Dislikedyea i was shorting euro last night , made good pips and then left one scout out ... detected a strong presence against my scout and the chart already formed a good upswing previously... took the scout out and watched the euro went 200+ pips ...Ignored

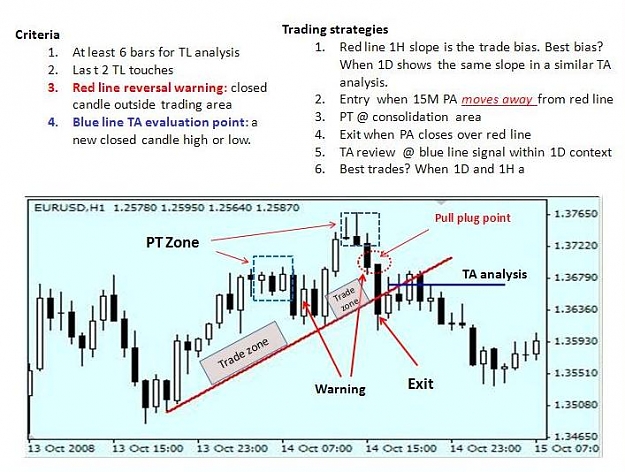

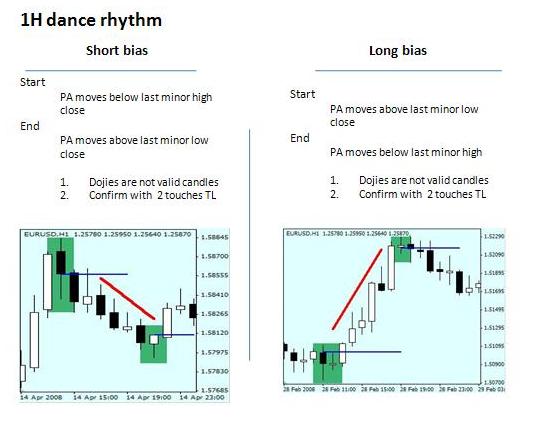

Key questions: (1) What is the current trend? (2) Any warning signs of potential reversal?

Note: the TA is NOT for trading but better listening to PA music.

Regards,

Empty as water and soft as a facing wind mountain