Will this be good or bad for euro when they hold rates steady. I have seen both instances in the past, up and down euro.

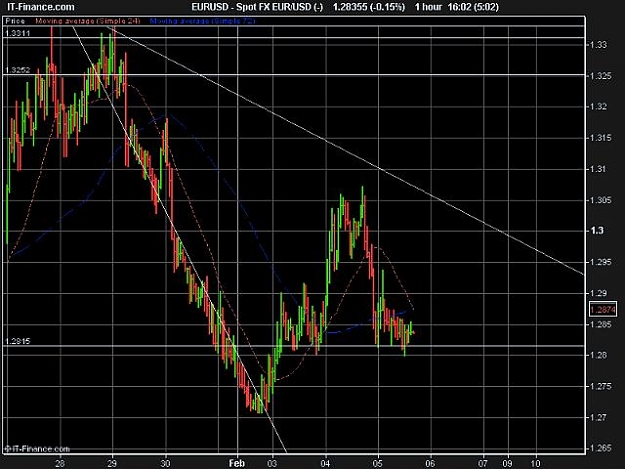

Oil hovering around $40, OPEC looking to cut production again, US inventories UP, global demand down, I see euro dropping in the short term but where is the bottom? Will we see 1.26 - 1.25 by March/April, who knows?

Holding rates steady signifies a wait and see how things will turn out till next meeting.

Should I just flip a coin, easier. Opinions please, thanks.

Oil hovering around $40, OPEC looking to cut production again, US inventories UP, global demand down, I see euro dropping in the short term but where is the bottom? Will we see 1.26 - 1.25 by March/April, who knows?

Holding rates steady signifies a wait and see how things will turn out till next meeting.

Should I just flip a coin, easier. Opinions please, thanks.