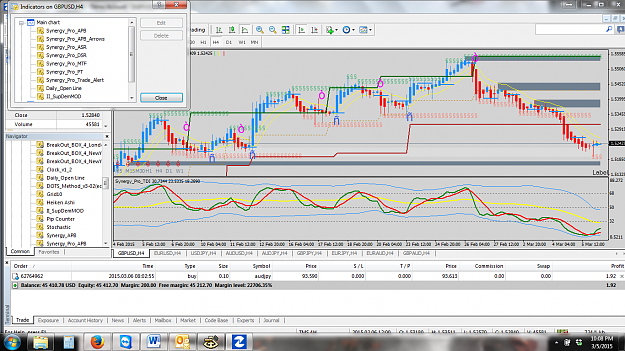

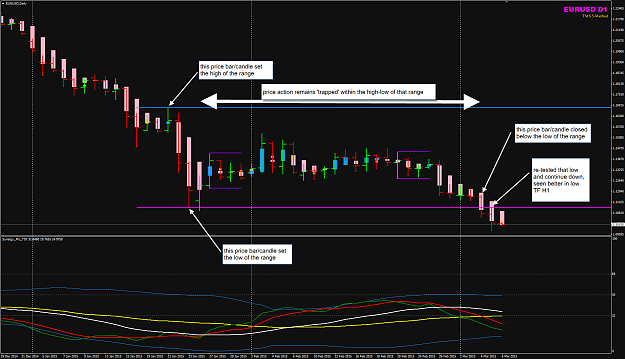

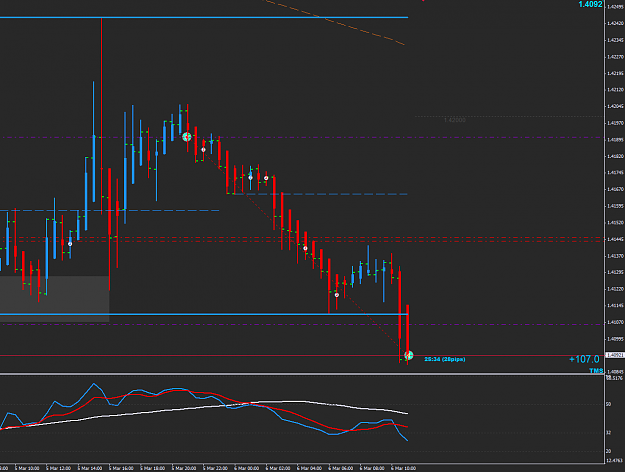

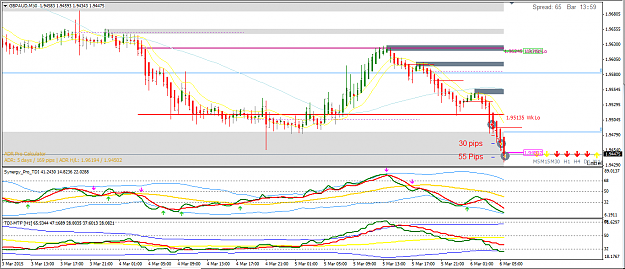

Disliked{quote} I've had similar thoughts, mainly that the DOTS acts more like a Pivot indicator based only on previous days' price action which might explain the narrow range it sometime displays? Even went so far as to get CJA to program the Daily Open Line indicator to display optional lines at user adjustable percentage away from the daily open - the picture will explain much easier. Basically, a possible entry line and projected target - I don't like the DOTS using 2 targets, it's too easy to claim success even it only hits the first; I'm an all or...Ignored

Long story but my computer went down today & I just got it fixed, yea.

Thank you for the Daily Open Line indicator! I will test it out but so far it looks good.

Thanks,

sj