Entropy...check out the H&S pattern:

Left shoulder (May 15th ish)

Head (June 7th ish)

Right Shoulder (June 28th ish)

Excellent low risk entry @ the low of Left Shoulder with stops below the head...would have been a tasty trade (long) ;-)

Mongo

Left shoulder (May 15th ish)

Head (June 7th ish)

Right Shoulder (June 28th ish)

Excellent low risk entry @ the low of Left Shoulder with stops below the head...would have been a tasty trade (long) ;-)

Mongo

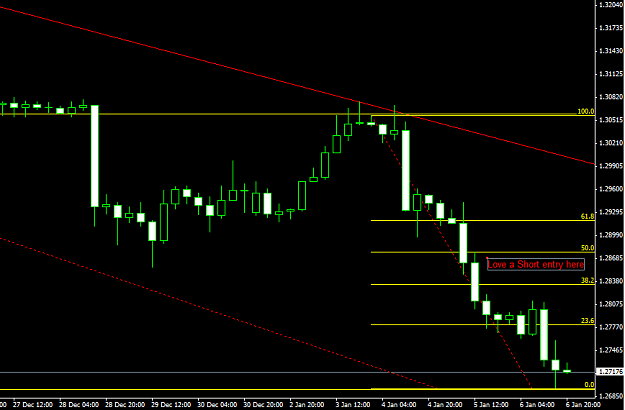

DislikedHEY, DANuk,

Given your technique, i am wondering if you enter short at 1.2245 area on the 17th of june. I have tried highlighting it in blue.

Or does this not fit with your criteria?Ignored