However, you might find answers to any questions in the links below (use your web browser's text search facility to find the topic you're looking for).

Last updated: Aug 27, 2020.

Personal contact

Sorry, but I'm no longer accepting private messages, and I won't be replying to any forex related e-mails (reasons here). However:

If you're looking for MT4 programming services, please see the 'MT4 programming' section below. I don't do MT5 coding, as I've never looked at MT5 and hence am unfamiliar with both the language and the IDE.

If you want to ask about profitable MT4 EAs, the short answer is that in 13 years I've yet to find one that meets by personal criteria of both consistency and safety. Some general info on EAs here.

If you want trading advice, I'm strictly a part-time amateur, but if you want my opinions, see the 'Strategy tips...' section below.

If you want proof that it's possible to be consistently profitable at retail trading, see this. But be aware that the spot fx industry is full of myths, scams and pitfalls, and that the vast majority who attempt to trade, eventually lose. Trading is an exercise where wealth is ultimately transferred from the hapless majority into the hands of an elite minority, who will take your money whether by fair means or foul.

I see many questions in these forums that could be answered immediately by simply performing a forum search, or using an internet search engine. Google or Wikipedia has the answer to almost every conceivable question. Want a good news source? Want to find a certain indicator? Want to know how to install something? what a certain MT4 error message means? how to calculate the Sortino ratio? what contango and backwardation are? what pareiodolia is? Just use Google.

Strategy tips, ideas and caveats

Please keep in mind that, although I've been playing the markets since 2001 (and FX since 2006), I'm a retired programmer, not a pro trader. I run a couple of small accounts as a hobby, and I enjoy tinkering intermittently with both automated and discretionary approaches. I simply post my opinions, right or wrong, like everybody else. All of the following is offered free, on a take-it-or-leave-it basis. I suggest that you take nothing for granted; always test the viability of concepts and strategies to your own satisfaction -- ideally over several months' worth of changing markets -- before using them on a live account.

Fwiw here is the basis of my own approach, which uses a lot of FA. For folk who prefer TA, and would like some original ideas as a possible starting point to investigate further, you might like to try this (mainly mean reversion; more here), or this (trend following; see the last couple of paragraphs).

As requested by MTaufiq, I've also shared some thoughts on: trading myths, caveats, market 'iceberg', orderflow patterns, automation, C-liquidity, risk & leverage,

methods & markets (& here), money management, limitations of TA (& here), qualitative analysis, nuanced analysis, statistical validity, zero sum, contrarian/SSI,

holy grail (& here), position sizing, scaling returns, martingale (& here), nedging (& here), recovery, visibility, PA, risk calcs, risk of ruin, rags to riches, P/L concepts,

inverting losses, pyramiding, random entries, KISS, randomness (& here here), expectancy & MM, uncorrelated positions, trends, indicator types, repainting (& here),

strength meters, best MAs, divergence, Bollinger bands, fibo/pivot calcs, OB/OS, broker types, losing trades, staking systems, hedging & correlation, trade explorers,

competitions, psychology, educators, vendors (& here here), naysayers (& here), programmers, coding requests (& here), member ranking, 7 pillars, rocket science,

broker statistics (& here), trading 'pyramid', order types, MT4's popularity, Gil Blake, Ryan Jones' MM, gambler's fallacy (& here), roulette (& here here here), blackjack,

discipline, fallacies in RNG charts, targets, IP & broker hacking (& here), indicator uses, equities v fx, paths to success, saddle blankets, crystal ball indicator (LOL),

failure, backtesting, curve fitting, Dunning Kruger effect, forums (& here), 16 links, MQ4 source, fonts, sponsorship, Newcomb's paradox, NZ tax law, and MONOPOLY.

Much of the above is the result of my own R&D, and it's all original material that you won't find anywhere else on the internet.

There are more links in the 'Twelve stepping stones for rookies' post here.

Among my favorite posts on pro trading are by fx1986, Ziad (blue typeface), Graviton, soultrader, ronaleo10, Fudomyo, copi88, medici, Parmalat, triphop, flotsom, TheRealThing, Marv, skfx, EcoTrader, Davit, Gaston, topherhk88, Xela and HedgePiglet. Here is the best post about trendlines that I've read; much the same style of thinking applies to many other TA-based tools. Perhaps the most important post I've read in my 13 years at FF was written by alphaomega (IMHO anybody who doesn't understand its implications shouldn't attempt to trade). DonPato explains the first principles of price movement very well here. Here is a great video on the realities of trading by prop trader Tom Dante (warning: he uses some colorful language!). And a very sobering video on how some brokers manipulate their trader customers here. Here are two very good (imho) posts by davelansing and Oldtraderman, that accurately describe the differences in how one might reasonably approach mechanical, and discretionary, trading respectively.

Education: Where to go after you've completed Babypips school? Read carefully what Market Wizards author Jack Schwager says here. DonPato's thread on market structure and orderflow is a must read imho. Here is a great post by PipMeUp. After you have some experience, then if you're willing to spend $$$, and a lot of time familiarizing yourself with new concepts, the best institutional education that I've found is discussed in the latter posts in this thread. However, if you're looking to use TA, the best FREE educational threads I know of are LauraT's Roadmap (and here); and PVSRA (and logically, its spin off here). Davit's 'Pivot Trading' thread has maintained its popularity for a while now, and the main contributors have been posting profitable results. Bionics' equilibrium thread is an excellent read imo. There are many excellent audio podcasts with REAL pro traders here -- a goldmine of information. Some good material (especially on 'price action' trading) from TheForexGuy here. And some very good blog articles by Sam and Justin here. Some valuable concepts by CrucialPoint in this thread, for folk who are not looking to be spoon fed a trading system. Interesting article on orderflow trading here. Articles by Dr Brett Steenbarger on trading psychology here. Plenty of listening and reading in all of those links -- a must for newcomers.

If you're looking to develop automated systems (EAs), then Daniel Fernandez offers comprehensive comment in his blog. You might want to also check out threads/posts by FXEZ, Copernicus, algoTraderJo, PipMeUp, mikkom, 60minuteman and Craig. Also, two excellent posts by topherhk88 and merlin about system design.

FWIW the extent of what I'd learned up to 2012 is reflected in this post, which also contains links to a lot of my older posts.

Programming tips: MT4 navigation tips, using iCustom(), SupDem and Zigzag, debugging EAs, MT4 editor colors. (see also 'Miscellaneous resources' section below)

Indicator calculations: Heikin-Ashi smoothed, TDI.

The brain teasers thread -- dozens of seriously good puzzles contributed by various FF members -- if you have time to kill waiting for the market. And for some subtle off-beat humor, I enjoy this thread.

I will add to this list as I find other good (IMHO) posts or links. Anybody, please feel welcome to post suggestions.

MT4 programming

I am very sorry, but I'm no longer coding or troubleshooting indicators or EAs, neither for payment nor goodwill (reasons here and here).

You could try posting in one of the "I code your indicators for free" threads (e.g. here), and hopefully somebody will help you.

If you need an indicator, you could look in this thread (note especially the posts here and here, where there are ZIP files containing thousands of indicators), the links in the 'Miscellaneous resources' and 'MT4 Indicators' sections below, or try finding it using Google. If a MQ4 file was written before Feb 2014, it will probably need to be compiled using MetaEditor/compiler build 509 -- see this.

If you want to add alerts to an indicator, this thread might help you. Or the material here.

If you want to try to build an EA yourself, you could try any one of FXDreema, EAtree, ForexSB, Molanis, FXpro Quant or Etasoft forex generator. Search YouTube for videos showing how to operate them. I can't offer a recommendation, as I've never used any of them myself.

If you're willing to pay to have a programmer do the work, you could try MQL or upwork. There are many programmers who are happy to code for money. Or if you prefer to stay within the boundaries of FF, there are many competent programmers you could try contacting, e.g. FerruFX, cja, sangmane, minmin830, mladen, Nicholishen, pips4life, abokwaik, Xaphod, cyber1, euclid, futurespec, MathTrader7, braintheboss, ......

If you want to teach yourself MQL4 programming, Jim Dandy has created some very good tutorials (e.g. here here or here). Even better, Xaphod has posted some great links here. Also threads like the one by broketrader here.

Miscellaneous resources

Indicator sources:

Recently I read that an estimated 8,000,000 third party indicators have been developed for MT4. Apart from FF's search facility, here are some links:

- http://www.forexfactory.com/showthread.php?t=62722 (see ZIP file attached to post #1)

- https://www.forexfactory.com/showthread.php?t=546414 (lots of indicators and EAs in this thread)

- https://www.forexfactory.com/showthread.php?t=193727 (lots of order related scripts, indicators, EAs in this thread)

- http://codebase.mql4.com/ (perform a site search)

- https://www.fx141.com/category/mt4-indicators/

- https://atozmarkets.com/indicators

- https://www.mt5traders.com/category/mt4indicators/

- http://www.greattradingsystems.com/f...-4-indicators/

- http://www.desynced.net/fx/eas/indicators.php

- https://www.best-metatrader-indicators.com/

- https://www.forexmt4indicators.com/f...t4-indicators/

- http://forex-indicators.net/mt4-indicators

- https://mt4indicators.com/

- Google "mt4 indicators" (or "mt5 indicators") for plenty more sources

(if the indicators are old -- coded before Feb 2014 -- and they compile with errors, then you might need to do this first)

Other useful material:

- Links to free TA resources here.

- One-stop-shop of FA links here.

- MT4 navigational tips and techniques here.

- MQL4 extensible functions library here; generously updated for b600 by pips4life here.

- Calculation formula for currency indices here; USD index from Wikipedia.

- List/comparison of more than 200 MT4 br0kers here.

- How to compile old (created before Feb 2014) MQ4 files here.

- Equity curve simulators here and here.

- Trading simulator (warning: it costs $99) here.

- MT4/5 trade publishers, copiers, simulators, etc by FX Blue here (all free, as far as I know. Haven't tested any of their products myself; any feedback is welcome).

- How to add alerts to a MT4/MT5 indicator here (thanks to RedLineFred for pointing this out).

- All order related EAs provided by forexsaint here (for details, see posts #1 thru #25, and also post #127, of the thread).

- Miscellaneous trade management EAs and panels in this thread.

- Assorted scripts by zznbrm in this thread.

- EAs by cja to trail limit, stop and limit-stop orders.

- SteveHopwood's multi purpose trade manager in this thread (link to latest version here).

- Pyramid/anti-martingale (adds to winners rather than losers) EA by 7bit here. Concept has been developed further by MaryJane here.

- Useful MT4 utilities provided by PeterE and others here and here.

- Code formatters/"beautifiers" for programmers here here & here.

Hanover MT4 indicators

Note: apart from the items listed below, I don't share my work publicly (especially EAs, which are open to piracy). Therefore if you see any claims by vendors that their EAs were written by 'hanover', or that I contributed to their development in some way, these claims are COMPLETELY FALSE (and the vendor is obviously a fraud).

Here's an alphabetical list of the MT4 indicators and EAs that I have shared (links are to the latest versions, as far as I know):

Action forex pivots

Candle lengths

Candle strength

Chiming clock (this is an executable app, not an indicator. It plays a sound file X minutes before each Y minute interval)

Claudia's wine bar EA (this is an EA, not an indicator)

Close/delete orders (this is an EA, not an indicator)

CME options levels

Critical levels

CSM (currency strength meter histogram)

Currency strength - Giraia

Daily high/low histogram

Daily lines/boxes

Display info all pairs

Download central bank rates (this is an executable app, not an indicator)

EMA dashboard (latest .ex4 versions for Stochastic, RSI, EMA and Oscillator dashboards here)

Find unmatched parentheses (this is an executable app, not an indicator)

Guppy CBL and GMMA (latest fix to Guppy CBL here)

J4D strength

Load price history (this is an executable app, not an indicator)

MA dashboard

MACD traditional

MTF supply/demand zones (using Bredin's 'II_SupDem' method)

Options levels

Output history and script (instructions)

Pair Strength Analyzer (PSA) (usage info here, here and here; how RefreshPeriod works)

Pivots dashboard

Plot COT futures

Plot external data (example) (latest versions of 'PlotExternalData' and 'PlotExternalData (main chart)' available here).

Plot long/short retail data volumes

Plot News 4.0 (related links; history/usage; how to extract FF calendar data)

Recent Candles (or Christina Li's more sophisticated Multicharts indicator here; or FerruFx's creation here; or Multicharts Gold here).

Recent Prices

Recent S/R

Recent Strength (calculation explained here; links to other strength meters in green typeface; best strength indy)

Room up/down

RSI based strength indicator and dashboard

Screenshot EA (this is an EA, not an indicator)

Sessions/time zones (more info)

Signal indicator

Spaced lines 3.0

Stochastic dashboard (latest .ex4 versions for Stochastic, RSI, EMA and Oscillator dashboards here)

System info dump (this is a script, not an indicator)

Time zones (latest links) (how to find your MT4 broker's timezone)

Trades History

Trend length count

Unscramble binary files (this is a script, not an indicator)

Indicators should be downloaded into your ...../MQL4/Indicators folder.

EAs should be downloaded into your ...../MQL4/Experts folder.

Scripts should be downloaded into your ...../MQL4/Scripts folder.

Files should be downloaded into your ...../MQL4/Files folder.

Use the File....Open Data Folder..... option on the MT4 menu to find your MQL4 folder.

After installing the .ex4 file, open MT4's Navigator (type Ctrl-N) and then right click and click on 'Refresh' to update the Navigator's expandable 'trees' with the new indicator/EA/script.

Terms and conditions:

I've written these indicators and apps originally and primarily for my own use. All code shared here is supplied FREE of charge, and is offered on an 'as is' basis. I'm NOT offering a programming or troubleshooting service. Where source code is supplied, you are welcome to modify it** for your own use; however, neither the original nor modified versions may be sold or distributed commercially.

I offer no guarantee that the software is fit for purpose, or free of errors. Download and use the indicator(s) at your own risk. I accept no liability for computer damage or financial losses.

[**NOTE: All of these indicators were written using MetaEditor/compiler build 509, and the code libraries here. If the .mq4 source is available, and you want it to compile/run without errors, you'll need to do this first. Otherwise, download only the .ex4 file.]

Personal note

At the risk of sounding narcissistic, sorry........ but I often get asked, that if I know how to trade profitably, then why don't I trade for a living? Some reasons:

1. I'm happily retired, and I already have a passive income from other sources (mainly software royalties and investments). I tend to indulge myself with hobbies while they interest me, but for enjoyment rather than additional money. With FX, I enjoy the analysis, and devising and testing different strategies, more than the actual business of trading. For me, there are less time consuming, less stressful, and safer ways to generate income.

2. Profitable trading requires patience and nerve, qualities that don't come easily to me. I'm risk averse, and also something of a perfectionist, which doesn't help either.

3. Back in Jan 2015, I lost my entire trading account when Alpari UK went broke overnight (the SNB debacle), and I didn't even have any open trades at the time. While the loss wasn't crippling personally, it could have been if it was a larger size account. And to make a decent income from trading, you need a decent size account. FX involves risks that many traders apparently overlook.

____________________________________________

Essay: Requirements for success as a retail trader

Mathematically, there is only one way to be profitable as a retail trader. To obtain an 'edge' you must be be net long while prices are rising, and net short while they're falling, frequently/heavily enough to overcome transaction costs. (By 'heavily' I mean that if you are going to vary your position size, then the larger positions must somehow coincide with winning trades, otherwise your position sizing will work against you). It doesn't matter whether you enter or exit manually, use a TP or SL, hedge your positions, trailing SL, scale in or out, all of these are merely different operational ways of adjusting your net position (and exposure); and each component position ultimately exists as pips between entry and exit, multiplied by position size, in your account history. Hence your P/L ultimately comes down to how accurately you adjust your positions relative to turns in the market, given the price/time horizon that you're trading -- or in other words, DIRECTION and TIMING -- everything else is merely operational preference or convenience. The past can't be changed; it follows that decisions should be dynamic and based on upcoming market behavior and probabilities, regardless of both current P/L, and (unless serial correlation can be demonstrated) the outcomes of prior trades. A trader's recent P/L has no bearing on how the market will subsequently behave; whether your current trade is +10 or -10 shouldn't affect your immediate strategy.

All of the above applies regardless of the type of analysis (TA, PA, FA, quant, discretionary, whatever) you use; all that matters is that you have some kind of edge, and just as importantly, the personal qualities (patience, composure, discipline, self-belief, diligence, perseverance, etc) to apply it consistently. A further difficulty is that your edge must also be robust enough to survive several years' worth of changing markets. Market conditions tend to change over time for several reasons (e.g. shifts in belief systems, changes in economic relationships, advancing technology, etc; recently, the growing use of algos and HFT has gradually changed price patterns). Pro traders adapt their systems accordingly; you will even see some quants adjusting their parameters or moving between markets whose conditions offer the greatest potential compatibility with their algos. This makes it very unlikely that you will find, let alone buy, a retail system or EA that's long-term profitable; unless grounded in an indestructible or indefatigable market truism, fixed systems are unlikely to be intelligent or adaptable enough to maintain their effectiveness over the long term.

Sentiment leads price, and current price leads TA/PA, because the latter involves comparison with historical prices. I'm not saying that TA/PA can't work profitably, just that TA-based strategies lag others in an industry where speed of access to quality info can provide a competitive advantage. Apart from faster access to superior information, many institutional traders have other advantages over their retail counterparts: greater expertise and experience, vastly more capital, institutional grade prices, and faster execution. Imho the retail trader's best bet is to become knowledgeable in market fundamentals, microstructure, orderflow, and ways in which markets are manipulated, and then to continually update this knowledge; in short, learn how and why markets move the way that they do. Randomness is not necessarily measurable by studying price, it is a matter of information and perspective (see the essay on 'Qualitative vs Quantitative analysis' below).

Having devised a demonstrably robust edge by whatever means, the final piece of the puzzle is Money Management. You must size your positions small enough that a worst case sequence of losses will not cause personally unacceptable drawdown; a Monte Carlo analysis run across a large enough trade history might help. The pros recommend risking 1% to 2% of total trading capital per position. It might well be true that this level of risk is insufficient to grow a small account effectively, but brokers nonetheless state that the biggest reason for failure among their client traders is that they overleverage themselves. The rookie trader who wants to make money quickly and effortlessly is projecting his own wishful agenda onto an unsympathetic market.

Obviously you must find a broker who doesn't cheat you (e.g. trading against you, running your stops or VDPs that cause deliberate slippage, etc). Under such conditions you have no chance, no matter what strategy you employ; find another broker. Also, to minimize account loss in the event of flash crashes, black swans, broker failure (think 15 Jan 2015!) or cheating, imho it's also sensible to deposit only enough of your trading capital with your broker to avoid a margin call -- an advantageous use of leverage -- and deploy the rest elsewhere, where it is available on immediate call and ideally in an account that also pays some interest.

Good luck. ![]()

____________________________________________

Essay: Edges and expectancy theory

This is likely to be a very controversial post. People are welcome to express their strong disagreement. I don't wish to appear conceited, but I've been trawling financial forums since 2002, and the chances are I can anticipate much of what will be written in reply, as the same old cliches and textbook explanations tend to get trundled out repeatedly. So I'll simply state my view, and -- unless anybody posts something that's exceptional or revolutionary enough to warrant a response -- leave it at that.

The nature of an edge

In gambling parlance, an 'edge' means a winning advantage. In the context of price movement, an edge can only arise only as (1) the result of some kind of objectively demonstrable bias existing, from studying repeating historical patterns of behavior, and (2) the trader's knowledge/skill in being able to identify and exploit this bias. If price movement was 50/50 at all times, or the trader trades it on the basis that it is 50/50, then the long term expectancy of ANY strategy that he employs must necessarily be zero minus br0ker costs; in other words, he is destined to eventually lose.

Biases are probability based -- as Mark Douglas says "an edge is nothing more than an indication of a higher probability of one thing happening over another" -- and, unlike casino games where probabilities can be precisely calculated -- market probabilities can only be based on prior history, and hence they are fuzzy at best. No two situations in the market are ever identical; there are always different participants operating, whose agendas are unknown to the retail trader. As the disclaimer rightly says, past results offer no absolute guarantee of future performance. Nonetheless, there are similarities in aspects of collective psychology, and ways in which prices can be repeatedly manipulated. Ultimately biases are the result of imbalances between supply (sellers) and demand (buyers).

Biases may be directional or behavioral. A directional bias means that, based on past behavior in a given situation, a future scatter plot of price would occupy a statistically significant amount of more space in either an upward or downward direction from the current price. Examples of directional bias might be: the continuation of a strongly backed trend; trend exhaustion/reversal at conspicuous S/R barriers and/or profit taking at extreme overbought/soldness; market response to an unexpectedly bullish or bearish news outcome. Whereas an example of behavioral bias might be a breakout from tight or prolonged consolidation. The analyst might not know which direction price will break out, but past history tells him that when it does eventually break out, the move will be far/fast enough, on average, to deliver a potentially exploitable outcome.

Some traders might indignantly respond: "that must be wrong, because I'm profitable, and I don't trade in any of those ways!". Well, first, those are just some possible examples of potential bias. And secondly, it's possible for a trader to profit despite being unaware that he is exploiting some kind of bias; or perhaps he simply doesn't think in those terms.

A bias is determined by the market, not subjectively by the trader (however, the edge comes from the trader's ability to recognize it). A bias might occur at any time; the market doesn't care whether an insignificant retail trader is contemplating an entry or exit. I prefer not to think in terms of 'entry' and 'exit'. Here's why. Suppose my analysis perceives a situation of impending upward bias, therefore I want to be long. If I'm currently out of the market, then I want to ENTER long. Whereas, if I'm currently short, I want to EXIT my short. In reality, all I'm doing is altering my net position to reflect my assessment of probable bias.

If you doubt this, consider a trader who uses nedging (aka same pair hedging). This trader EXITs one of his hedged positions to leave himself net long or short, and ENTERs a new position to (re)create his hedge. Hence he is entering when a conventional trader is exiting, and vice versa. Thus any edge can't be attributed to the process of entry or exit; it comes down to direction and timing in adjusting his net position to exploit possible bias.

What an edge is not

One big illusion is that making trading decisions based on one's P/L, as opposed to trading on the basis of underlying market probabilities and behavior, can be the basis of an edge. Without an underlying bias, entries and exits do not, in themselves, represent edges. For example, all an exit does is convert floating P/L into realized P/L. The gain (or loss) was made while the trader was previously net long while price was rising, or net short while it was falling, i.e. prior to closing the position.

If you doubt this, think carefully about the following logic: if there is no bias, and (at any given point) you choose to leave a position open, instead of closing it, then 50% of the time price will subsequently move in your favor, and 50% of the time it will move against you, in approximately equal measure. Hence over a very large number of trades, this expectancy will balance itself out; meaning that in the long term, you're no better off by closing a position, at any given point, than leaving it open. So whether you exit 'now' or not makes no real difference.

However, supposing there is currently a 40% probability that price will move in your favor, and 60% that it will move against you. Now you should definitely exit. Why? Because of the 60/40 bias.

Unless your volumes are large enough to move the market, P/L-based decision making does not affect the market's subsequent behavior. The market doesn't care whether an insignificant retail trader is buying or selling, entering or exiting. A common misconception held by newcomers is this: if I close every winning trade while it's in profit, and hold every losing trade until it returns to breakeven, I can't fail to make money in the long term. That's the same misconception held by the roulette player who believes he can't lose money provided that he never ends a casino visit while his fluctuating balance remains negative. The player fails to see that, without an edge, his negative balance is just as likely to go deeper into the hole, as it is to recover. Recovery is guaranteed only in the hypothetical world where one has an infinite amount of time and resource. The same is true about positive balances: everything else being equal, they have a 50/50 probability of becoming more, or less, positive.

There is no edge in money management. Varying position size is merely a hit-or-miss proposition, unless you can somehow get your larger positions to coincide with winning trades. In other words, another type of bias. Adding to losing positions is not, in itself, an edge, unless the probability of price reverting to the mean somehow increases, the further price moves away from it -- another example of bias. Conversely, adding to winning positions improves profit only in a market with a trending bias. Moving SL to breakeven is a feel-good measure rather than an edge: in a 50/50 market, the curtailment of future profit due to trades being cut at BE will, over a large number of trades, offset any losses that were averted. (Unless price is somehow supported just under the BE point, i.e. the order volumes provide some kind of bias). Scaling out of winners creates a similar issue: in a 50/50 market, you would have been better off holding the position open 50% of the time, and better off taking the full profit earlier 50% of the time.

There is no edge in psychology. Sure, lapses in discipline, and emotionally based decision making, will likely sabotage your results -- but only if you had an edge to begin with. If you trade for long enough, some of your worst decisions -- in terms of failing to follow your strategy -- will turn out to be winning trades; and conversely, there will be occasions when you executed your strategy perfectly, but suffered your heaviest losses. (Indeed, the market can be a fickle mistress!) If you don't have a real edge, then you can still make money fortuitously, rather than systematically; in studying your short term performance -- days, weeks, possibly even months -- it can be all too easy to believe that you have conquered the market, when in fact you've been fooled by randomness. One thing that definitely isn't random is br0ker costs -- these decrease your winning trades, and increase your losing trades, with absolute consistency -- guaranteeing that, in the long term, unless you have a significant edge -- one that's solidly grounded in some type of bias -- you'll eventually lose. As indeed the vast majority of retail traders do.

Don't get me wrong. Inconsistent execution erodes the value provided by an edge. Patience, self-control, a steady nerve, self-belief, dedication, stamina -- these qualities are all required, and in almost superhuman doses, if a trader is to have any chance of success. But psychology in itself can not provide an edge; only the systematic exploitation of a demonstrable market bias can.

Unless you have an edge that's somehow grounded in the HOWs and WHYs of price behavior, you are merely guessing, and therefore gambling; the long term expectancy of your strategy is effectively zero minus br0ker costs, which means that you must eventually lose.

Finally, don't worry if the above doesn't make sense. You don't have to understand expectancy math to be a successful trader. (In fact you don't even have to understand how technical indicators work -- Steve Patterson is evidence of this!). For some, trading is an art -- or even a process of subconscious visualization -- rather than a statistically based science. There are discretionary traders, and there are quants. As I said earlier, you could be exploiting market biases without realizing it, or at least without thinking in those terms.

____________________________________________

Essay: Qualitative vs Quantitative analysis

Suppose I have a regular (D6) blue die, with four faces depicting 'UP' and two 'DOWN'; and a red die with four faces depicting 'DOWN' and two 'UP'. Let's further suppose that I first toss a fair coin which determines which die I will roll, heads = blue and tails = red (hence I will be rolling the blue die approx 50% or the time, and the red die 50% also). Each trial involves tossing the coin and then rolling either the red or blue die, as determined by the coin. Hence the overall result will be that 'UP' occurs approx 50% of the time, and 'DOWN' approx 50%. Let's further suppose that I have two friends, Adam and Bill, both of whom are betting on each trial outcome; I inform Adam of the result of the coin toss just before I roll the die, but I don't give this information to Bill.

Now if Adam bets on UP every time the blue die is about to be rolled, and DOWN for the red die, he'll be correct approx 4/6 or 66.7% of the time, giving him a significant 'edge'. While Bill will be right only 3/6 or 50% of the time, no matter what betting strategy he chooses to employ, giving him no edge. But most importantly, note that the outcome of each event (UP or DOWN) is the same for both of them. Bill could study a plot of prior trends of UPs and DOWNs -- the equivalent of technical analysis -- but he would gain no statistical advantage from it. Adam meanwhile benefits from his 'insider' knowledge. The point is that both players have DIFFERENT edges (mathematical expectancies) even though the outcome of each event ('UP' or 'DOWN') is UNIVERSAL.

I can't prove that this 'insider knowledge' model can be applied any financial market; the market might be sufficiently large, diverse or efficient, so as to make it impossible to be be manipulated by any bank cartel, or to allow 'sentiment' to otherwise be objectively determined. But the demonstration does show that, given a certain TYPE of speculative game, knowing the CAUSE of the current outcome (qualitative or fundamental analysis) can give one an advantage over merely knowing past OUTCOMEs (quantitative or technical analysis).

However, if (and I stress IF) prevailing sentiment can be ascertained, then the current price necessarily lags sentiment, and chart-based analysis (being derived from historical price) further lags the current price. To repeat my point, qualitative analysis seeks to understand the cause, while quantitative analysis looks at its effect. Technical analysis promises us -- or perhaps more accurately, makes the assumption -- that the outcome (price) reflects the net total effect of all of the current fundamental causes. But it makes no promise about its ability to forecast, i.e. to measure the sentiment that will drive subsequent price movement.

It follows that 'quant' systems can work profitably only to the extent that 'trends' are caused by genuine, objectively measurable bias, as opposed to 'randomness' (creating what is often called a 'fat tailed distribution' or 'levy flight'). In such a scenario, one would gain a small edge by trading in the direction of such a 'trend', rather than against it, and by cutting losses quickly and seeking to maximize gains from any profitable opportunities, which of course is the basis of 'trend following' systems.

Conversely, in scenarios where price is more likely to revert to a mean than 'trend' further away, the reverse strategy would deliver an edge.

And finally, in a random 50/50 game, such as a fair coin toss, or a market where price rises and falls on an exact 50/50 basis at every point in time, no edge is possible (and hence transaction costs will cause every trader, and every strategy, to eventually lose).

However, the experiment I presented shows -- at least theoretically -- that randomness can potentially be a matter of information-based perspective, as opposed to being a function of the game mechanism itself. In other words, outcomes might be measurably random to the uninitiated observer, but to an 'insider' who has information pertinent to their cause, they are not, thereby allowing the information to be profitably exploited.

____________________________________________

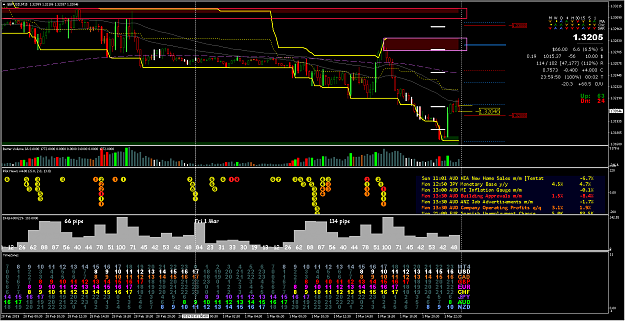

TA-based intraday methodology (M15 chart)

The method below is the best (using only TA) that I've devised after 12 years of studying FX. It's a discretionary approach based primarily around S/D orderflow, price action and exhaustion volume. I can't prove that it's long term profitable because I trade only part time, and for fun rather than serious money; there are more important things in my life than trading. Anyway, the template and that I use are all in the zip file below (for instructional material on each of the indicators, see the links in the 'Hanover MT4 indicators' section earlier in the post). Feel welcome to add some of these tools to your trading arsenal. ![]()

I look for confluences of the following factors (in order of priority; the more confluences, the better):

M15 chart:

1. S/D zones -- these are areas of where large volumes of orders are potentially clustered. Works best for major pairs; you can also look for confluence across related majors, e.g. if GBPJPY reaches a zone, see if GBPUSD and USDJPY are also reaching zones simultaneously. (Triangular equilibrium: GBPJPY always = GBPUSD x USDJPY).

2. Price action: pin bars or engulfing bars (stronger signal) or indecision/doji (weaker signal) occurring at/near these zones; OR

3. Exhaustion volume within these zones. Bright green and red painted candles frequently occur near the start and end of moves. Check the volume histogram for confirmation; compare volumes with the largest volumes in view on the chart (except for red news volumes).

NOTE: Alternatively, you can look for PA/volume reversals just beyond these zones (aka 'stoploss hunts' or 'C-liquidity').

4. Overbought/oversold (the yellow Donchian channel): look to buy when price is low (the nearer the bottom of the channel, the better); sell when high. The reason I prefer Donchians to Bollingers or Keltners is that they use prior S/R levels.

5. Time of day: the gray histogram gives the relative probability of a daily high or low occurring during that hour of each day. Note that reversals occur frequently at 9am-11am during both the London and New York sessions (heavyweight traders are active), and also at 5pm-6pm New York (see the TimeZones indicator).

6. Room up/down indicator: the nearer price gets to reaching its daily ADR, the greater the probability of a reversal (time to consider exiting any intraday trades).

7. Widely used MAs (self-fulfilling prophecy): if trending, price occasionally turns within the gray EMA50 channel; the dashed purple EMA200 also sometimes provides S/R. Self-fulfilling prophecy works because many traders (and algos) follow these EMAs and place orders at these levels.

8. Critical Levels (self-fulfilling prophecy): round numbers and floor trader pivot levels sometimes provide S/R.

9. News indicator: either exploit or avoid high impact news. The method can be improved significantly by using some relevant FA.

Long term confirmation:

10. Strength/weakness (s/w) analysis: pair strong against weak currencies on longer TFs (H4, D1, W1) as a proxy for fundamentally driven trends. Or better yet, use FA to determine currency s/w; the best buy setup is when there are several fundamental reasons why the pair should be rising, but it has fallen significantly, i.e. divergence between TA and FA. One way of doing this is using PSA, as described here.

11. Check the D1 chart for trend, and also avoid trading into strong S/R areas.

In general, the more of these factors that line up, the higher the entry probability. Most of this is commonsense. If my analysis suggests that price is likely to rise from a certain level, I want to be long; more likely to fall, short. When exhaustion of a move appears imminent, I want to exit.

Exits: I seldom use hard stoplosses. My exits are based on analysis, not my P/L or RR, which the market takes no cognizance of. For example I will exit a buy trade when price enters resistance, or has reached its ADR for the day, or if the fundamentals driving it upward appear to have weakened. Conversely, it makes no sense to exit a losing buy trade if price is about to fall into support, or sentiment is clearly strengthening, merely because I've lost a certain number of pips/$/%.

MM: My position sizes are based on what I call 'ADR$', which is the average dollar value that the traded pair moves daily. This helps to equalize risk across trades made with different pairs/instruments. The signal indicator can automatically calculate the number of lots for you; simply enter your risk (e.g. 2% or $200) into Signal's AmountToRisk setting, and the leftmost value on the '$' row (0.17 lots in the screenshot) is your number of lots. For example, with AmountToRisk set to 2%, this means that if price moves 149 pips (GBPCAD's ADR) I will win (or lose) 2% of my account. However, normally I would exit losses MUCH earlier than that, because I can always re-enter if I want to, at a better price, thus saving pips. Everything else being equal, a smaller loss has the same net long term effect as a (bigger) win. The converse applies also: I will bank profits when exhaustion appears imminent, and then possibly look to re-enter after price has retraced. I'm trying to maximize pip/dollar returns, not necessarily to win individual trades.

____________________________________________

F.A.Q.

I received a couple of PMs asking me about my Ignore list. Most of these folk are there because they support software piracy, or have otherwise shown disrespect toward programmers' work; and to prevent me from mistakenly helping them out, their future requests are now automatically hidden from me.

I also get a lot of PMs asking me about which are the most profitable EAs, or for general trading advice. That's flattering, because I'm a programmer, NOT a professional forex trader. Nonetheless, I enjoy tinkering with systems and run a couple of small accounts. I used to play blackjack, and I believe in the inviolability of expectancy math; most of my opinions are simply grounded in Math 101, commonsense logic, and a basic knowledge of how markets operate.

Anyway, for whatever it's worth, here is my reply to one PM that I received. The writer asked me about how he could make a living from running EAs (he said something like "I'm not looking for the holy grail, just an EA with a 60% win rate"):

[NOTE: most of what appears below was originally written back in 2012. Hopefully I've learned a bit more since then

If there was an easy way of attaining a guaranteed consistent 60% win rate, we would all be forex millionaires. Any system that’s guaranteed to deliver any kind of profit (assuming such a system exists) IS THE HOLY GRAIL. The key word being “guaranteed”.

Read this post, which was written by Joel Rensink, who has been trading forex for more than 30 years. Also this one. Then understand that these guys are expert discretionary traders, and that experienced human traders will always outperform EAs. EAs can not apply intelligent 'contextual' analysis or adapt to changing market conditions. As the saying goes "a good trader follows his rules; a great trader knows when to break them".

As an example, the EAs that I co-developed here have backtested very profitably (up to 20% return per year), but this offers no guarantee that they will be profitable going forward on a live account. And even in backtest, they don't produce "consistent" returns --- there are many losing months. After 7 years of studying forex, this is the best that I have been able to achieve. Please read also the posts by mim2005 in that thread, where he talks about automated forex systems being a small (and the most risky) part of a balanced investment portfolio.

Here is an interesting blog written by some very experienced traders. Read how their EA, which was performing much more consistently than ours, crashed badly when it suddenly encountered market conditions that the developers hadn't anticipated.

The only way to learn forex is to start reading and experimenting yourself. If you want to be profitable, be prepared for a long journey (I'm into my tenth year now and I'm still learning). There are no tricks, and no shortcuts. There is no return without taking a consummate amount of risk. In general, if you want big returns, you must take bigger risks, which means bigger drawdowns whenever your strategy encounters unfavorable market conditions. Hence IMO you should trade only with money that you can afford to lose.

If forex is your only source of income, then there will be added pressure to meet the targets needed to pay your bills. If losses cause you to get behind in meeting your targets, you will find yourself being forced into overtrading, and/or overleveraging yourself, which eventually leads to mistakes and even bigger losses.

Now that we have the caveats out of the way, here are some (free) FF threads that have helped me to understand forex:

James16 is highly regarded, although his price action techniques tend to work best on longer timeframes. At any rate, it's a good introduction to understanding candles and support/resistance types.

Millipede is a great concept, that involves taking low risk intraday entries, an then allowing those that hold to play out over several days/weeks/months, for high RR trades.

Deadly accuracy also gives low risk intraday entries, around probable reversal points.

No-brainer trades uses support/resistance to do likewise.

Seneca pilot's Ramblings explains key levels that are recognized by institutional traders.

Money flows, although not specifically a system, provides excellent material that every trader should know.

If you prefer indicator-based systems, here are some of the more popular ones:

Sonic R

Genesis

Choros

Trading Made Simple

Trade What You See

symphonie

To be fair, I haven’t followed any of these extensively, but they have been around for a while, and I’ve read good things about them.

IMO, things to stay well away from: anything involving Martingale variants, adding to losing trades, wide or no stoplosses, recovery-type systems. More info here. A lot of these concepts can work extremely profitably for several months, giving the trader a false sense of success, before they crash equally spectacularly. One of the biggest reasons that many traders lose, is that they make decisions based on their own P/L, instead of market behavior and probabilities.

In addition to the above, and if you want to trade successfully intraday, find out as much as you can (Google, YouTube) about these concepts:

--- Orderflow trading (check out posts by skfx in this thread).

--- How banks manipulate forex markets (and sabotage retail traders). Search for YouTube videos by people like Martin Cole and Mark Chapman.

--- Sam Seiden supply and demand levels (there's also a comprehensive post here).

It's my view that most robust systems are based around price patterns and behavior created by underlying drivers like: macroeconomics, money flows, levels of supply and demand, orderflow, the need to maintain across-the-board triangular equilibrium (e.g. EURJPY = EURUSD x USDJPY), breakouts during times of high liquidity, tracking central bank/heavyweight activity, self-fulfilling prophecy, news trading, fading extreme overboughtness/oversoldness, trapped trader behavior, key OHLC and 'bank' levels, session/time-of-day idiosyncrasies........ and no doubt many others that I'm unaware of. Conventional indicators don't directly measure any of these. With all of these factors acting continuously and simultaneously, forex is perhaps the most complex market to analyze and trade.

The most robust approach that I currently know of involves studying price from the standpoint of longer term trend strength, and then the way in which it consolidates, then expands, then consolidates, then expands, over and over, within the trend.

I've been around Forex factory's forum for more than 11 years now. Here is a list of contributors (past or current) whom I believe are either profitable traders, or have helped to shape the way that I think about forex. IMO there is high quality information in their posts (those in bold font I've found particularly helpful):

alphaomega, auslanco, auxesis, billbss, billflet, BillyRayVal, Bionics, birdt, capitalist88, claudia1, Copernicus, copi88, Craig, CrucialPoint, Cubbybgood, Custos, Darkstar, davelansing, Davit, daytrading, DonPato, Dopey, EcoTrader, endroute, FerruFX, flotsom, forexhard, fti, Fudomyo, FXEZ, Gaston, GEfx, Graviton, grkfx, hayseed, HedgePiglet, heshuhan, HiddenGap, Houdini, ianf0ster, j4d, Jack_Larkin, james16, Jarroo, jmn5611, KeenPips, Kenneth Lee, kiwi_trader, kprsa, MagnumFreak, mbqb11, medici, merlin, mikkom, mim2005, mypipbull, mzvega, nhen, Nicholishen, nubcake, numbnuts, Oldtraderman, Parmalat, PeterCrowns, PeterFM, philmcgrew, pipEASY, PipMeUp, pipmutt, Porkpie, ppxdf, Rabid, r61, scooby-doo, Seneca_pilot, simnz, Sis.yphus, sisse, skenobi, skfx, skyway, smjones, soultrader, stevepatt, the redlion, the_wizard, TheRealThing, TeamAphid, topherhk88, triphop, Trotty, ubeee, unknown4x, v2vboni, vox_dei, wmd, Xela

No doubt there are other traders who are equally worthy of honorable mention, but FF is a vast forum, and there aren't enough hours in a day to read, let alone test, every idea that's presented here.

Some of the educational material I've listed includes a commercial agenda. Perform your own due diligence, and if you decide to spend money — that's YOUR choice. Markets can change over time, as they react to different economic climates and global agendas, hence there is no absolute guarantee that ANY approach will remain consistently profitable forever.

However, there might well be forex traders who have found a an infallible price pattern that delivers a handsome, consistent weekly profit. Hence they would likely disagree with much of what I've said. It's also possible that their 'edge' might remain effective over several years worth of changing markets, and even employ a prudent, sustainable MM. If you're lucky enough to find one of them that posts here, then — obviously — ignore what I've said, and follow them. But rest assured that I'm not one of them.

My 2c, for whatever it's worth,

David

______________________

As PMs don't allow attachments, I'll reply to them in this thread. OK, here's the first one......

No, I've never coded a MTF CCI, but I found the attached indy in my archives. You might also look to the Project Ultra thread, and ask jmw1970 if he has coded one. Also maybe check this thread, and try Googling something like "mtf cci mt4" if you haven't already done so.