Disliked{quote} So hould start picking up as long as there is full employment. We got the knee jerk reaction with inflation numbers but we still haven't broke the range. Markets dont really believe this hawkish tone. So...Ignored

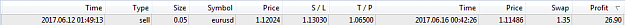

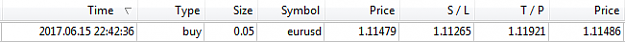

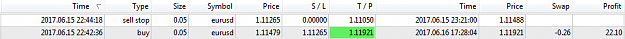

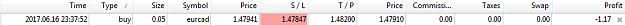

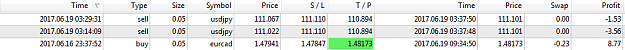

Done today the close below 1.116 with nice break and retest on lower time frame chart (h1). Next level I will be looking for is 1.11.