Since starting this journal at the start of the year I have been asked by a couple of people to explain how I trade, so here it goes:

I trade the trend. I learned to do this with assistance from two very helpful Forex Factory members - Johnedoe and Jacko. This is my take on it...

Step 1 - Identify The Trend

The first thing is to identify the major trend. I use a top down approach to analyse the trend. Weekly, Daily, 4 Hourly.

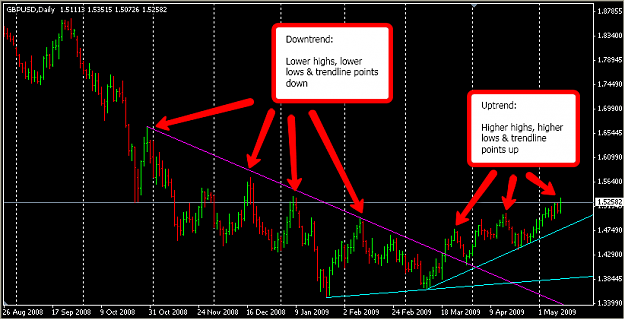

An uptrend can be identified by higher highs and higher lows. A downtrend can be identified by lower highs and lower lows. Trendlines drawn across the highs and the lows should also help to show direction.

Step 2 - Enter At A Discounted Price

Once I know what direction I want to trade in, I look to enter at a good price. In an uptrend I am looking for a dip to enter in. In a downtrend I am looking for a peak to enter in. I use support and resistance and fib levels (if confluence is found) to guide me.

See attached chart...

I only buy/sell at round numbers (ending xx00 or sometimes xx50). I identify areas to trade using a 1 hour chart. I am looking for price to make a u-turn as shown on the attached chart.

The potential trade at 1.4900 is exactly what I look for – a nice little retracement; rejected at 1.4850 and back up (buy) through 1.4900 creating the u-turn. Of course, not all trades are as nice looking as that, but you get the general idea!

Stick on a 100 pip stop loss and move it up as price goes (I tend to move the stop manually as the next round number gets hit, but you could use a trailing stop that moves pip by pip, as it goes).

If price goes against me I will also use Jacko’s Anti-Hedge strategy, whereby we let price move 50 to 100 pips beyond our stop loss and then re-enter at the point where we got stopped out.

Any questions please ask. This is a learning process for me too so helpful advice is also appreciated!

Regards,

Dan

Please note that none of the trades posted are signals or advice. They are only here as a record of what I have already done - not what I recommend to do!

I trade the trend. I learned to do this with assistance from two very helpful Forex Factory members - Johnedoe and Jacko. This is my take on it...

Step 1 - Identify The Trend

The first thing is to identify the major trend. I use a top down approach to analyse the trend. Weekly, Daily, 4 Hourly.

An uptrend can be identified by higher highs and higher lows. A downtrend can be identified by lower highs and lower lows. Trendlines drawn across the highs and the lows should also help to show direction.

Step 2 - Enter At A Discounted Price

Once I know what direction I want to trade in, I look to enter at a good price. In an uptrend I am looking for a dip to enter in. In a downtrend I am looking for a peak to enter in. I use support and resistance and fib levels (if confluence is found) to guide me.

See attached chart...

I only buy/sell at round numbers (ending xx00 or sometimes xx50). I identify areas to trade using a 1 hour chart. I am looking for price to make a u-turn as shown on the attached chart.

The potential trade at 1.4900 is exactly what I look for – a nice little retracement; rejected at 1.4850 and back up (buy) through 1.4900 creating the u-turn. Of course, not all trades are as nice looking as that, but you get the general idea!

Stick on a 100 pip stop loss and move it up as price goes (I tend to move the stop manually as the next round number gets hit, but you could use a trailing stop that moves pip by pip, as it goes).

If price goes against me I will also use Jacko’s Anti-Hedge strategy, whereby we let price move 50 to 100 pips beyond our stop loss and then re-enter at the point where we got stopped out.

Any questions please ask. This is a learning process for me too so helpful advice is also appreciated!

Regards,

Dan

Please note that none of the trades posted are signals or advice. They are only here as a record of what I have already done - not what I recommend to do!