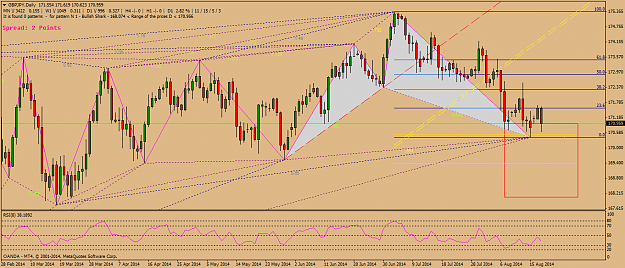

DislikedUJ corrective and bearish. GU corrective and bearish. GJ ultimately bearish - next week. Not that I use many moving averages ... but .... daily 200 (sma) is rising and sits now at 170.45. The last time GJ met this ma was at 126 in November 2012. I would suggest that any break below there next week is a little bit bearish, n'est ce pas?Ignored

Now if you put Monthly chart on for Price action, you will see this month's bar looks like the mirror of the bar 2 months ago, and there is a Bearish Pin in the middle. If price closes like this then we'll most probably be heading South in the next month and toward you-know-where. Except (and this is more probable scenario) if this month finishes as a Bullish pin, then price might climb easily toward 177.3-4 area.