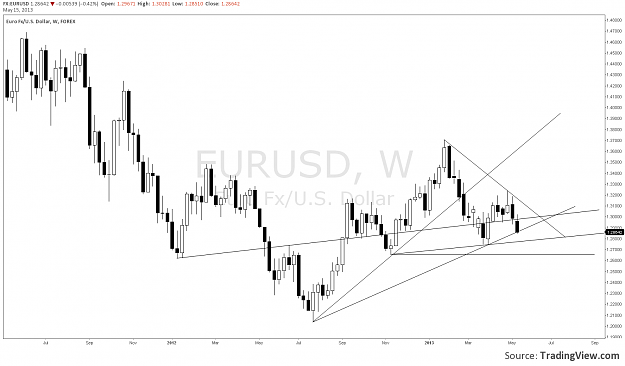

1,3215 open 25 feb

1,3061 high 28 feb

1,2847 open 4th april

1,2900 low 5th april

When we were between 1,3061 and 1,3215 risk was to the downside...in fact anything above 1,3061 needed a retracement down.

Now we are below 1,2900...retrace needed,

COT: The precious data ignored