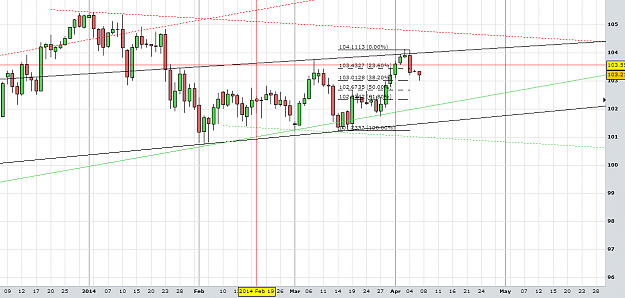

DislikedI think we're at an interestng crossroads right now. If USD/JPY moves up more here, then it has attracted buying. It it falters, this bouce was merely profit taking on the back of Friday's moves (all IMO).Ignored

- Post #44,562

- Quote

- Apr 7, 2014 7:33am Apr 7, 2014 7:33am

- Joined Sep 2013 | Status: boreddddd | 3,136 Posts

- Post #44,563

- Quote

- Apr 7, 2014 7:36am Apr 7, 2014 7:36am

A word to the wise ain't necessary - it's the stupid ones that need advice

- Post #44,564

- Quote

- Edited 8:22am Apr 7, 2014 7:49am | Edited 8:22am

- Joined Sep 2013 | Status: boreddddd | 3,136 Posts

- Post #44,565

- Quote

- Apr 7, 2014 8:46am Apr 7, 2014 8:46am

- Joined Oct 2008 | Status: Sentiment and Global Macro | 2,321 Posts

- Post #44,569

- Quote

- Apr 7, 2014 10:29am Apr 7, 2014 10:29am

- | Joined Apr 2014 | Status: Sizzlin | 11 Posts

- Post #44,570

- Quote

- Apr 7, 2014 12:35pm Apr 7, 2014 12:35pm

- Joined Aug 2009 | Status: Ride the Pig | 31,178 Posts

Look Sharp/Trade Tight

- Post #44,572

- Quote

- Apr 7, 2014 2:43pm Apr 7, 2014 2:43pm

- | Joined Jan 2008 | Status: Member | 42 Posts

- Post #44,573

- Quote

- Edited 4:46pm Apr 7, 2014 4:35pm | Edited 4:46pm

- Joined Sep 2013 | Status: boreddddd | 3,136 Posts

- Post #44,576

- Quote

- Apr 7, 2014 7:39pm Apr 7, 2014 7:39pm

- | Joined Jan 2014 | Status: Self Taught | 851 Posts

- Post #44,577

- Quote

- Apr 7, 2014 10:56pm Apr 7, 2014 10:56pm

- Joined Aug 2013 | Status: Member | 4,057 Posts

- Post #44,578

- Quote

- Apr 7, 2014 11:18pm Apr 7, 2014 11:18pm

- | Commercial Member | Joined Sep 2010 | 1,472 Posts

- Post #44,580

- Quote

- Apr 8, 2014 2:41am Apr 8, 2014 2:41am

- Joined Sep 2013 | Status: boreddddd | 3,136 Posts