DislikedThank you Graeme, that is a very good lesson on when to slow down with the probing and not overtrade.

Kindest Regards,

CamIgnored

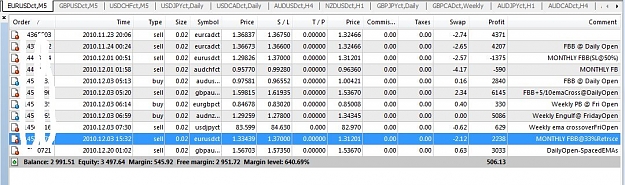

Yes. At the moment it is definitely a no trade for eurusd.

It is impossible to extract profit out of current movement.

Unfortunately, it looks like day 3 for eurusd for not moving.

That is fine as we have been conservative and the only damage is the few ammos we spent on probing.

In a traders starting phase a selected pair may not move for few weeks. It is the belief in the traders own self that will hold him/her together.

Days like this will most likely have the next day revisit todays price range. If today is destined to have a volatile breakout right after we all turn off the computer, the move will flow into next day and next week and even next month. One of the main reason why trading longer hours does not increase productivity in forex.

Today wasnt as exciting as yesterdays US session and hope readers are not disheartened but there is nothing one can do to force the market to move.

Good night all

Sincerely,

Graeme