Hi all,

EDIT: No idea why this is in commercial as I'm not selling anything.

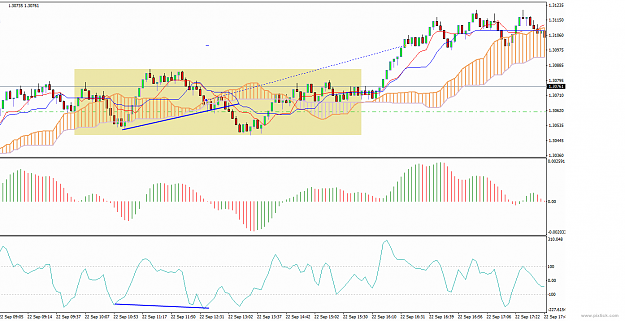

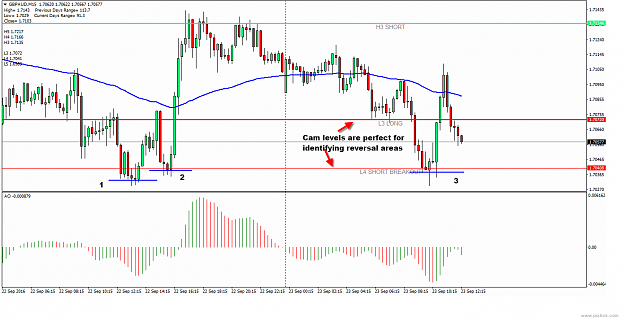

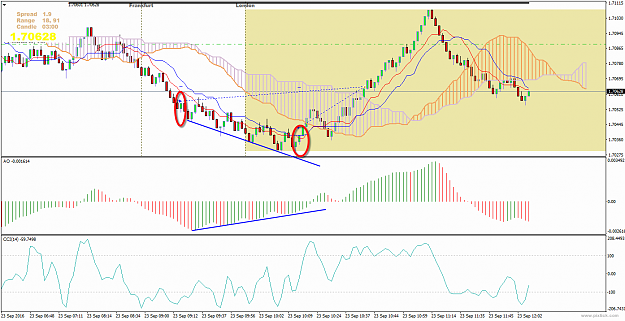

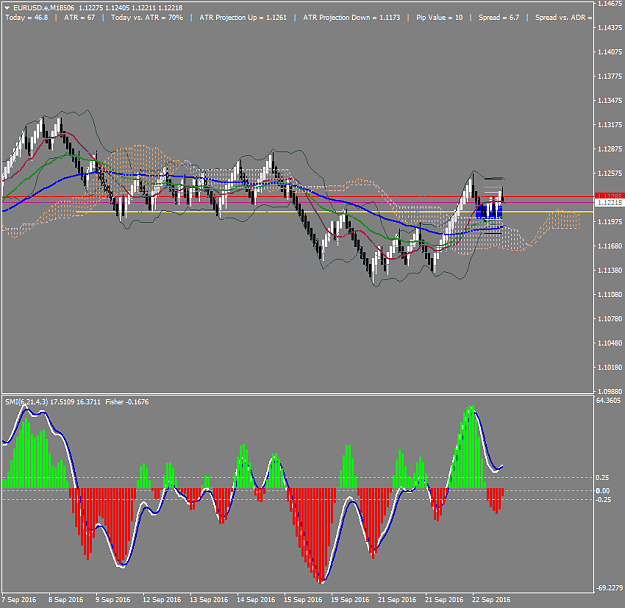

My first foray into posting a new topic. I've been using piprange charts for 7 years and via the contributions of @Rockypoint using the Ichimoku indicator, I've been able to combine my use of divergence and Ichimoku.

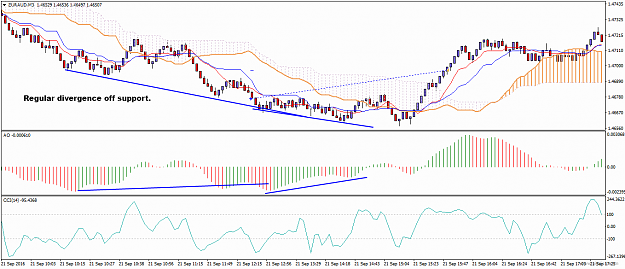

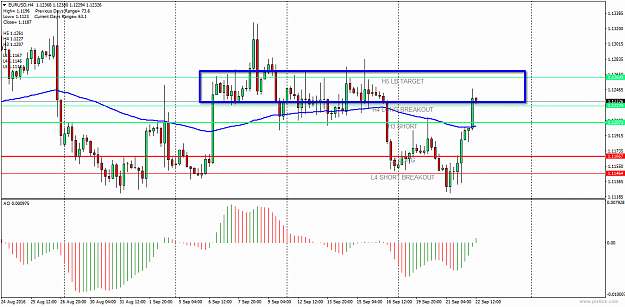

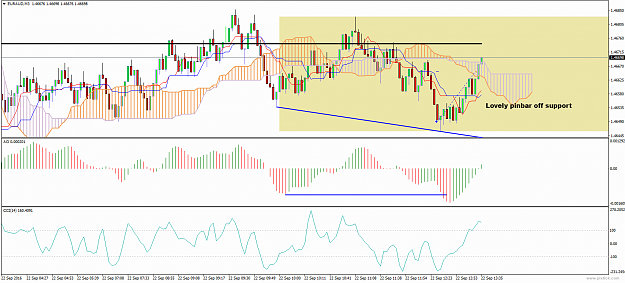

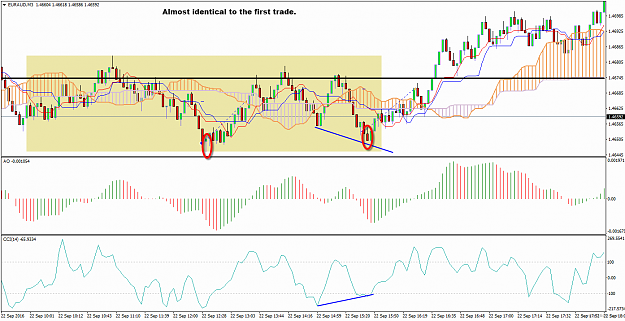

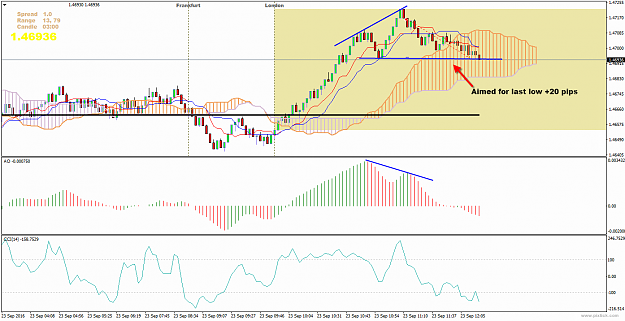

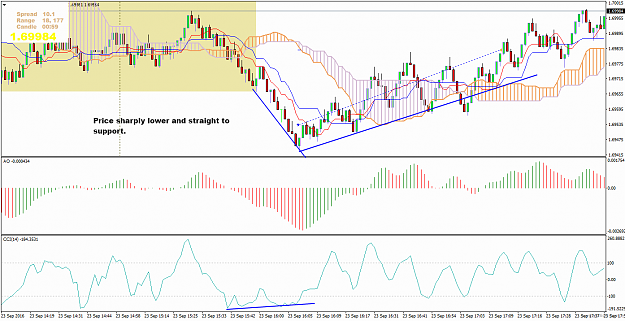

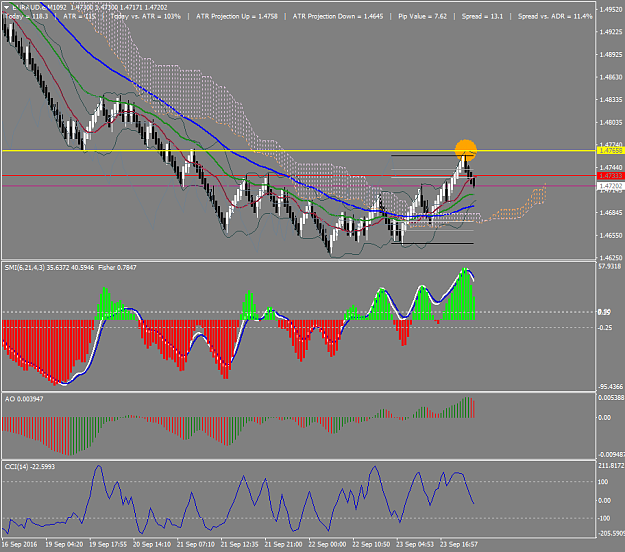

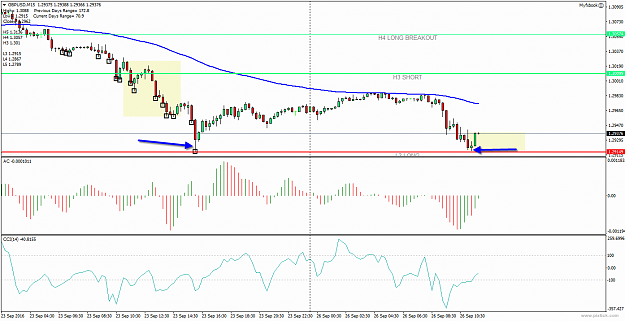

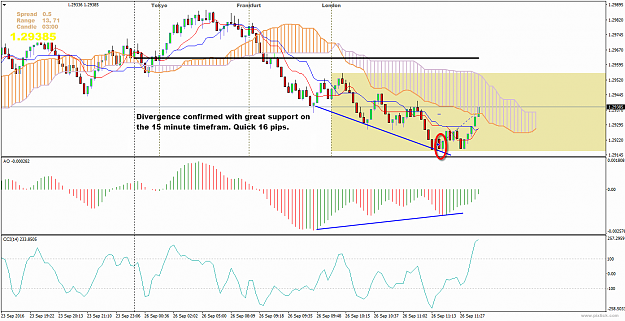

I thought I'd share some examples and try and generate some discussion on the much neglected method of using pip range charts. To me they provide a much clearer picture of the market and provide a different perspective on charting. I am very much a technical trader and firm believer that patterns repeat themselves. Hopefully this will be evidenced by examples posted.

A few things to note:

I have a lot of examples on my Instagram page. My username is @Flipfloptrader.

Today's trade so far:

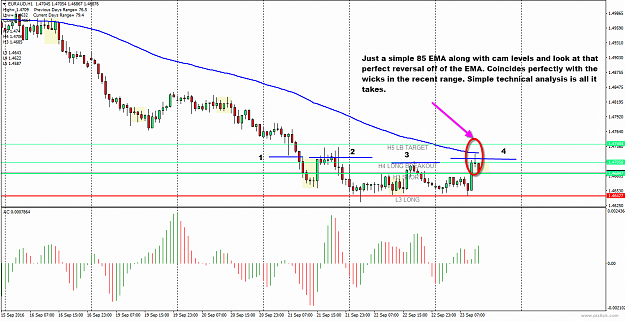

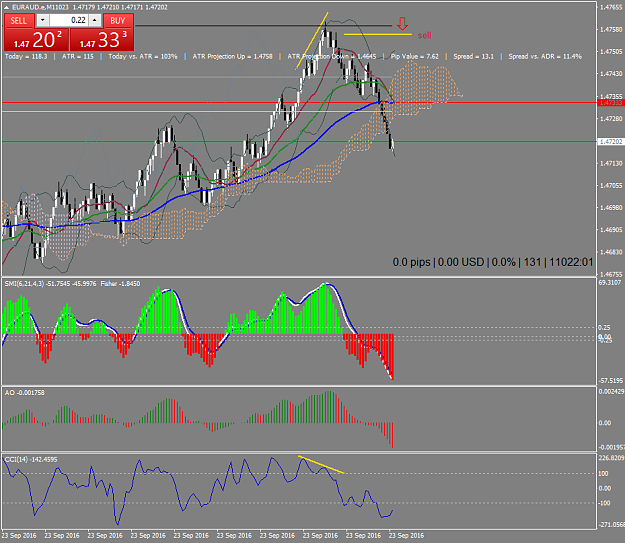

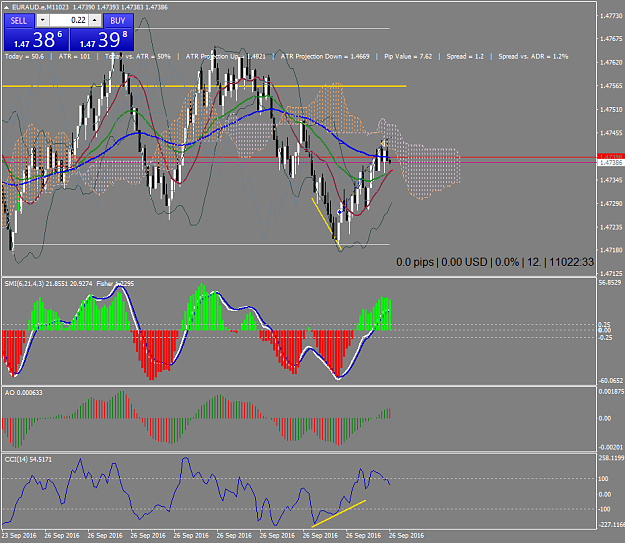

EURAUD. Very strong AUD vs most pairs and EURAUD can trend very well when in these phases. Price made a lower high, oscillator made higher highs to complete hidden divergence.

Any questions are welcomed.

FlipFlop.

https://flipfloptrader.com

EDIT: No idea why this is in commercial as I'm not selling anything.

My first foray into posting a new topic. I've been using piprange charts for 7 years and via the contributions of @Rockypoint using the Ichimoku indicator, I've been able to combine my use of divergence and Ichimoku.

I thought I'd share some examples and try and generate some discussion on the much neglected method of using pip range charts. To me they provide a much clearer picture of the market and provide a different perspective on charting. I am very much a technical trader and firm believer that patterns repeat themselves. Hopefully this will be evidenced by examples posted.

A few things to note:

- I will not be posting EAs, indicators etc. There are dozens of EAs designed for MT4 to construct offline charts to create pip range charts.

- I am not interested in an EA being developed, I much prefer manual trading.

- Please take the effort of researching an answer before asking a question, should you not find it, feel free to ask.

I use a 5 pip range chart, I avoid any CHF pairs and JPY pairs for the simple reason I do not want to be in a trade when they manipulate the market. What the SNB did with the Franc and the Euro was absolutely ridiculous. My main pairs are GBPAUD, GBPUSD, EURUSD, EURAUD. I am a firm believer in mastering a few pairs rather than trying to trade too many pairs. I do not trade positively correlated pairs at the same time....to do so is to simply double your risk on the same outcome.

You can download CRB EA here.

Inserted Video

I have a lot of examples on my Instagram page. My username is @Flipfloptrader.

Today's trade so far:

EURAUD. Very strong AUD vs most pairs and EURAUD can trend very well when in these phases. Price made a lower high, oscillator made higher highs to complete hidden divergence.

Any questions are welcomed.

FlipFlop.

https://flipfloptrader.com

flipfloptrader forum