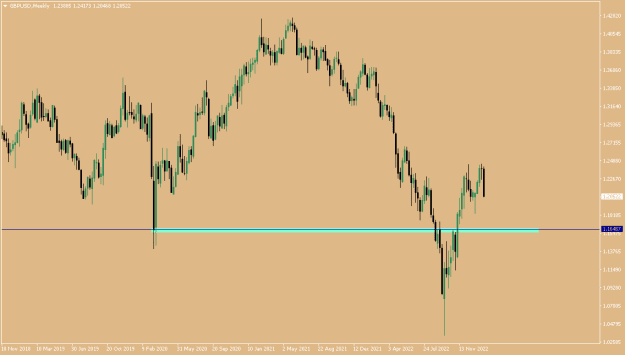

I can lose only 10 pips but can win 30

- Post #726,321

- Quote

- Edited 6:22pm Feb 4, 2023 6:11pm | Edited 6:22pm

- Joined Dec 2017 | Status: Member | 26,833 Posts

- Post #726,322

- Quote

- Feb 4, 2023 6:24pm Feb 4, 2023 6:24pm

- Joined Oct 2009 | Status: Member | 3,519 Posts

Always trade your own plan...I don't provide trading signals.

- Post #726,323

- Quote

- Feb 4, 2023 7:22pm Feb 4, 2023 7:22pm

- Joined Jul 2013 | Status: Member | 2,586 Posts

- Post #726,324

- Quote

- Feb 4, 2023 9:51pm Feb 4, 2023 9:51pm

- Joined Mar 2020 | Status: Member | 2,971 Posts

Compulsions can be hard to resist

- Post #726,325

- Quote

- Feb 4, 2023 11:14pm Feb 4, 2023 11:14pm

- | Membership Revoked | Joined Nov 2022 | 1,789 Posts

- Post #726,326

- Quote

- Feb 4, 2023 11:33pm Feb 4, 2023 11:33pm

- Joined Jul 2021 | Status: Rookie | 2,999 Posts

Not afraid to be wrong, ik what am goin' to lose!

- Post #726,327

- Quote

- Feb 4, 2023 11:40pm Feb 4, 2023 11:40pm

- Joined Jul 2021 | Status: Rookie | 2,999 Posts

Not afraid to be wrong, ik what am goin' to lose!

- Post #726,329

- Quote

- Feb 5, 2023 1:29am Feb 5, 2023 1:29am

- Joined Sep 2017 | Status: Member | 4,296 Posts

- Post #726,330

- Quote

- Edited 2:55am Feb 5, 2023 2:17am | Edited 2:55am

- Joined Apr 2020 | Status: stopped posting to cable thread | 6,722 Posts

Intraday swing trader @ 30min+ supp/res, & 5min+ sbr/rbs, via 1min+ set-ups

- Post #726,331

- Quote

- Feb 5, 2023 2:19am Feb 5, 2023 2:19am

- Joined Sep 2013 | Status: Member | 19,555 Posts | Online Now

ITS ABOUT THE CASH NOTHING ELSE.

- Post #726,333

- Quote

- Edited 3:33am Feb 5, 2023 2:36am | Edited 3:33am

- Joined Apr 2020 | Status: stopped posting to cable thread | 6,722 Posts

Intraday swing trader @ 30min+ supp/res, & 5min+ sbr/rbs, via 1min+ set-ups

- Post #726,334

- Quote

- Feb 5, 2023 3:08am Feb 5, 2023 3:08am

- Joined Mar 2020 | Status: Member | 2,971 Posts

Compulsions can be hard to resist

- Post #726,335

- Quote

- Feb 5, 2023 3:11am Feb 5, 2023 3:11am

- Joined Dec 2008 | Status: Newbie | 15,587 Posts | Online Now

I come from the future.

- Post #726,336

- Quote

- Feb 5, 2023 3:18am Feb 5, 2023 3:18am

- Joined Mar 2020 | Status: Member | 2,971 Posts

Compulsions can be hard to resist

- Post #726,337

- Quote

- Feb 5, 2023 3:20am Feb 5, 2023 3:20am

- Joined Dec 2008 | Status: Newbie | 15,587 Posts | Online Now

I come from the future.

- Post #726,338

- Quote

- Feb 5, 2023 3:25am Feb 5, 2023 3:25am

- Joined Dec 2008 | Status: Newbie | 15,587 Posts | Online Now

I come from the future.

- Post #726,339

- Quote

- Feb 5, 2023 3:28am Feb 5, 2023 3:28am

- Joined Dec 2008 | Status: Newbie | 15,587 Posts | Online Now

I come from the future.

- Post #726,340

- Quote

- Feb 5, 2023 3:32am Feb 5, 2023 3:32am

- Joined Dec 2008 | Status: Newbie | 15,587 Posts | Online Now

I come from the future.