First round of closes. EZ Equities barely held a neutral close (DAX and CAC ) but they will need a very generous help from ECB and Italy next week to avoid a painfully bearish yearly close.

FTSE also barely held in Neutral but it looks awfully hard to hold for much longer. OIL and Commodity rally is very bad news for the UK (the last thing they needed for next year) and they are floating on air until US and EZ flows are cleared this year. Let's just said for now, that the odds of today next year being remotely close to the current levels are pretty much evaporated if things on the Brexit don't radically change (or even shift) .... for now yearly close first but the perfect storm is on top of the Island ....

Tracking Energies and commodity close next ....

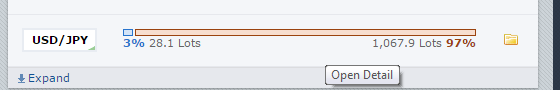

Yen* is irrelevant for the current moves.

While Sterling* got a very bad hammer via inflation (OIL and commodities). BOE will have a very hard time devaluing Sterling further as the shock in inflation next months (real wages and consumer spending) is going to be very bad already, now with further external inflationary pressures this is going to be a fck up scenario for next year...GU will mainly move and softly as collateral of Dollar for the foreseeable future.

sisse

FTSE also barely held in Neutral but it looks awfully hard to hold for much longer. OIL and Commodity rally is very bad news for the UK (the last thing they needed for next year) and they are floating on air until US and EZ flows are cleared this year. Let's just said for now, that the odds of today next year being remotely close to the current levels are pretty much evaporated if things on the Brexit don't radically change (or even shift) .... for now yearly close first but the perfect storm is on top of the Island ....

Tracking Energies and commodity close next ....

While Sterling* got a very bad hammer via inflation (OIL and commodities). BOE will have a very hard time devaluing Sterling further as the shock in inflation next months (real wages and consumer spending) is going to be very bad already, now with further external inflationary pressures this is going to be a fck up scenario for next year...GU will mainly move and softly as collateral of Dollar for the foreseeable future.

sisse

Pending conversations? PM for a chat...I am mainly in OTM now