Strategy Summary

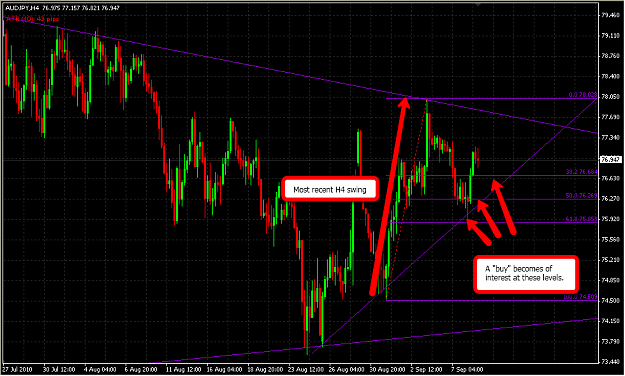

The basic premise of my trading method is to follow the trend as defined by the higher time frames (typically 4 hour and above). It is a very simple method that is essentially made up of four main elements:

- Support & Resistance Levels

- Trendlines

- Fib Retracements

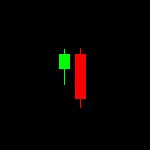

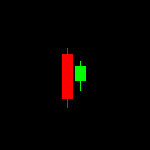

- Candlestick Patterns & Breakouts

This thread is a development of my original Trend Trading Chart Thread that I started in August 2009. Since I started that thread my trading has grown and my strategy has changed slightly. So rather than clutter the old thread with my new ideas I decided to start a new thread and set out my strategy as we go.

If you haven’t ever visited the old thread don’t worry – I will explain everything from the beginning so no need to go back over all the old posts.

If you did follow the old thread please feel free to continue posting there or here – depending on which variation of the method you prefer!

I have called this thread “Advanced Trend Trading” because the entries and trade management are a little more refined than before (not rocket science, I still like to keep it simple!) but the general premise of trend trading remains. I am also going to talk about some counter-trend trades as a compliment to the main strategy.

I’m afraid that nothing here is going to be new or exiting – it’s just a concoction of what I have found to work for me. I am not a professional trader and do not claim to be (although I would perhaps like to be one day!). Anyone who does want to try this method of trading should do so on demo only! I cannot guarantee that anyone will be successful following the way I trade – after all, a great deal of success depends on your own psychological issues. One of the biggest things you will need to get over to become a profitable trader is yourself!

Potential Trade Setups

This thread should be used for educational purposes only. It is not intended to be a signal service.

As this thread has grown, a few of us have decided to start posting possible trade setups. These should not be considered signals to trade and there are no guarantees implied or otherwise herein. The trades are shown for educational reasons, to help illustrate what we are looking at and how we might act once in a trade - should you wish to take a trade you should only do so once you have undertaken your own analysis.

CFTC RISK DISCLOSURE STATEMENT:

NOTICE: "HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

That being said, let’s begin…