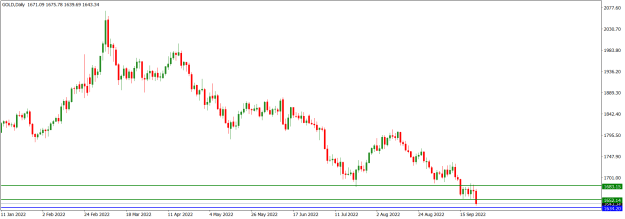

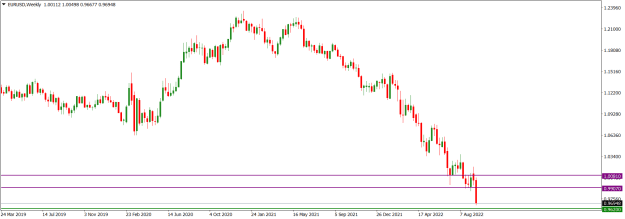

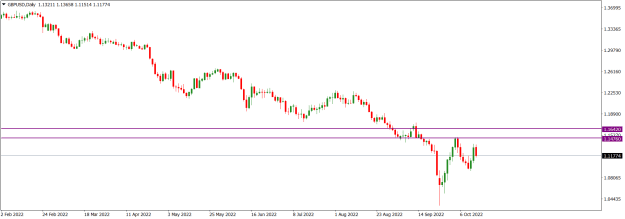

EURUSD Weekly Technical Outlook

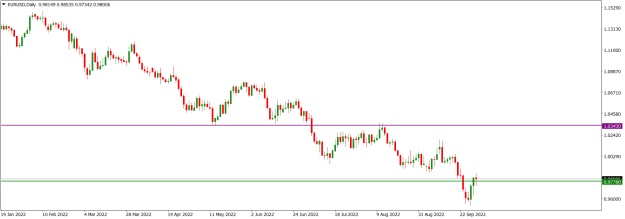

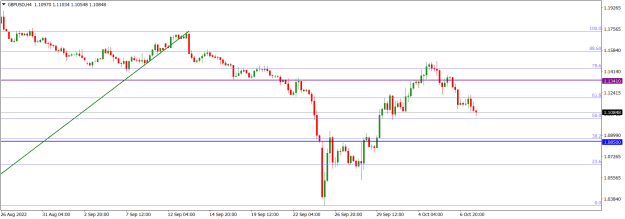

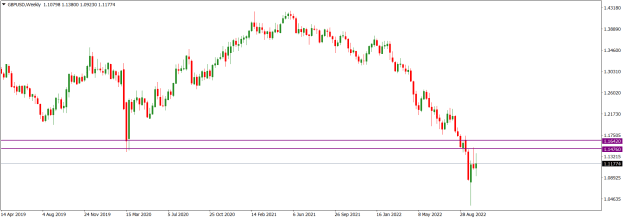

Bearish market operation dominated the EURUSD market last week, but sellers struggled to retain market influence within the 1.00810/0.99070 multi-year horizontal support zone (green). Although the printed bearish candlestick has shadows on both ends, we may still see further bearish push towards the lower part of the 1.00810/0.99070 multi-year horizontal support zone (green).

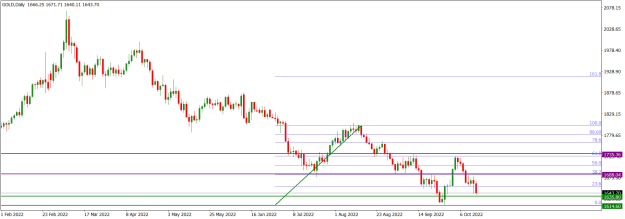

The 1.03260/0.98635 bearish swing on the EURSD daily time frame saw 61.8/78.6 Fib zonal retracement last week Monday and headed southwards on Tuesday. There was insignificant bullish price action throughout the week, and we may not see much northward directional momentum before further southward drive. However, we should be mindful of the fact that price action is within the 1.00810/0.99070 multi-year horizontal support zone (green) seen on the weekly time frame.

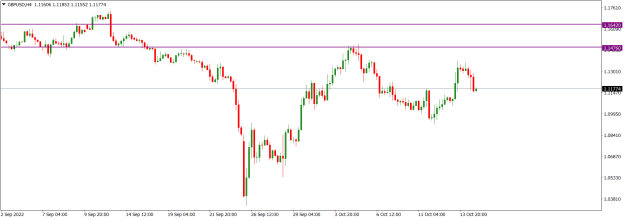

EURUSD price action on the H4 time frame is in a consolidation phase as it tackles the 1.00810/0.99070 multi-year horizontal support zone (green) seen on the weekly time frame. Although recent technical patterns favour bears, we may still have some northward move before any further southward drive.

I may be wrong. Trade safe and prosper.

KP

Bearish market operation dominated the EURUSD market last week, but sellers struggled to retain market influence within the 1.00810/0.99070 multi-year horizontal support zone (green). Although the printed bearish candlestick has shadows on both ends, we may still see further bearish push towards the lower part of the 1.00810/0.99070 multi-year horizontal support zone (green).

The 1.03260/0.98635 bearish swing on the EURSD daily time frame saw 61.8/78.6 Fib zonal retracement last week Monday and headed southwards on Tuesday. There was insignificant bullish price action throughout the week, and we may not see much northward directional momentum before further southward drive. However, we should be mindful of the fact that price action is within the 1.00810/0.99070 multi-year horizontal support zone (green) seen on the weekly time frame.

EURUSD price action on the H4 time frame is in a consolidation phase as it tackles the 1.00810/0.99070 multi-year horizontal support zone (green) seen on the weekly time frame. Although recent technical patterns favour bears, we may still have some northward move before any further southward drive.

I may be wrong. Trade safe and prosper.

KP

Do your homework, follow the footprints of smart money