Tuesday

10:30

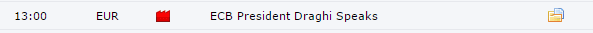

12/15/15

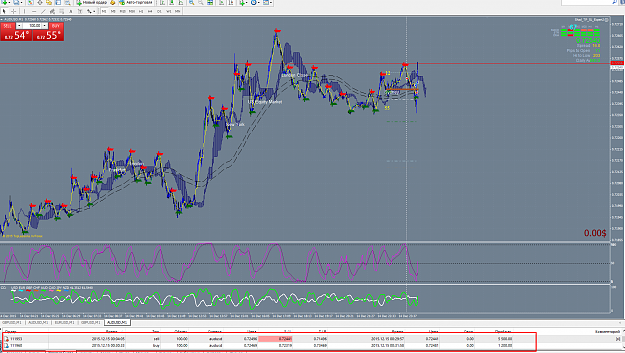

SE Interest

(SE Interest Rate), Sweden, EURSEK

Average reaction when the trigger 50.00 points in the first minute after the release.

25% probability trades.

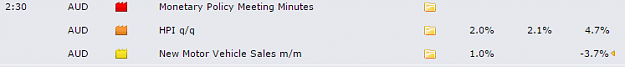

Tuesday

11:30

12/15/15

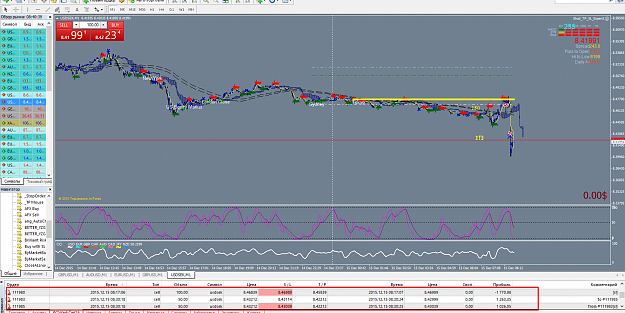

GB CPI GOOD

(GB CPI), England, GBPUSD

Average reaction when the trigger 30.00 points in the first minute after the release.

30% probability trades.

Tuesday

15:30

12/15/15

The core US consumer price index

(US Core CPI), the United States, USDJPY

Average reaction when the trigger 35.00 points in the first minute after the release.

15% probability trades.

10:30

12/15/15

SE Interest

(SE Interest Rate), Sweden, EURSEK

Average reaction when the trigger 50.00 points in the first minute after the release.

25% probability trades.

Tuesday

11:30

12/15/15

GB CPI GOOD

(GB CPI), England, GBPUSD

Average reaction when the trigger 30.00 points in the first minute after the release.

30% probability trades.

Tuesday

15:30

12/15/15

The core US consumer price index

(US Core CPI), the United States, USDJPY

Average reaction when the trigger 35.00 points in the first minute after the release.

15% probability trades.

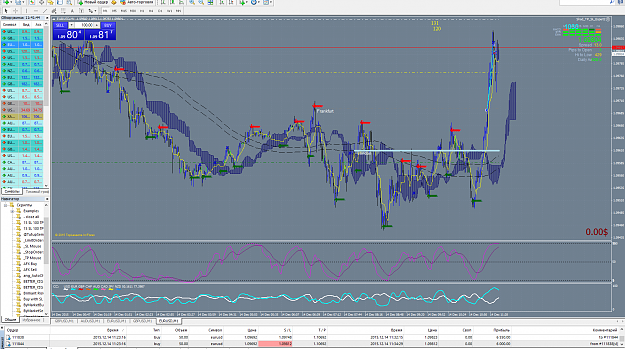

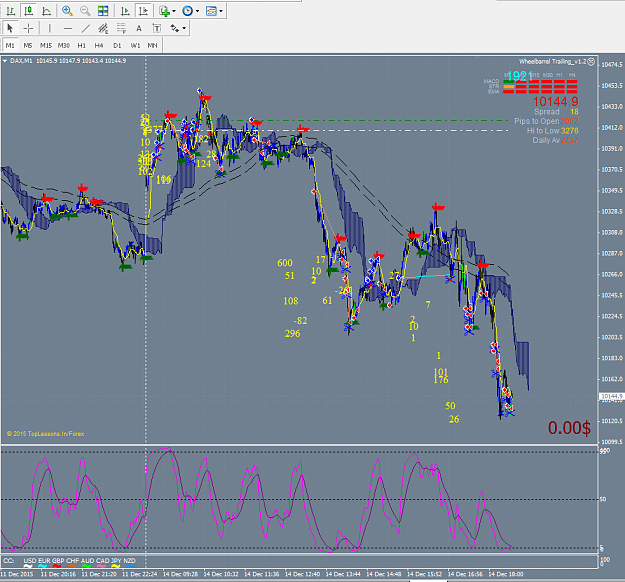

Only the price on the chart can show the entrance to the deal...