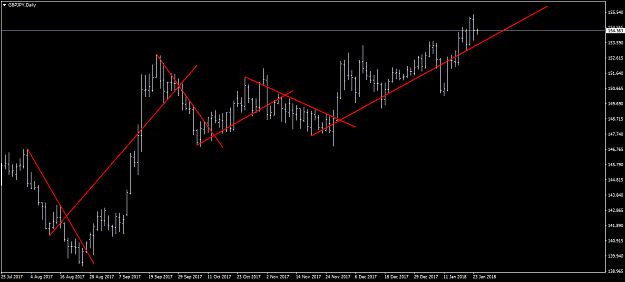

Trend & major pull-back trading.

Quite timely as trend changes or major pull-backs appear likely over the next few days.

SL is placed 20 pips above / below last major high / low.

SL then becomes safety TP should price move against you whilst you sleep. SL is moved every time a new lower high is made when trend is down. Or higher low when trend is up.

Entry / exit is made when price crosses the line with NO touch.

The line is HINGED at the left end. This end of the line never moves.

Candles… Plain bar candles.. No need for Jap candles or color change candles. And NO indicators required or necessary.

BS News, FOMC, WTF etc etc. Forget it. Let the spikes stop others out. Not you.

Pairs. Choose your pairs carefully. Not all pairs are “trend friendly”

Videos are located at Posts 15, 470 and 471

Check posts 717 & onward for reference to funding traders

Thought it was time to show my trend trading system. You will either love it or hate it. Makes no matter to me. If you don’t like it, just move on. If you like it & want to know more, stick around.

Trend & major pull-back trading.

Quite timely as trend changes or major pull-backs appear likely over the next few days.

SL is placed 20 pips above / below last major high / low.

SL then becomes safety TP should price move against you whilst you sleep. SL is moved every time a new lower high is made when trend is down. Or higher low when trend is up.

Entry / exit is made when price crosses the line with NO touch.

The line is HINGED at the left end. This end of the line never moves.

Candles… Plain bar candles.. No need for Jap candles or color change candles. And NO indicators required or necessary.

BS News, FOMC, WTF etc etc. Forget it. Let the spikes stop others out. Not you.

Pairs. Choose your pairs carefully. Not all pairs are “trend friendly”

Conventional trading is for losers