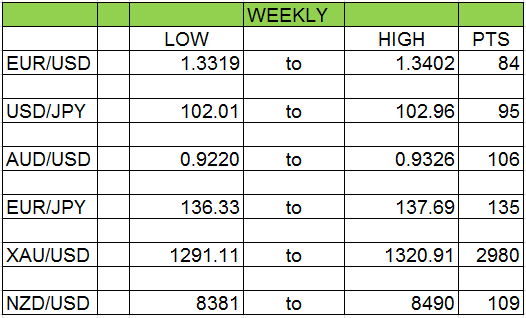

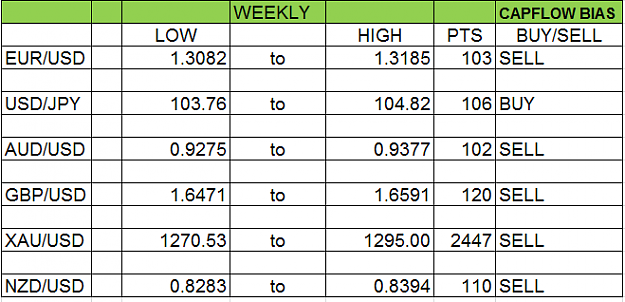

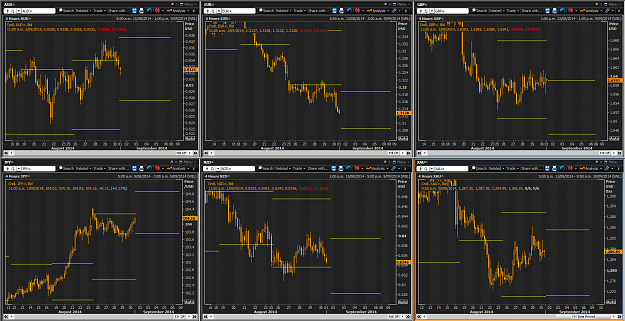

Projected ranges for this week attached.

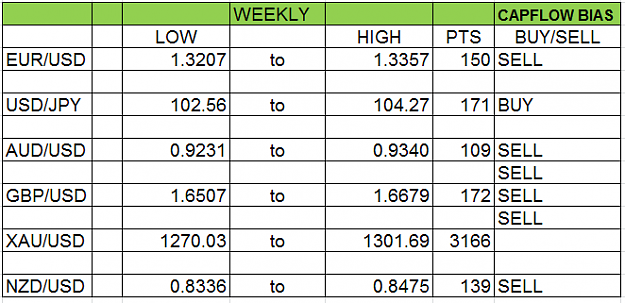

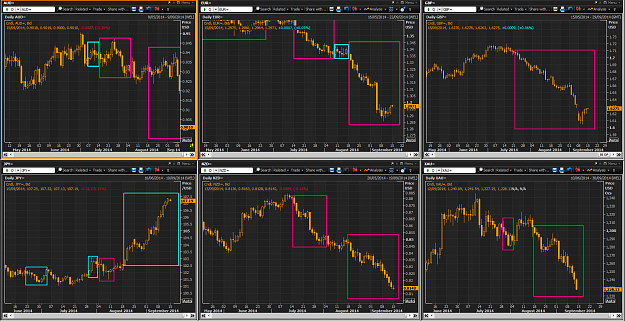

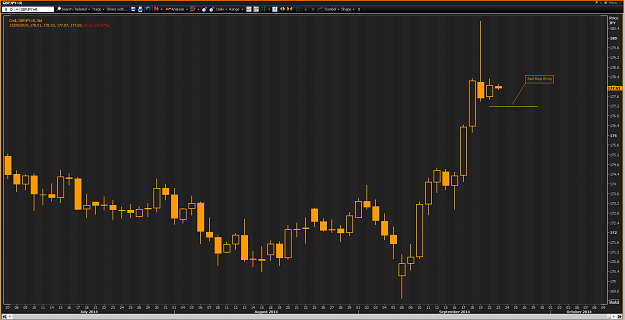

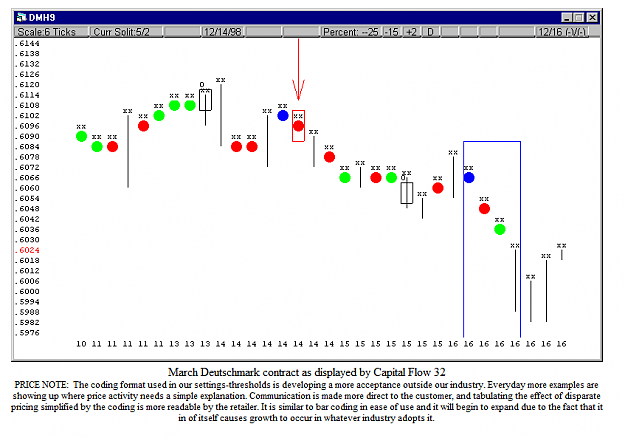

Interesting times in the FX markets. The Kiwi, Aussie and Euro all look well supported at the end of last week. This is supported by my Capflow analysis.

However I feel any upward move that results (if any) should be viewed as a bounce that should be sold into. I have no doubt that after such a bounce, my systems will turn and indicate they are a sell again.

I would like to sell Kiwi on a bounce towards 8570 and definitely around 8620.

The EURO bounce could be more severe because of the extreme short positioning. I would target between 1.3520 to 1.37 and a good area to locate shorts.

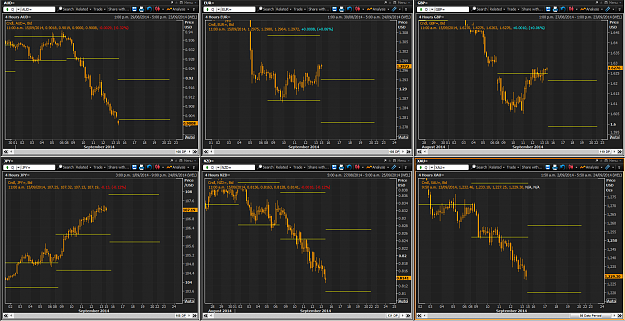

There are many cross currents at present. On the one hand the global search for yield and NZ is still paying people a handsome carry to buy the Kiwi Dollar.

On the other, there are plenty of fires smouldering around the globe most notably in the Middle East and the Ukraine.

The outcome in the Ukraine is pivotal to world economic growth. Trade wars are never conducive to world growth and if Putin is emboldened in the Ukraine who knows where his ambitions might end (with other post USSR break up Republics). The 23 year trend of economic and market friendly geopolitics is at a fork in the road right now….

A negative view of all this would confirm the top in the Kiwi is in place, send the EURO towards 1.3 and beyond and certainly unwind the Yen carry trade.

I need to monitor sentiment surrounding this.

On the subject of the Yen the USD/JPY longs have held this view now at extreme levels since December 2012 and for the most recent 12 mths have seen the currency basically stay at the same level. Surely “Mrs Watenabe’s” patience has a limit?

This may take several weeks to play out. I need to be patient and wait for my levels.

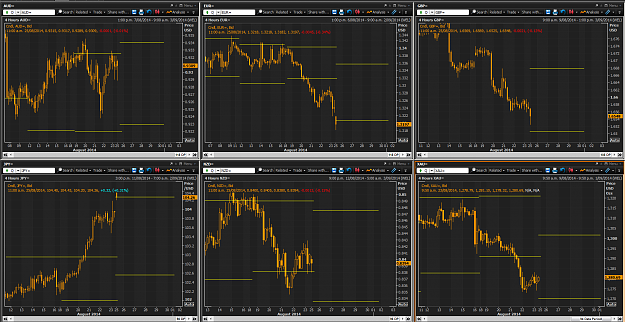

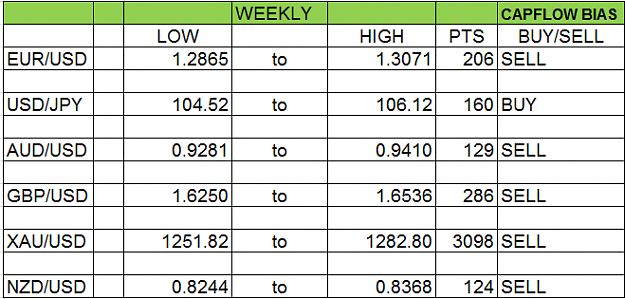

The long signals in the EUR/USD I think should be taken. My guess is the blue box that appeared last week will be short lived but we'll see.

Interesting times in the FX markets. The Kiwi, Aussie and Euro all look well supported at the end of last week. This is supported by my Capflow analysis.

However I feel any upward move that results (if any) should be viewed as a bounce that should be sold into. I have no doubt that after such a bounce, my systems will turn and indicate they are a sell again.

I would like to sell Kiwi on a bounce towards 8570 and definitely around 8620.

The EURO bounce could be more severe because of the extreme short positioning. I would target between 1.3520 to 1.37 and a good area to locate shorts.

There are many cross currents at present. On the one hand the global search for yield and NZ is still paying people a handsome carry to buy the Kiwi Dollar.

On the other, there are plenty of fires smouldering around the globe most notably in the Middle East and the Ukraine.

The outcome in the Ukraine is pivotal to world economic growth. Trade wars are never conducive to world growth and if Putin is emboldened in the Ukraine who knows where his ambitions might end (with other post USSR break up Republics). The 23 year trend of economic and market friendly geopolitics is at a fork in the road right now….

A negative view of all this would confirm the top in the Kiwi is in place, send the EURO towards 1.3 and beyond and certainly unwind the Yen carry trade.

I need to monitor sentiment surrounding this.

On the subject of the Yen the USD/JPY longs have held this view now at extreme levels since December 2012 and for the most recent 12 mths have seen the currency basically stay at the same level. Surely “Mrs Watenabe’s” patience has a limit?

This may take several weeks to play out. I need to be patient and wait for my levels.

The long signals in the EUR/USD I think should be taken. My guess is the blue box that appeared last week will be short lived but we'll see.