Hello guys,

I'm back from a short hiatus from FF. I have had a load of PM's regarding the similarity CI method, wheather I still use it and if I can explain it deeper.

Me explaining this concept is not me agreeing with what eurusdd has done, which is a huge shame as some of his concepts were good, some appeared to be flawed, but let's not dwell on what has happened and experiment.

So I am taking this opportunity to address those questions. No, I haven't used it recently, but when I did I made some good profit, but noticed it was flawed in trending markets. I have applied just a simple logic not to get caught out in strong trends.

I don't claim this to be the "holy grail", but it can be very useful, especially if you use good R:R. You can apply SL ideas if you want to.

Please keep the discussions clean and not resort to silly arguments

RULES

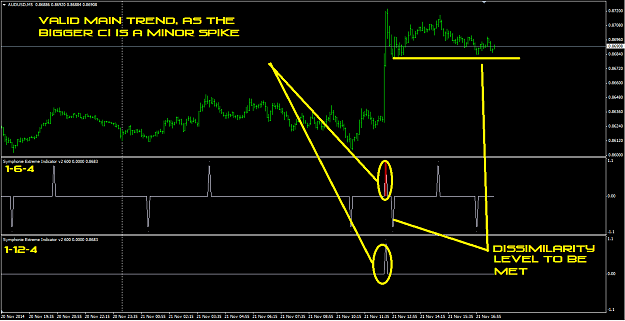

1) Both CI's have to be in agreement for their to be a main trend change

2) When there is a dissimilarity on the smaller CI indicator against the direction of the main trend that is the level for price to come back to

This is the important part for not getting caught out

3) Only acknowledge valid main trend changes are when the bigger CI is not a major spike (minor spike)

Note: Red and green spikes are majors, non coloured spikes are minors

The CI settings example - Small CI= 1-x-4

Big CI= 1-2x-4

Please don't ask for optimum settings as CI settings will differ from each broker.

Attached is the extreme spike indicators, if any coder out there could make them run more efficiently, please do!

I'm back from a short hiatus from FF. I have had a load of PM's regarding the similarity CI method, wheather I still use it and if I can explain it deeper.

Me explaining this concept is not me agreeing with what eurusdd has done, which is a huge shame as some of his concepts were good, some appeared to be flawed, but let's not dwell on what has happened and experiment.

So I am taking this opportunity to address those questions. No, I haven't used it recently, but when I did I made some good profit, but noticed it was flawed in trending markets. I have applied just a simple logic not to get caught out in strong trends.

I don't claim this to be the "holy grail", but it can be very useful, especially if you use good R:R. You can apply SL ideas if you want to.

Please keep the discussions clean and not resort to silly arguments

RULES

1) Both CI's have to be in agreement for their to be a main trend change

2) When there is a dissimilarity on the smaller CI indicator against the direction of the main trend that is the level for price to come back to

This is the important part for not getting caught out

3) Only acknowledge valid main trend changes are when the bigger CI is not a major spike (minor spike)

Note: Red and green spikes are majors, non coloured spikes are minors

The CI settings example - Small CI= 1-x-4

Big CI= 1-2x-4

Please don't ask for optimum settings as CI settings will differ from each broker.

Attached is the extreme spike indicators, if any coder out there could make them run more efficiently, please do!

Attached File(s)