The motivation:

I would like to get my holly grail, which I will follow and trade in live account. I am hoping to become a full time trader from my money once. I would like to be homeless and stay in a car presented here and do a few caritative events. For me it is a big difference in helping people with a fish or teaching them to catch the fish, not everybody will like to learn, most of lazy people will prefer the fish only.

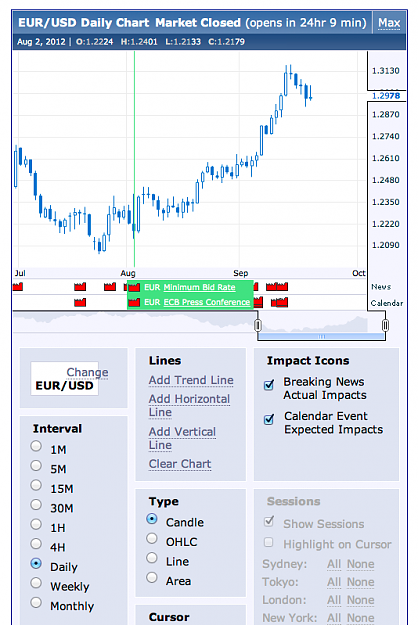

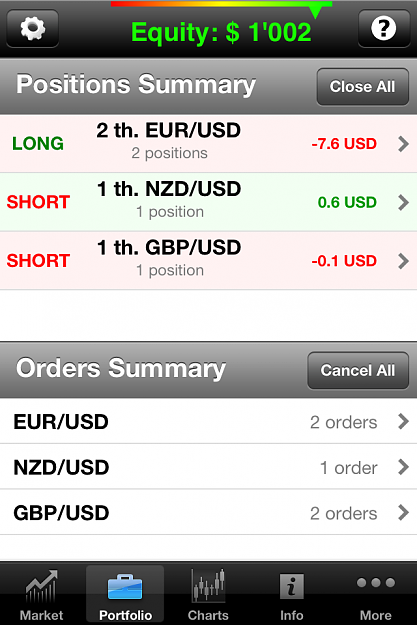

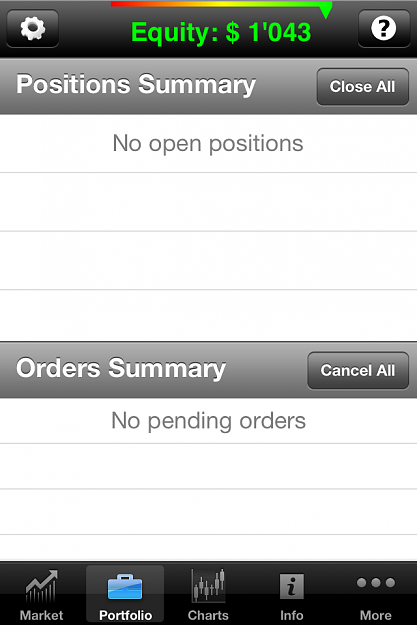

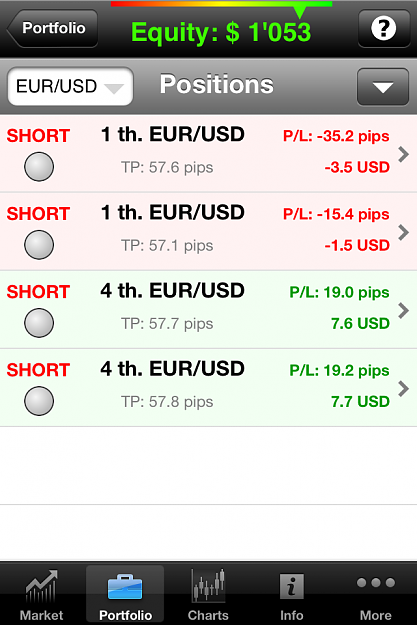

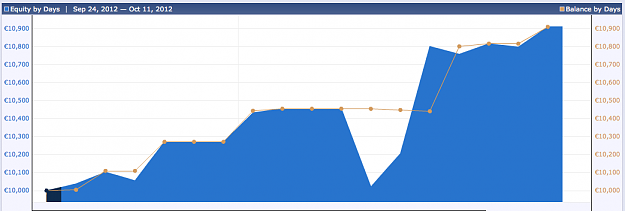

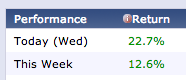

I have calculated with 1000 base currency account, every month +15% gain it is over 1 million at the 50th month. At August, I don't want to trade, same around New Year, so 10 month / year, theoretically can be done in 5 years. 15% / month should be realistic, but I have traded on lower timeframes the most of the time. I know it will be drawdowns and when I lose and when I can't trade, and need money and I will withdrawn, but this is my target: around 10-20 %, what market gives: no forced trade, no bank loans, periodically add founds, if is possible while I have daily job.

The Reality:

In history there was/are a few traders who made hundred of millions from nothing. Jesse Livermore , George Soros and many others. Like not everyone become F1 world champion who has driving license, I do believe after a few years of research and experiments can I become finally full trader and get out from Rat race (working from 9 to 5 to pay the next month bills)

This is one man business, it is perfect who has problem with communication, people and disabilities of moving and who do prefer to stay at calculator and "do nothing" with a bit irony. I think all old software engineers ( over 10 years of experience) are ideal candidates to become forex traders. And learning this and doing over 10-15 even 30 years, should be better than expecting the pension from state or private. Those who are managing your private pension what they do with your money? -investments?

It is a business, it is not a job. It does require to invest money to live from it and sometimes can you loose even with holy grail in hand, because it's a business. In every kind of business: if you take higher risk, than higher can be the reward, lower risk, lower possible rewards there are better periods and there are worse, although even on worse period need to pay my bills.

I would like to get my holly grail, which I will follow and trade in live account. I am hoping to become a full time trader from my money once. I would like to be homeless and stay in a car presented here and do a few caritative events. For me it is a big difference in helping people with a fish or teaching them to catch the fish, not everybody will like to learn, most of lazy people will prefer the fish only.

I have calculated with 1000 base currency account, every month +15% gain it is over 1 million at the 50th month. At August, I don't want to trade, same around New Year, so 10 month / year, theoretically can be done in 5 years. 15% / month should be realistic, but I have traded on lower timeframes the most of the time. I know it will be drawdowns and when I lose and when I can't trade, and need money and I will withdrawn, but this is my target: around 10-20 %, what market gives: no forced trade, no bank loans, periodically add founds, if is possible while I have daily job.

The Reality:

In history there was/are a few traders who made hundred of millions from nothing. Jesse Livermore , George Soros and many others. Like not everyone become F1 world champion who has driving license, I do believe after a few years of research and experiments can I become finally full trader and get out from Rat race (working from 9 to 5 to pay the next month bills)

This is one man business, it is perfect who has problem with communication, people and disabilities of moving and who do prefer to stay at calculator and "do nothing" with a bit irony. I think all old software engineers ( over 10 years of experience) are ideal candidates to become forex traders. And learning this and doing over 10-15 even 30 years, should be better than expecting the pension from state or private. Those who are managing your private pension what they do with your money? -investments?

It is a business, it is not a job. It does require to invest money to live from it and sometimes can you loose even with holy grail in hand, because it's a business. In every kind of business: if you take higher risk, than higher can be the reward, lower risk, lower possible rewards there are better periods and there are worse, although even on worse period need to pay my bills.

I want to buy PATIENCE