DislikedHi luSan,

I take it you are trying to work through an approach to determine trend changes to help you with trading flips. Is that correct? Are you interested in a discussion on this topic? I do not want to add something here that is not what you are looking for. I also try to make a distinction between reversals and retracements, but that may not be what you are interested in either.Ignored

So far my best idea:

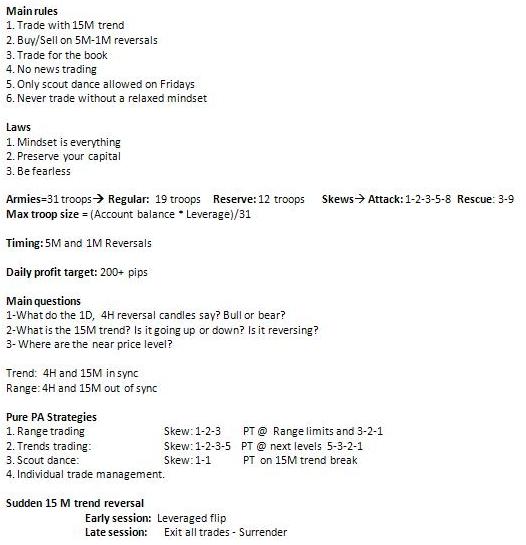

Setup

1) Draw 2 touch TL from last minors in 4H - Main trend

2) Draw 2 touch TL from last 2 minors in 1H - Secondary trend

3) Draw 2 touch TL from last 2 minor in 15M - Trade chart

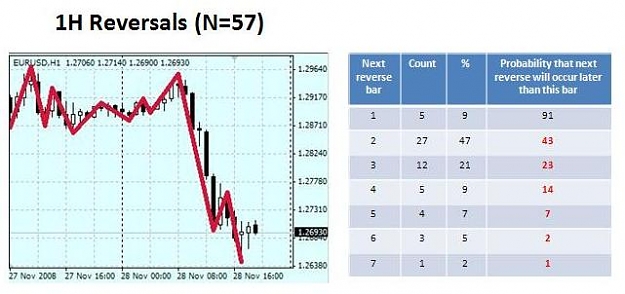

4) Time entry with 5M when PA moves in in harmony with 1, 2, and 3. On 15M and 5M reversals. This is wave watching.

Never against the 4H, 1H and 15M trends above.

Trade always away from the 1H TL

Pull-the-plug: When 15M and 1H trends are broken. Eye on 15M and 1H. First sign of trouble observed in 15M, then 1H. Inmediate exit if current 1H bars break previous 1H high/low. (As shown in the previous post.)

Flip - When I mis-read #1, #2 and #3. Flip only for 1st entry. A flip means that PA made a sudden change or I screwed up initial trend analysis.

Note: I choose not to trade against 4H, 1H and 15M anymore. Too risky.

why all these analysis? I hate to flip and I hate not having a plan in place to pull the plug as well. The general needs to have plan B in place before going into war. Also note that this topic affects profit taken. Profit could be taken at the 15M reversals into the current trend. This would maximize profit: scaling into 15M and exiting all trades when 15M and 5M agree on reversal.

Welcome to your views. However I would appreciate to stay away from indicators. Note that the way I use TL is not as a trading indicator but as way to decide/monitor the trading bias.

Regards,

Empty as water and soft as a facing wind mountain