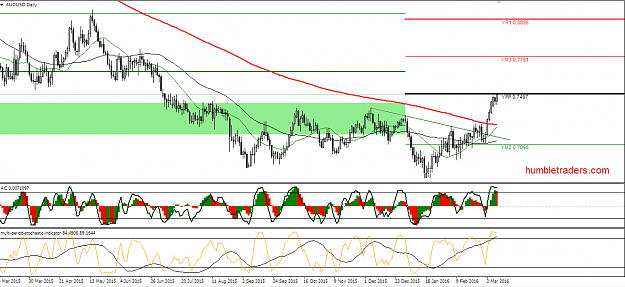

I'm still not convinced that AU is changing to uptrend from downtrend. Revised strat here is breakout above 50% long until 7660-80 and then upon resistance I'd look to short sell, but that might be few weeks away from now.

- Post #95,941

- Quote

- Mar 9, 2016 3:29am Mar 9, 2016 3:29am

- Joined Feb 2014 | Status: trading bank levels | 8,143 Posts

- Post #95,942

- Quote

- Mar 9, 2016 4:03am Mar 9, 2016 4:03am

- | Joined Aug 2009 | Status: Member | 1,068 Posts

Bulls Make Money, Bears Make Money, Pigs Get Slaughtered

- Post #95,943

- Quote

- Mar 9, 2016 4:04am Mar 9, 2016 4:04am

- Joined Feb 2014 | Status: trading bank levels | 8,143 Posts

- Post #95,944

- Quote

- Mar 9, 2016 4:06am Mar 9, 2016 4:06am

- | Joined Aug 2009 | Status: Member | 1,068 Posts

Bulls Make Money, Bears Make Money, Pigs Get Slaughtered

- Post #95,945

- Quote

- Mar 9, 2016 4:11am Mar 9, 2016 4:11am

- | Joined Oct 2014 | Status: Member | 915 Posts

- Post #95,946

- Quote

- Mar 9, 2016 4:14am Mar 9, 2016 4:14am

- | Joined Aug 2009 | Status: Member | 1,068 Posts

Bulls Make Money, Bears Make Money, Pigs Get Slaughtered

- Post #95,948

- Quote

- Mar 9, 2016 5:31am Mar 9, 2016 5:31am

- | Joined Jun 2011 | Status: Member | 277 Posts

- Post #95,949

- Quote

- Mar 9, 2016 5:34am Mar 9, 2016 5:34am

- | Joined Aug 2009 | Status: Member | 1,068 Posts

Bulls Make Money, Bears Make Money, Pigs Get Slaughtered

- Post #95,950

- Quote

- Mar 9, 2016 6:16am Mar 9, 2016 6:16am

- | Commercial Member | Joined Apr 2013 | 193 Posts

HumbleTraders

- Post #95,953

- Quote

- Mar 9, 2016 11:25am Mar 9, 2016 11:25am

- | Joined Feb 2016 | Status: Member | 14 Posts

- Post #95,954

- Quote

- Mar 9, 2016 11:37am Mar 9, 2016 11:37am

- | Joined Aug 2009 | Status: Member | 1,068 Posts

Bulls Make Money, Bears Make Money, Pigs Get Slaughtered

- Post #95,955

- Quote

- Mar 9, 2016 12:01pm Mar 9, 2016 12:01pm

Hope for the best, prepare for the worst.

- Post #95,956

- Quote

- Mar 9, 2016 12:05pm Mar 9, 2016 12:05pm

- | Joined Aug 2009 | Status: Member | 1,068 Posts

Bulls Make Money, Bears Make Money, Pigs Get Slaughtered

- Post #95,957

- Quote

- Mar 9, 2016 12:14pm Mar 9, 2016 12:14pm

- | Joined Aug 2009 | Status: Member | 1,068 Posts

Bulls Make Money, Bears Make Money, Pigs Get Slaughtered

- Post #95,958

- Quote

- Mar 9, 2016 2:03pm Mar 9, 2016 2:03pm

Believe in your thesis and stick to the plan, don't get scared with moves

- Post #95,959

- Quote

- Mar 9, 2016 2:58pm Mar 9, 2016 2:58pm

- | Joined Aug 2009 | Status: Member | 1,068 Posts

Bulls Make Money, Bears Make Money, Pigs Get Slaughtered