If there was easy money lying around,no one would be forcing it into your

- Post #17,441

- Quote

- Jan 3, 2012 7:37pm Jan 3, 2012 7:37pm

- | Membership Revoked | Joined Aug 2011 | 7,263 Posts

- Post #17,442

- Quote

- Jan 3, 2012 7:39pm Jan 3, 2012 7:39pm

- | Additional Username | Joined Oct 2011 | 2,098 Posts

- Post #17,443

- Quote

- Jan 3, 2012 8:08pm Jan 3, 2012 8:08pm

- | Additional Username | Joined Oct 2011 | 2,098 Posts

- Post #17,444

- Quote

- Edited 8:27pm Jan 3, 2012 8:23pm | Edited 8:27pm

- | Additional Username | Joined Oct 2011 | 2,098 Posts

- Post #17,445

- Quote

- Jan 3, 2012 8:27pm Jan 3, 2012 8:27pm

- Joined Feb 2009 | Status: Member | 25,867 Posts

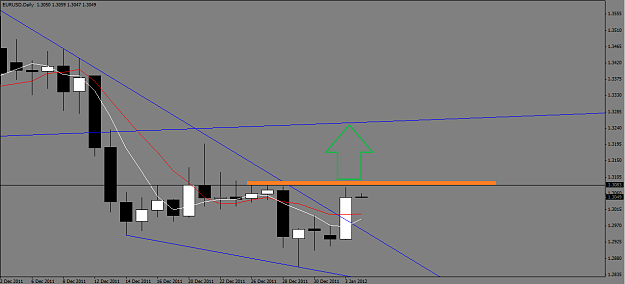

SEE LINE,TRADE LINE..PRICE HAS TO GO SOMEWHERE,,, PRICE WILL GO SOMEWHERE.

- Post #17,446

- Quote

- Jan 3, 2012 8:34pm Jan 3, 2012 8:34pm

- | Additional Username | Joined Oct 2011 | 2,098 Posts

- Post #17,447

- Quote

- Jan 3, 2012 8:37pm Jan 3, 2012 8:37pm

- Joined Dec 2010 | Status: Hybrid PA | 4,506 Posts

Mark ... Everything you have been told is a LIE

- Post #17,448

- Quote

- Jan 3, 2012 8:38pm Jan 3, 2012 8:38pm

- Joined Feb 2009 | Status: Member | 25,867 Posts

SEE LINE,TRADE LINE..PRICE HAS TO GO SOMEWHERE,,, PRICE WILL GO SOMEWHERE.

- Post #17,449

- Quote

- Jan 3, 2012 8:47pm Jan 3, 2012 8:47pm

- | Additional Username | Joined Oct 2011 | 2,098 Posts

- Post #17,450

- Quote

- Jan 3, 2012 8:52pm Jan 3, 2012 8:52pm

- | Additional Username | Joined Oct 2011 | 2,098 Posts

- Post #17,451

- Quote

- Jan 3, 2012 8:59pm Jan 3, 2012 8:59pm

- Joined Feb 2009 | Status: Member | 25,867 Posts

SEE LINE,TRADE LINE..PRICE HAS TO GO SOMEWHERE,,, PRICE WILL GO SOMEWHERE.

- Post #17,454

- Quote

- Jan 3, 2012 9:02pm Jan 3, 2012 9:02pm

- | Joined Feb 2010 | Status: Member | 188 Posts

"Pippin aint easy"

- Post #17,455

- Quote

- Edited 9:12pm Jan 3, 2012 9:04pm | Edited 9:12pm

- | Additional Username | Joined Oct 2011 | 2,098 Posts

- Post #17,456

- Quote

- Jan 3, 2012 9:09pm Jan 3, 2012 9:09pm

- | Joined Feb 2010 | Status: Member | 188 Posts

"Pippin aint easy"

- Post #17,457

- Quote

- Jan 3, 2012 9:12pm Jan 3, 2012 9:12pm

- Joined Feb 2009 | Status: Member | 25,867 Posts

SEE LINE,TRADE LINE..PRICE HAS TO GO SOMEWHERE,,, PRICE WILL GO SOMEWHERE.

- Post #17,458

- Quote

- Jan 3, 2012 9:13pm Jan 3, 2012 9:13pm

- | Additional Username | Joined Oct 2011 | 2,098 Posts

- Post #17,459

- Quote

- Edited 9:17pm Jan 3, 2012 9:16pm | Edited 9:17pm

- | Additional Username | Joined Oct 2011 | 2,098 Posts

- Post #17,460

- Quote

- Jan 3, 2012 9:16pm Jan 3, 2012 9:16pm

- Joined Dec 2010 | Status: Hybrid PA | 4,506 Posts

Mark ... Everything you have been told is a LIE