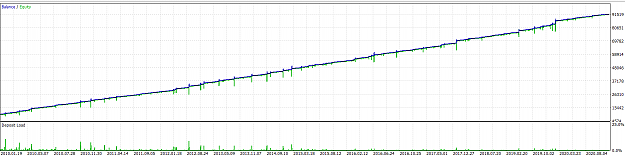

See this thread trading results with real money in myfxbook.

Price always goes somewhere - sooner or later - but as you can see with many TOP companies stocks - it goes UP.

Strategy:

Enter BUY when RSI oversold (depending on the stock - from 10 to 40, period 5). Any timeframe starting from M15.

Choose stable and good outfit stocks that can go UP in the longterm - you can use this tool to choose the best candidates.

SL - no stop loss. Wait.

TP - close when RSI overbought (depending on the stock - from 60 to 80, period 5).

History of this thread:

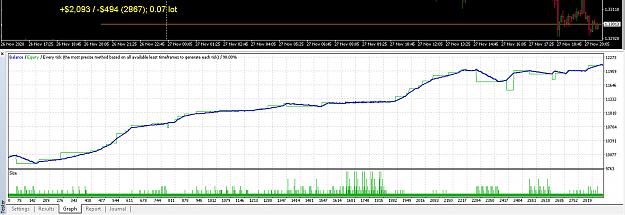

It all started with currencies and averaging/martingale long-term strategies - 5 setups with averaging running in myfxbook portfolio and 1 with virtual averaging and standard SL/TP approach.

But now focus on stocks - starting from this post mainly focus on stocks.

My current portfolio of small companies stocks and why:

#SEAC - software, they looking for new CEO, 182 employees in IT industry is good. Maybe someone could buy that team + subscribers of their services or they will get good new CEO. The online video platform they provide is ok. They don't have debts. Insiders own 25%. Analytics give a good target price 2.00 usd. Entered at 1.34 usd

#PFIE - services for gas & oil companies in US and I bet on covid situation improvement and gas&oil demand increase. They don't have debts. Analytics give a good target price 1.83 usd. Entered at 1.15 usd

#MYSZ - software, attracted investments 2 mil usd month ago, have an app for online shopping which helps to get the right size of dress to purchase. Covid and post-covid life will push more and more online shopping. This app is a good solution for that. Entered at 1.79 usd

Price always goes somewhere - sooner or later - but as you can see with many TOP companies stocks - it goes UP.

Strategy:

Enter BUY when RSI oversold (depending on the stock - from 10 to 40, period 5). Any timeframe starting from M15.

Choose stable and good outfit stocks that can go UP in the longterm - you can use this tool to choose the best candidates.

SL - no stop loss. Wait.

TP - close when RSI overbought (depending on the stock - from 60 to 80, period 5).

History of this thread:

It all started with currencies and averaging/martingale long-term strategies - 5 setups with averaging running in myfxbook portfolio and 1 with virtual averaging and standard SL/TP approach.

But now focus on stocks - starting from this post mainly focus on stocks.

My current portfolio of small companies stocks and why:

#SEAC - software, they looking for new CEO, 182 employees in IT industry is good. Maybe someone could buy that team + subscribers of their services or they will get good new CEO. The online video platform they provide is ok. They don't have debts. Insiders own 25%. Analytics give a good target price 2.00 usd. Entered at 1.34 usd

#PFIE - services for gas & oil companies in US and I bet on covid situation improvement and gas&oil demand increase. They don't have debts. Analytics give a good target price 1.83 usd. Entered at 1.15 usd

#MYSZ - software, attracted investments 2 mil usd month ago, have an app for online shopping which helps to get the right size of dress to purchase. Covid and post-covid life will push more and more online shopping. This app is a good solution for that. Entered at 1.79 usd