I'm starting this journal to record thinking/feeling behind the trades that I will be going through, following pipEASY's and his friend trading strategies. They can be found here (Equity millipede and Flying Buddah). Having tried using technical and fundamental analysis as well as some of EAs, this is going to be my journey on becoming skillful in trading foreign exchange.

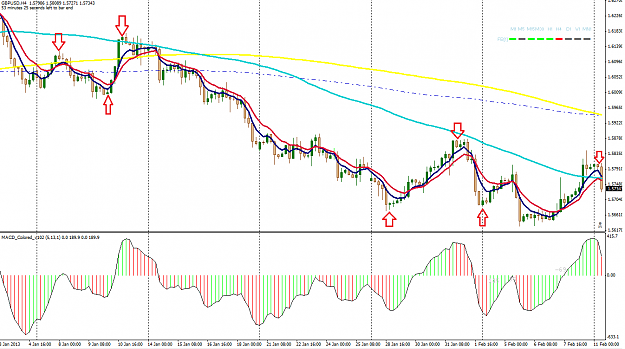

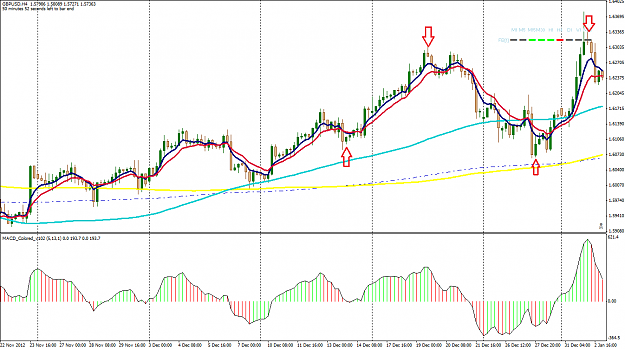

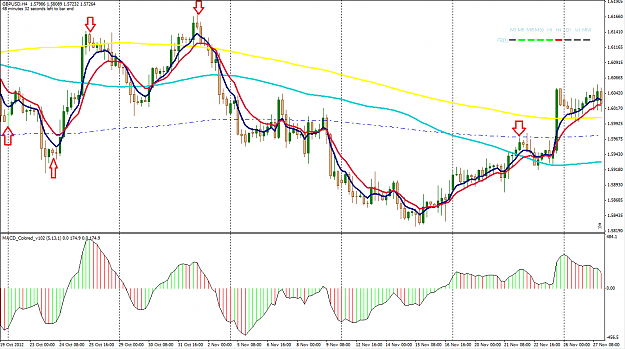

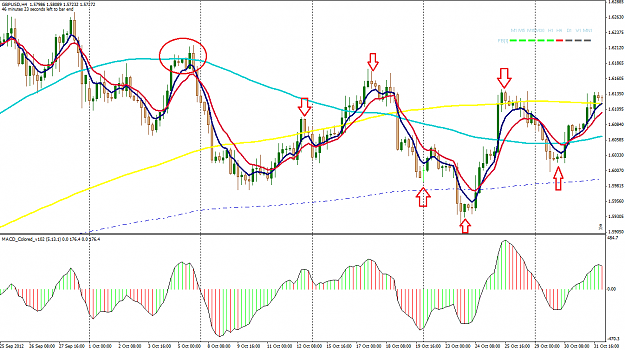

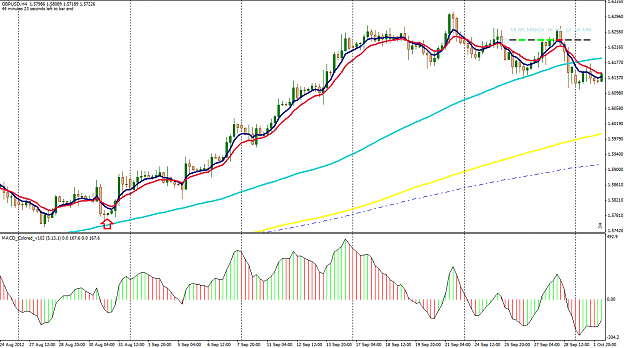

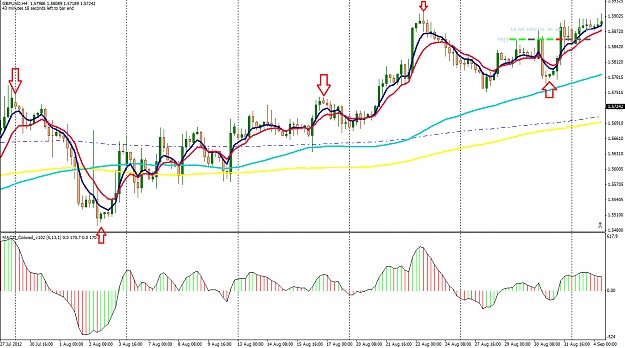

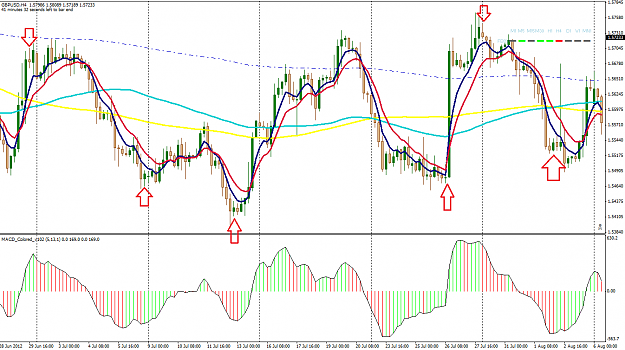

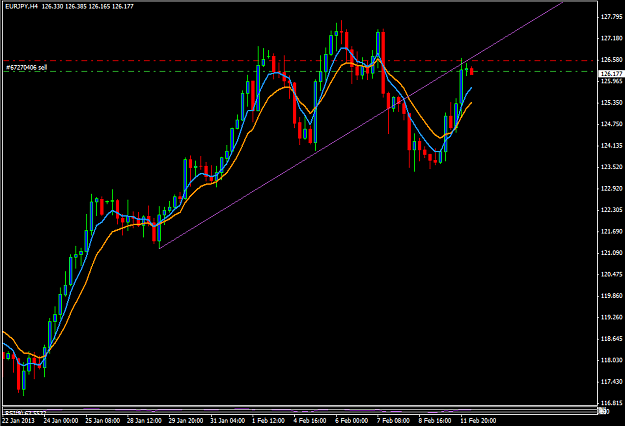

Fyling Buddah strategy will be used for short and intermediate returns (hours to days) while equity millipede will be used for long term investment (weeks, months and years). I will be trading on quite a few currency pairs to diversify my experience and broaden the understanding of those currencies. Flying Buddah signal will be checked for convergence/divergence (4 hour MACD) as described by Phillip Nel.

Two separate demo accounts will be used for each strategy and I will begin live trading within a month with $1000 on third account with the purpose of transitioning smoothly from demo into live trading. Live trading will commence with Flying Buddah to build momentum and capital while fourth account will be created for building my millipede.

Let's do it.

NOTE: I've closed both accounts (in surplus) and re-opened them on another broker that have 10 point spread and are faster. I have traded on classic where spread is 10 pips and SL/TP is way too high, now it's going to be sub-100ms to prevent slippage and re-quoting.

Fyling Buddah strategy will be used for short and intermediate returns (hours to days) while equity millipede will be used for long term investment (weeks, months and years). I will be trading on quite a few currency pairs to diversify my experience and broaden the understanding of those currencies. Flying Buddah signal will be checked for convergence/divergence (4 hour MACD) as described by Phillip Nel.

Two separate demo accounts will be used for each strategy and I will begin live trading within a month with $1000 on third account with the purpose of transitioning smoothly from demo into live trading. Live trading will commence with Flying Buddah to build momentum and capital while fourth account will be created for building my millipede.

Let's do it.

NOTE: I've closed both accounts (in surplus) and re-opened them on another broker that have 10 point spread and are faster. I have traded on classic where spread is 10 pips and SL/TP is way too high, now it's going to be sub-100ms to prevent slippage and re-quoting.

Attached File(s)

Those that can't, teach, and those that can, do.